Addressing the Root Causes Not Just the Symptoms of Financial Instability

ADDRESSING THE ROOT CAUSES, NOT JUST THE SYMPTOMS, OF FINANCIAL INSTABILITY

In an era often dominated by sensationalist headlines, it’s imperative to sift through the noise and discern the deeper currents reshaping our global landscape. A prime example of this is the recent political upheaval in Argentina, epitomized by hard-right libertarian Javier Milei's unexpected election as President. Milei's emergence as a formidable political force, securing a significant victory over the center-left candidate Sergio Massa, has sent ripples through the Argentine political arena.

Milei, often controversially referred to as "El Loco" (the madman) by his detractors, has vowed to implement radical economic reforms. These include a proposal to transition from the local currency, the peso, to the US dollar, coupled with a bold initiative to dismantle the central bank to curb its currency printing practices, which he blames for fueling inflation.

We at Blockchain Coinvestors are not in the business of political analysis and it is crucial to acknowledge the complexity of factors driving such political shifts. However, dismissing Milei's victory as a mere populist wave overlooks a broader, more systemic issue: the enduring instability of the global financial system, which has been particularly pronounced in Argentina over the past forty years. Far from being the bedrock of economic stability, this system has repeatedly plunged numerous countries, especially those outside the Western democratic sphere, into recurrent crises.

We believe that blockchain technology is poised to be a transformative force in addressing these issues and offers the potential to stabilize and secure our financial networks, thereby averting trillions in potential losses. In the following report, we broadly outline core issues with the financial system and identify three key areas where blockchain technology could significantly enhance its infrastructure:

Secure and Instant Payments: Blockchain can revolutionize the way payments are processed, offering security, speed, and efficiency, markedly improving global financial transactions.

Access to Diverse Stores of Value: This technology enables a broader range of secure and stable value stores, either via cryptocurrencies are fiat-backed stablecoins; these can provide alternatives to everyday individuals whose traditional financial systems have been prone to inflation and volatility.

Revolutionizing Regulatory Oversight and Compliance: Blockchain's inherent transparency and traceability could dramatically improve regulatory processes, ensuring compliance while reducing bureaucratic inefficiencies. Furthermore, instantaneous settlement and monitoring could allow for greater oversight and stability in the banking system.

At the core of our investment thesis is the conviction that the world's financial infrastructure is in dire need of an overhaul. The ongoing crises and vulnerabilities plaguing the current system underscore the urgency of this need. Blockchain technology, in our view, is not just a novel innovation but a necessary evolution to foster a more stable, secure, and efficient global financial system.

