The Evolution of Digital Finance

The Evolution of Digital Finance

DIGITAL FINANCE = BLOCKCHAIN, FINTECH, AND NOW AI

It is now ten years since we created our first investment strategies for Blockchain, and more than 30 years since we started working on, and investing into, the digitalization of the world's financial system.

We view Blockchain as our investment focus, and Digital Commerce is the most important benefit it brings - The Internet of Value if you will. As part of our work, we spend a lot of time as ambassadors for Blockchain, spreading the word of what it is, and why it is now ushering in Digital Finance including digital monies, commodities and assets, among other benefits.

Ever since ChatGPT came on the scene we have been getting inbound questions from you on Artificial Intelligence (AI) as well:

How will AI impact your investment thesis?

How will AI accelerate the arrival of digital monies, commodities and assets?

How does AI overlap with Blockchain?

Etc.

This week, after a few months of research and evaluation from the Blockchain Coinvestors investment team, we share our developing perspectives.

If you read to the end you will understand:

Our investment thesis is still intact and inevitable - all of the world's commerce and finance will be digital.

This requires all of the world's financial infrastructure to be upgraded.

It will be the greatest value creation event the world has ever seen.

Blockchain and AI will power and accelerate this and they already are doing so.

However, Digital Finance is not only about Blockchain, and it is certainly not just about Crypto.

Other innovations are already a part of this and new innovations yet to be named will come too.

Unfortunately for TradFi, AI will also exploit the vulnerabilities of the Internet and traditional ways of doing finance.

That's good for Distributed Ledger Technology (Blockchain) which is the perfect complement to the Internet.

Which is why it was invented in the first place by Satoshi.

Please read on.

BLOCKCHAIN COINVESTORS INVESTMENT THESIS

Let's begin by recapping the investment thesis we wrote down ten years ago when we pivoted to focus on Blockchain investing.

For those who want to go deeper please listen to our Blockchain Coinvestors Investment Thesis recording.

DIGITAL FINANCE IS INEVITABLE

The Blockchain Coinvestors investment thesis is inevitable.

Not only because we can't have a global digital economy without it, but also because the problems of the current financial system are so profound that it will not be able to survive without a comprehensive upgrade.

Put bluntly, the current financial system is beginning to break down, and consumers everywhere are beginning to get so frustrated with the difficult access, high cost, low speed, and fragile and deteriorating offerings of today that a crisis point has been reached. Nowhere is this more obvious than with the digital natives who simply no longer want to be served by TradFi. They are now more than 50% of the world's population and they are the future.

Digital Finance is the solution, and brings with it powerful benefits, some of which we have summarized in the following exhibit.

But what do we mean by this?

Are we saying everyone will have to become a crypto enthusiast and start buying and selling cryptoassets?

PAST IS PROLOGUE

In order to make clear that the digitalization of finance is not synonymous with the powerful innovation of cryptoassets, let's go back and see what we have already done to upgrade financial products and services with digital technologies.

The next chart summarizes four projects we worked on directly which we think were all examples of digitalization, and technology enablement of traditional financial products and services to enable the arrival of digital monies, commodities and assets. All four make the point that Digital Finance does not need to include decentralized, distributed, cryptoassets. While decentralization and distribution are powerful innovations in themselves, and in some use cases may be the winning design fundamentals, that does not mean that everything needs to go down those paths.

These examples are perhaps four of the most important breakthroughs in global finance of the last forty years.

However, unfortunately, most of the products and services offered by TradFi have not materially changed in that same time period. Their dominant characteristics are still:

Hard to access with large populations unserved

High cost, with consumers paying heavily for the inefficiency and profits of the providers

Slow, with consequent friction for consumers, and the frightening risks that result, including ubiquitous counterparty risk

Etc.

Ten years ago we talked about the coming digitalization of the global financial system and the arrival of Digital Finance but it was mostly in the future.

Now it is already here and growing fast.

DIGITAL FINANCE IS NOW

Digital Finance is now. Some of the world's largest, fastest growing, and most profitable financial products and services run on Blockchain infrastructure.

Digital monies are where the point is most clear. Digital commodities and digital assets are earlier in their adoption curves, but the core infrastructure to enable them is now mostly built.

If you need just one example to keep firmly in mind that proves the point, Tether now has approximately the same global transaction activity as Visa, and is more profitable than Goldman Sachs.

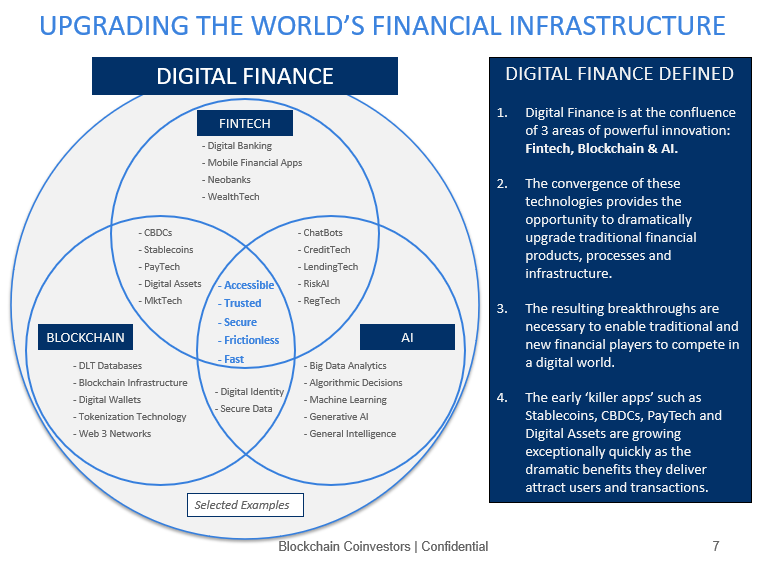

DIGITAL FINANCE IS AT THE CONFLUENCE OF THREE POWERFUL INNOVATIONS

Of course, not all Digital Finance needs to be built on Blockchain (Distributed Ledger Technology) and not all applications of Blockchain technology are in finance. Far from it. We are very excited by Web3 networks, decentralized computing, and Blockchain based digital entertainment to name just three that don't start with finance as their objective.

