60 Days that Changed the (Investing) World

60 DAYS THAT CHANGED THE (INVESTING) WORLD

What Just Happened?

On January 11th, after years of arbitrary and capricious delays, the US Securities and Exchange commission (SEC), under the scrutiny of the US Judicial System which had brought the legal hammer down on their shenanigans, approved a family of Bitcoin (BTC) spot exchange traded funds (ETFs). In the sixty days (45 trading days) that have passed since the approvals, the entire world of commodities investing has been forever changed. How and why is the subject of this week's newsletter.

For our investors at Blockchain Coinvestors, since we focus on early stage venture investing into Blockchain and not public liquid token trading, the purpose of this newsletter goes beyond celebrating a momentous win for digital monies, commodities and assets. It also spells out how the appreciation of Bitcoin's price drives the valuations of our funds. But more of that towards the end of today's newsletter.

First let's focus on the Bitcoin ETFs. If you read to the end you will be able to answer the following questions:

What is an ETF?

Why are ETFs Superior Financial Products?

What have ETFs got to do with Bitcoin?

Why were Bitcoin Spot ETFs the Fastest ETF Launches of All Time?

How do the Bitcoin Spot ETFs Compare to Other ETFs?

Why is this a Revolution in the Commodity Investment Marketplace?

Will Performance Matter in the New World?

How will the Bitcoin ETFs Drive Bitcoin Price?

How will Bitcoin Price Drive Blockchain Coinvestors Fund Valuations?

Is it Too Late to Invest in Blockchain?

Please read on.

What is an ETF?

In March 1996, Barclays Global Investors (BGI) launched its first ETFs. Known as the World Equity Benchmark Shares (WEBS), these were low cost, easily accessible, tradable products which enabled institutional investors to gain exposure to specific asset classes. All three attributes were important:

Low Cost. WEBS were much cheaper than other investment vehicles of the nineties with typically 50 basis points of cost.

Easily Accessible. WEBS were accessible to any institutional investor through the investment platforms that they were using for other public equity investments.

Tradeable. WEBS could be traded as quickly as a public equity, with rapid settlement at a time when most alternatives required lengthy people and paper based processes that might take weeks.

In 1997 Matthew and Alison, Co-founders of Blockchain Coinvestors, were co-leading the financial services practice of consulting firm AT Kearney. They were asked by Lee Kranefuss, the head of strategy at BGI, to define a number of breakout growth strategies for the firm. The project generated several powerful strategies including both on-us netting, and the scaling up of WEBS.

The 'killer analysis' which launched BGI's iShares was a simple one. The project team asked Morningstar to evaluate all BGI institutional WEBS as if they were retail products, and suggest what Morningstar rating they would have achieved had they been such. The result was stunning.

Every WEBS would have been a 5 star Morningstar fund.

Why are ETFs Superior Financial Products?

Well very simply, in a time of 3% upfront load, high annual cost mutual funds, a 50% basis point competitor had much higher investment returns. Essentially, at least 250 basis points of reduced cost was added back into high returns for investors.

Prior to this retail customers were having their investment returns heavily cannibalized by an inefficient financial industry that cared more for its profits than for the returns it provided its customers. An idea that was heretical at BGI. Patty Dunn, CEO of BGI at that time, and her Managing Directors believed that the only purpose of BGI was to deliver high returns that would enable pensioners to live a good life in their elder years. Investment returns to BGI investors were everything. Accessibility and tradability mattered too.

WEBS were extended to be retail accessible, the products were rebranded iShares and a new division was created to launch them globally initially under the leadership of Lee. Alison became CFO of BGI to help incubate the new product and division, among other priorities. focused on unlocking the value of BGI, while maintaining its focus on delivering consumer benefits.

During the Great Financial Crisis, BGI was sold by Barclays Bank to Blackrock. The following exhibit is from the Blackrock iShares website.

Source: Blackrock iShares

Today BGI is part of Blackrock, and iShares with $3.3 trillion of assets under management (AUM) is the largest branded product of any type in the world. It has helped power Blackrock to be the world's largest asset manager, and today Blackrock manages hundreds of ETFs and investors have saved hundreds of millions of dollars through the reduction of fees begun 20 years earlier.

What have ETFs got to do with Bitcoin?

It may seem odd that Bitcoin, the peer to peer cash created to serve those attempting to free themselves from the deflationary monetary policies of the traditional fiat money and markets, would now appear in ETF form. However, the reason is again very simple. Most of the world's investors are not allowed to self-custody their investments and/or they prefer to work with intermediaries who help them invest. While it is still true that the most efficient way to invest in Bitcoin is to buy and hold it yourself, and while it is also true that if you don't control your Bitcoin keys, you don't actually own the Bitcoin, your intermediary does, millions of investors have been waiting for 'traditional ways' to gain Bitcoin exposure.