A Vulnerable System: Crises and Exposed Networks

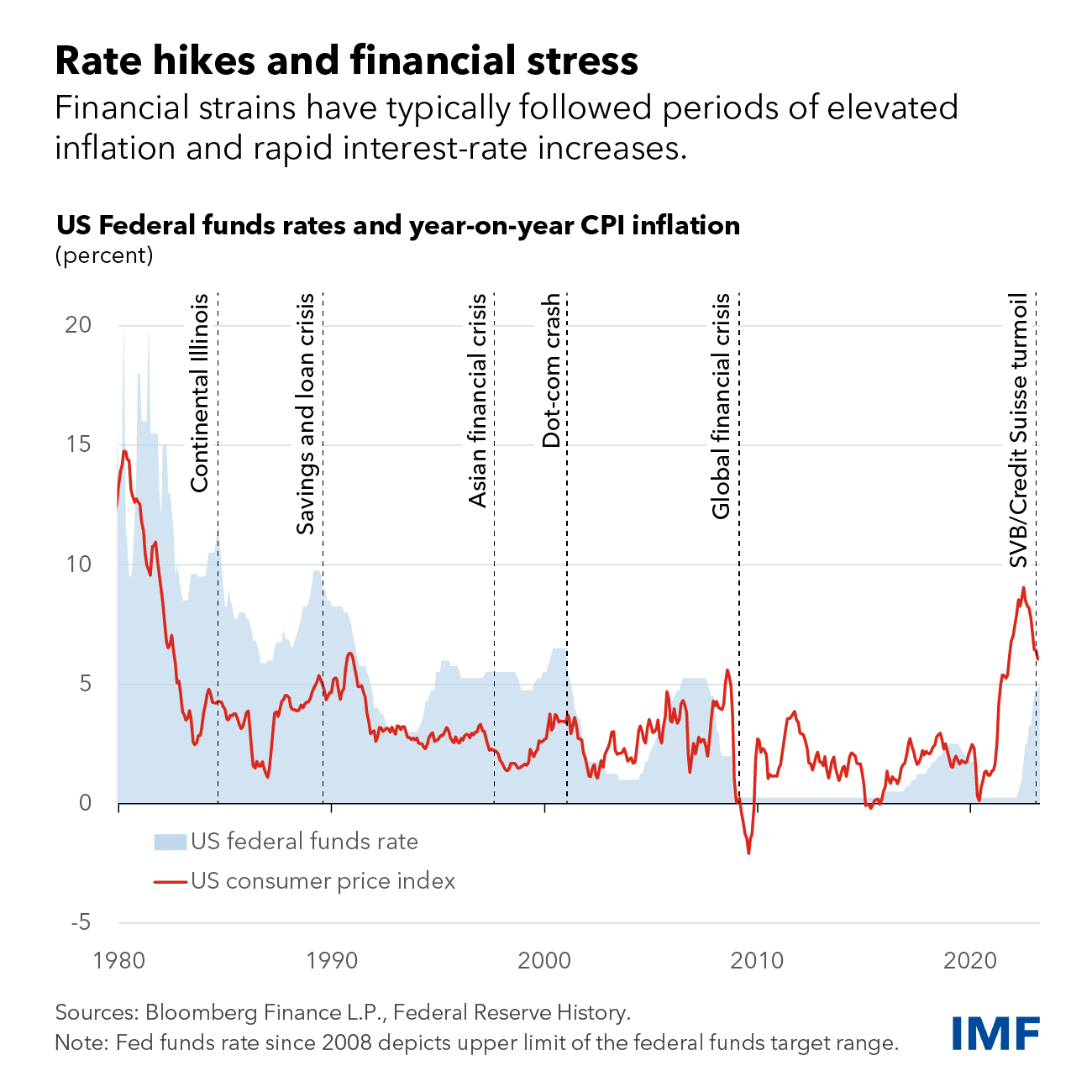

Early this year, turmoil at major Western financial institutions, such as Silicon Valley Bank and Credit Suisse, (re)exposed the inherent fragility of our global financial infrastructure. These incidents are not merely isolated cases but rather indicative of a broader, more systemic issue: a financial system that is increasingly insecure, inefficient, and susceptible to unpredictable shocks. The below chart illustrates the frequency with which our central banks are compelled to modify monetary policy, navigating a continuous sequence of crises.

The International Monetary Fund's Global Financial Stability Report reinforces these concerns, shedding light on the escalating risks confronting banks and non-bank financial intermediaries, particularly in the context of aggressive interest rate hikes. Historical patterns suggest that such rapid shifts in policy often unmask the underlying weaknesses in our financial systems, occasionally leading to devastating outcomes.

But let's consider the periods between these crises. Even then, our financial system displays a troubling level of vulnerability. For instance, a major cyber-attack targeting a financial services payment system could potentially trigger global losses upwards of $3.5 trillion, a significant portion of which may not be covered by insurance. This alarming scenario was outlined in a recent study by Lloyd's of London and the Cambridge Centre for Risk Studies. The United States alone could face losses amounting to $1.1 trillion over five years from such an attack, causing widespread disruption to international business operations. The cyber insurance market, with over $9 billion in gross written premiums in 2022 and an anticipated growth to between $13 billion and $25 billion by 2025, underscores the magnitude of this risk.

These developments paint a concerning picture of our financial system's resilience. The perceived robustness of our financial infrastructure appears increasingly questionable. Without significant improvements in security and systemic safeguards, we remain exposed to significant vulnerability.

A Broken System: Persistent Inflation - A Deep Dive into Argentina's Struggle

In the intricate landscape of global economics, Argentina's recent political developments, epitomized by Javier Milei's ascent to leadership, represent a critical juncture. Milei's advocacy for dollarization and the dissolution of Argentina's Central Bank (BCRA) underscores the profound economic challenges the nation faces. "Closing the Central Bank is a moral obligation. Dollarization is to get rid of the BCRA. We propose that the currency should be the one chosen by individuals," Milei asserts, highlighting the dire need for economic reform and stability in Argentina. This stance, though appearing radical, is rooted in a long history of economic turbulence marked by severe inflation and currency devaluation, issues that have long beleaguered the Argentine economy.

The Argentinian peso's precipitous fall in value, dropping approximately 51.6% in the year leading up to July 2023, is a stark indicator of the nation's economic distress. Such volatility not only erodes citizens' savings but also disrupts everyday commerce, with prices fluctuating rapidly. This economic instability, entrenched over decades, has seen inflation rates in Argentina averaging a staggering 190% from 1944 until 2023.

In response to these persistent economic crises, digital assets have emerged as a route to stability, with everyday citizens utilizing the new infrastructure to secure savings. Remarkably, during this period of financial turbulence, Argentina has led Latin America in cryptocurrency transactions, receiving an estimated $85.4 billion in value. The nation ranks second in the region for grassroots crypto adoption, a testament to the populace's quest for financial security amidst ongoing currency devaluation.