So how do we map digital financial use cases to Blockchain and/or Fintech and what is the role of AI in all of this?

The next exhibit seeks to build your understanding of this further.

A lot of Digital Finance has already been built by FinTech including before Blockchain was invented. Today almost all of us use mobile, digital apps or online solutions for some of our financial activities. That's the part we touch. What we may be less aware of is that behind the scenes TradFi, which is unfortunately still maybe 50% paper and people reliant, is now using digital infrastructure more widely - some of which is version 1, and some of which has already been upgraded to include powerful new innovations such as Blockchain.

Blockchain has begun to make rapid and accelerating thrusts into Fintech, with better solutions like blockchain based CBDCs, Stablecoins, and new PayTech and Marketplace Tech demonstrating that Digital Finance built on Blockchain rails is able to create killer apps when compared to the current state of play.

Now AI has arrived and is doing the same.

To be clear, TradFi has been using AI for at least thirty years based upon our own experiences. Credit card solicitations have relied upon data lakes, big data analysis and computer driven algorithms for all of that time and more. Most large financial institutions already have ChatBots with AI engines working, even if they may not be visible to external consumers. In the areas of credit and risk (which McKinsey once estimated accounted for roughly 40% of the cost of the US banking system when all the activities involved were included), AI had already been applied in assessing credit profiles, although the state of art is progressing rapidly.

That is the point. Just as FinTech innovators, and Blockchain innovators, are making their own areas of technology ever more powerful and ever more valuable, so the AI innovators just did the same. The new AI approaches and tools are opening up fantastic and exciting applications in finance so long as it is digital (AI does not work very well with paper).

At the intersection of Blockchain and AI, the world is now beginning to realize that digital identity and secure data are non-negotiables, and so innovation is needed here too.

Not least, because all innovations are double sided blades - they can be used for good and bad purposes.

AI has now let some very bad use cases out of Pandora's box.

AI HAS BAD AND GOOD USE CASES - A FURTHER ACCELERATOR OF BLOCKCHAIN ADOPTION

We have written in the past about the vulnerabilities of the Internet, which are its achilles heel:

Insecure

Inadequate systems of identity and trust

Overly concentrated

Absence of digital money

Absence of digital assets

Satoshi Nakamoto invented Distributed Ledger Technology (DLT or Blockchain) because he/she/they wanted to launch a global peer-to-peer distributed money which would need to run on the Internet, but must not be exposed to these vulnerabilities. So Blockchain is the perfect complementary technology stack to the Internet technology stack because it was designed to solve these issues and it does so very well indeed.

You can read about this in our book Blockchain Competitive Advantage which is at its five year anniversary in 2024.

Unfortunately for the world financial system and for all of us, AI is already very good at exploiting the same Internet vulnerabilities that Blockchain can solve.

The good news for Blockchain, is that as the hackers, breakers, phishers, and scammers successfully attack TradFi and its outdated products and services, Blockchain will become much more relevant to them.

All of the world's finance relies in one way or another on databases, and DLT databases are the best that we have for mitigating this coming AI onslaught.

CONCLUSIONS

So in conclusion:

Our investment thesis is still intact and inevitable - all of the world's commerce and finance will be digital.

This requires all of the world's financial infrastructure be upgraded.

It will be the greatest value creation event the world has ever seen.

Blockchain and AI will power and accelerate this and they already are doing so.

However, Digital Finance is not only about Blockchain, and it is certainly not just about Crypto.

Other innovations are already a part of this and new innovations yet to be named will come too.

Unfortunately for TradFi, AI will also exploit the vulnerabilities of the Internet and traditional ways of doing finance.

That's good for Distributed Ledger Technology (Blockchain) which is the perfect complement to the Internet.

Which is why it was invented in the first place by Satoshi.

That captures 80% of it.

A CLOSING THOUGHT

We did this thinking, and wrote this newsletter because you, our investors and community, are now asking these important questions about Digital Finance, Blockchain and AI.

But please don't lose the forest for the trees.

For investors, the raison d'etre is not to know but to act.

And the way to act, if you understand what we just shared, is to invest into Blockchain and Digital Finance now. While they are still in their infancy and most of the value creation has not been captured.

Thank you for reading,

The Blockchain Coinvestors Partners

About Blockchain Coinvestors

Blockchain Coinvestors is the best way to invest in blockchain businesses. Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns. Blockchain Coinvestors’ investment strategies are now in their 10th year and are backed by 400+ investors globally. To date we have invested in 40+ pure play blockchain venture capital funds in the Americas, Asia, and Europe and in a combined portfolio of 1000+ blockchain companies and projects including 80+ blockchain unicorns. Blockchain Coinvestors’ first fund of funds ranks in the top decile amongst all funds in its category on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in London, New York, Grand Cayman, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

“The best way to invest in blockchain businesses”