Ways that are low cost, easily accessible and tradeable.

Enter the Bitcoin Spot ETFs.

Bitcoin Spot ETFs

For some reason that we have never understood, the SEC resisted the launch of Bitcoin Spot ETFs for a long long time. Instead they approved Bitcoin Futures ETFs first, although we all knew that price discovery for Bitcoin futures relies upon Bitcoin spot marketplaces, and Futures ETFs are always a second class citizen to the Spot ETFs. They layer on additional cost and bring the risk of contango - they are just not very good at tracking the underlying investment or commodity that the investor wants exposure to.

However, in their wisdom the SEC did approve Bitcoin Futures ETFs first, and said they would not approve Bitcoin Spot ETFs, at least not until they were taken to court by Greyscale and lost the case. Greyscale is a division of Digital Currency Group which we invested in years ago, and Greyscale is the issuer of GBTC which is still the largest Bitcoin Spot ETF (formerly it was a traded trust).

Famously the judge adjudicating the case concluded that the SEC had been arbitrary and capricious which is about the most damning words a US judge can use with regard to an arm of the US government.

In short order, the SEC reversed itself and approved 11 Bitcoin Spot ETFS - one of which was the conversion of GBTC into an ETF product.

As the exhibit below shows, in just the first 60 days of their existence, the top US Bitcoin Spot ETFs have accumulated a total of 836,347 Bitcoin worth over US $57 billion at today's Bitcoin price.

Source: VettaFi

Please note that with the exception of GBTC, these are exceptionally low cost products. The lowest at launch being Bitwise (BITB) where we are also investors.

Why were Bitcoin Spot ETFs the Fastest ETF Launches of All Time?

This is a simple question to answer, but one which most of the world's leading financial journalists got wrong. Throughout last year, financial journalists at places like the Wall Street Journal, Financial Times, and Economist wanted their readers to believe that there was little or no demand for Bitcoin among institutional investors and Bitcoin Spot ETFs, if approved, would not grow the market for the underlying commodity - Bitcoin.

They will go down in history for being famously wrong and allowing their preconceptions, emotions and feelings overcome the facts that were in plain view.

Source: HODL15Capital

The Exhibit above from HODL15Capital shows the weekly net Bitcoin purchases by the US Bitcoin ETFs since inception. Even though GBTC, which remains the highest cost of the Bitcoin ETFs, has been shedding billions of dollars of investors, and even though the FTX bankruptcy estate has also been selling their GBTC in large amounts, the net gain has been remarkable. In just ten weeks the new products have net purchases of 220,000 bitcoins.

How does that compare to other ETF launches during the first ten weeks after approval?

This is the fastest ETF launch of all time when the products are combined together.

How do the Bitcoin Spot ETFs Compare to Other ETFs?

If this has been the fastest ETF product launch of all time, how does it compare with the much larger ETFs in other asset classes which have had decades to get to scale? Actually, very well indeed. The following Exhibit makes the point clearly.

So far in 2024 no other ETFs have done as well as the Spot Bitcoin variety.

Source: Daily Chartbook

Finally in 2024 the SEC has agreed that Bitcoin is a commodity which has been the official position of the Commodity Futures Trading Commision (CFTC) for several years now.

Why is this a Revolution in the Commodity Investment Marketplace?

So let's look at the world of commodities. It is our view as you have heard before, that all of the world's monies, commodities and assets will be digitized and this is why blockchain is so important - it is the enabling technology and innovation to drive that movement of value to natively digital format.

The next Exhibit, again from HODL15Capital, shows the ranking of commodities ETFs by AUM. At this point, the Bitcoin Spot ETFs have passed Silver and have Gold in their sights.

The Gold ETFs have had two decades to accumulate their AUM - the Bitcoin Spot ETFs ten weeks.

Source: HODL15Capital

But it is not size that matters in the world of investing. It is performance.

And so far in 2024 the performance shown in the final column of the Exhibit is what really matters to investors. Remarkable.

Will Performance Matter in the New World (?)

So does performance matter to investors? Of course it does.