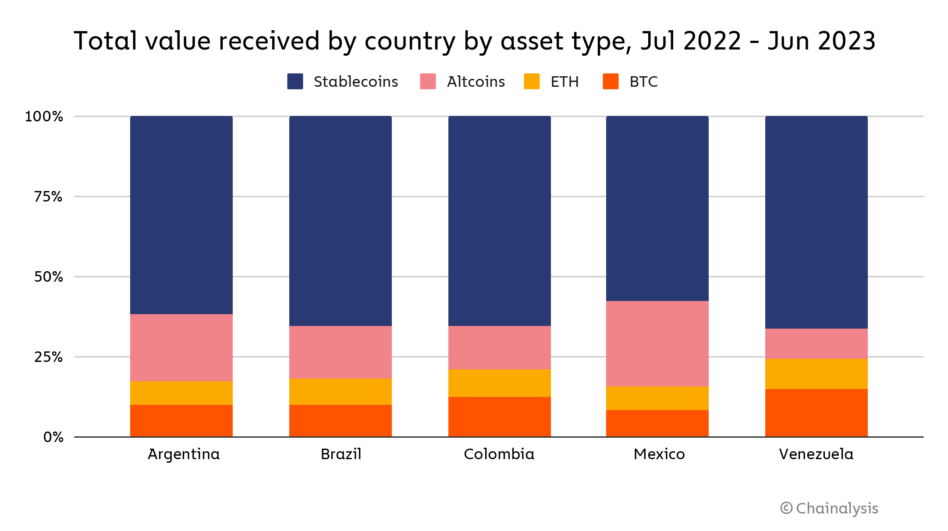

The Argentine experience with cryptocurrency, particularly the growing reliance on stablecoins, reflects a deep-seated desire for financial stability and access to more stable currencies like the U.S. dollar.

Argentina's scenario, unfortunately, echoes a broader trend in developing economies. Countries grappling with high inflation and rapid currency depreciation are increasingly turning to cryptocurrencies. For instance, Brazil witnessed a 218% devaluation of its currency, the real, against the U.S. dollar between 2011 and 2021, with 45% of Brazilians expressing intent to purchase crypto in the forthcoming year. Similarly, South Africa's rand experienced a 103% devaluation over the past decade, with 32% of South Africans expected to become crypto owners.

This pattern, also observed in other high-inflation countries like Mexico, Nigeria, and India, underscores a global shift towards cryptocurrencies as a hedge against economic instability. For emerging markets facing financial volatility, digital assets offer a semblance of security and autonomy, indicating a significant shift in the global financial paradigm.