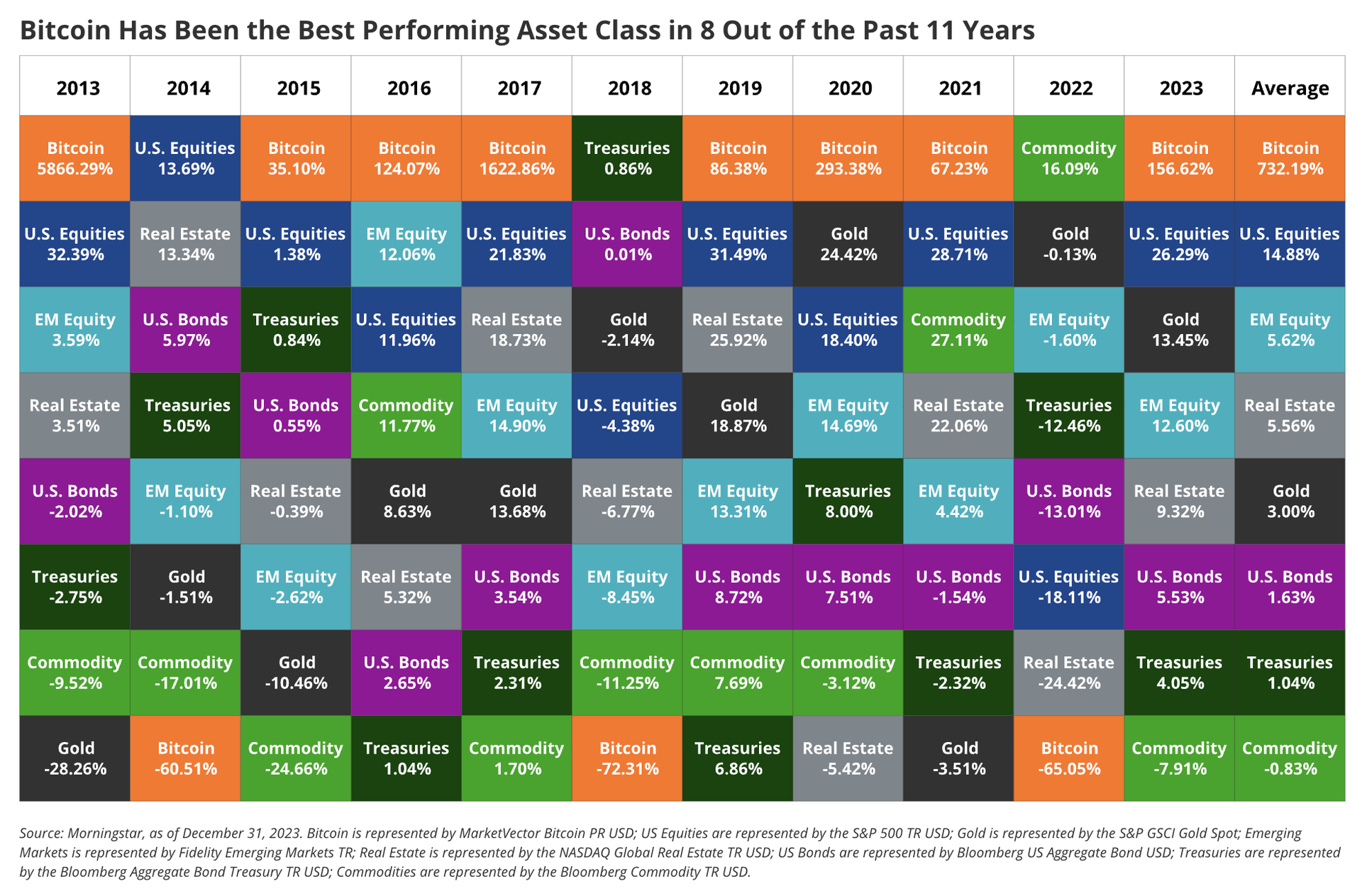

However, a month or two of performance is not that important. In investing we care about persistent superior returns. Is Bitcoin performance persistent? Take a look at the next exhibit from Morningstar which shows asset class performance over the years since Bitcoin was invented. In 8 of the last 11 years Bitcoin was the highest performing asset that Morningstar tracks!

What we find equally interesting about this chart is that in the other three years, Bitcoin was a very low performing asset class and those bad years were equally spaced every four years.

If we were traders, which we are not, we would want to understand what drives that one in four bad years for Bitcoin, and we would want to ask whether it implies that 2026 will also be a bad year. If there is such a pattern it would also imply that 2024 and 2025 should be very good years - but past performance may not be a good indicator of future returns.

However, for all long term investors, the takeaway has to be Morningstar's so what. Over 11 years Bitcoin has been the persistently highest performing asset in the world as shown in the final column.

An average annual return of 732.19%

In addition to the financial journalists, there are one or two very large asset managers who hang on to their beliefs that Bitcoin is not investable. While scores of the largest asset managers are offering the Bitcoin Spot ETFs to their clients, Vanguard stands out as one such asset manager who believes their feelings and emotions rather than Morningstar's facts.

Here is how Vanguard's largest products have performed year to date.

Source: HODL15Capital

Yes performance matters, and capital flows to persistent superior returns products.

How will the Bitcoin ETFs Drive Bitcoin Price?

Many of our investors have asked us recently what will happen to the Bitcoin price.

We are not traders, but last November in our 2024 Blockchain Predictions we told you that Bitcoin would reach new all time highs in 2024 driven by the Bitcoin Spot ETF approvals and by the upcoming halvening.

The reason is simple. In a world of capped supply, and rapidly accelerating demand, economics says price has to go up. Since the Bitcoin Spot ETFs were approved on January 11th the facts are:

New supply of Bitcoin mined = 58,500

Number of Bitcoin sold by GBTC = 240,984

Number of Bitcoin sold by everyone else = 158,627

Number of Bitcoin bought by the 9 new ETFs = 458,111

To make that exceptionally clear, the Bitcoin ETF demand from Bitcoin has exceeded the new supply of Bitcoin mined by over 7 times.

Well yes except that the Bitcoin Spot ETFs have not been the only buyers of Bitcoin this year. In fact, many other exchanges, marketplaces, custodians and so on have also seen their users buying Bitcoin.

So the price has been going up.

How will Bitcoin Price Drive Blockchain Coinvestors Fund Valuations?

Our funds do not actively trade Bitcoin. We focus on early stage venture investing in Blockchain. However, our valuations are impacted when Bitcoin goes up in price.

Direct Impact. While we don't buy and hold Bitcoin, many of the funds we invest into from our Fund of Funds do. Sometimes they have liquid trading allocations, sometimes they hold excess balances in Bitcoin and sometimes they have made strategic investments into Bitcoin.

Indirect Impact - Portfolio Companies. Many of the more than 1,000 companies that we have capital invested in have businesses that benefit from heightened buying and selling of Bitcoin and/or appreciations in price. They include wallets, marketplaces, exchanges, custodians, on and off ramp payments companies, and others. They are now reporting to us that their revenues are going up this year as a result of everything this newsletter has covered above.

Indirect Impact - Alternative Tokens. Finally, most of our blockchain venture fund partners invest in other tokenized blockchain projects, as does our Fund IV - Early Stage Token Fund. Over the last decade we have consistently seen that when the Bitcoin price goes up, so too do the altcoin prices.

So expect to see the accelerating price of Bitcoin impacting our fund valuations, although we report two quarters in arrears for our four Fund of Funds (Fund I, II, III and V) and somewhat in arrears for our two direct Funds (Funds IV - ESTF and Fund VI - MSGF).

We believe good news is on its way and will report to you as soon as we can.

Is it Too Late to Invest in Blockchain?

We believe our investment thesis will take decades to be reached, although we stand behind the words that it is inevitable:

All of the world's monies, commodities and assets will be digitized...

...and all of the world's financial infrastructure will have to be upgraded to enable this.

It will be the greatest value creation event the world has ever seen.

Now is an ideal time to invest, because, finally, the most important investors in the world are beginning to appreciate what every blockchain investor knows - blockchain is one of, and perhaps the most important, enabling innovation in this global upgrade.

We can't discuss our funds in detail within a public newsletter but we can remind you of our investment strategies:

Our new Fund of Funds (Fund VII) provides global, diversified exposure to early stage blockchain venture investments from the leading blockchain venture firms and is open for commitments now.

Fund IV (ESTF) provides concentrated exposure to early stage tokenized projects in their formation and seed phases and the quarterly subscription window is open now.

Fund VI (MSGF) provides concentrated exposure to the emerging unicorns of blockchain and is open for commitments now.

Please contact any of our team at IR@BlockchainCoinvestors.com to express your interest and receive the fund details.

Thank you for reading

The Blockchain Coinvestors Partners.

About Blockchain Coinvestors

Blockchain Coinvestors is the best way to invest in blockchain businesses. Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns. Blockchain Coinvestors’ investment strategies are now in their 10th year and are backed by 400+ investors globally. To date we have invested in 40+ pure play blockchain venture capital funds in the Americas, Asia, and Europe and in a combined portfolio of 1000+ blockchain companies and projects including 80+ blockchain unicorns. Blockchain Coinvestors’ first fund of funds ranks in the top decile amongst all funds in its category on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in London, New York, Grand Cayman, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

“The best way to invest in blockchain businesses”