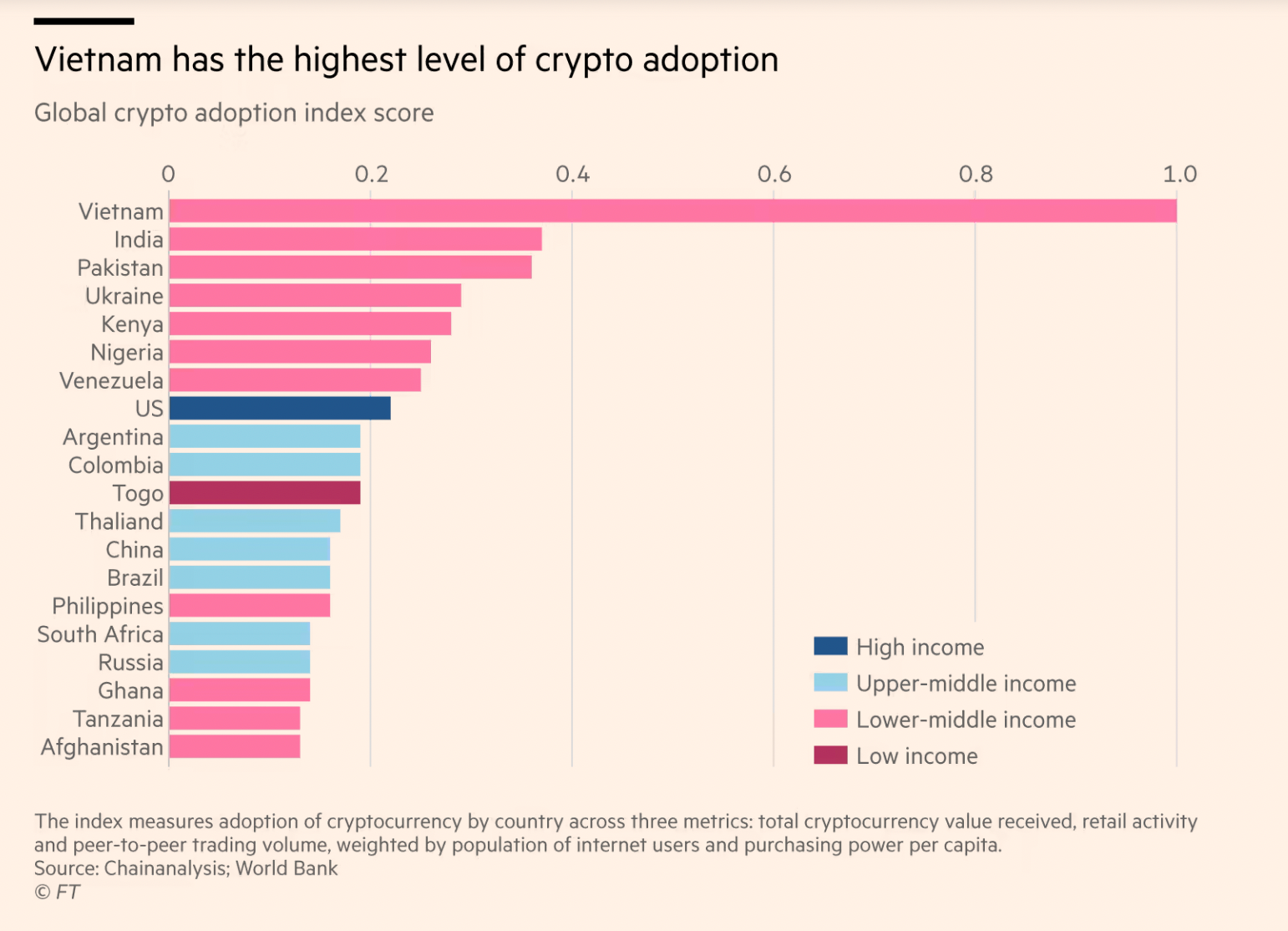

The profound trend of cryptocurrency adoption in emerging economies is strikingly evident, with 19 out of the top 20 countries by cryptocurrency adoption belonging to this category. This pattern, as clearly illustrated in the below chart, resonates strongly with the economic instability these regions frequently endure. For years, consumers in developing countries have helplessly witnessed their savings diminish, victims to a volatile financial system that operates outside their sphere of influence. It is these individuals, often the most affected by financial instability, who are now at the forefront of embracing and driving the next wave of financial innovation. Their rapid adoption of cryptocurrencies isn't just a trend; it's a response to a long-standing need for a more stable and controllable financial future.

Blockchain: Transforming the Financial Landscape

But how can blockchain technology reshape and fortify the global financial system? Through our analysis, we have identified three pivotal domains where blockchain stands to revolutionize our financial infrastructure.

I. Secure and Instant Payments

Blockchain technology heralds a new era in payment systems, characterized by tokenization, encryption, and programmability. A prime example of blockchain's commercial success is the advent of stablecoins, which amalgamate these features to offer a secure, resilient payment network. With an appropriate regulatory framework, this innovation could fundamentally transform global transactions.

The impact of blockchain in the realm of global payments is already significant and growing. Consider the current reach of stablecoins, which are barely 3 years old: more than 25 million blockchain addresses hold at least $1 in stablecoins. Of these, approximately 80%, or around 20 million addresses, maintain balances ranging from $1 to $100. To contextualize this scale, if a U.S. bank were to have 25 million accounts, it would rank as the fifth largest in terms of account numbers.

The magnitude of stablecoins' influence is further illustrated by their on-chain settlement volume in 2022, which exceeded $11 trillion. This figure not only dwarfs PayPal's processed volume of $1.4 trillion but also rivals Visa's $11.6 trillion payment volume. In comparison with traditional payment channels, stablecoins accounted for 14% of the volume settled by ACH and over 1% of the volume settled by Fedwire, as reported by Brevon Howard.

This burgeoning relevance of blockchain in payment processing is evident when juxtaposed with major payment conduits like PayPal and Visa, highlighting its global importance. PayPal's launch of its own stablecoin earlier this summer underscores the growing recognition of blockchain's transformative role in the payments industry.

In essence, blockchain's foray into payment systems is not just a novel experiment but a significant, burgeoning global channel. Its ability to offer secure, instant, and scalable transactions places it at the vanguard of financial innovation, poised to redefine how we think about and execute global transactions in the digital age.

II. Access to Diverse Stores of Value

In regions plagued by currency instability, blockchain emerges as a vital solution. Digital assets offer individuals a mechanism to safeguard their wealth against the unpredictability of local currencies. This includes access to decentralized digital currencies like Bitcoin (BTC) or Ethereum (ETH), as well as tokenized fiat currencies, commonly known as stablecoins. Intriguingly, in many inflation-stricken areas, the preferred digital assets are dollar-backed stablecoins. To give further detail to what was already noted above, the below chart illustrates how stablecoins constitute a sizable majority of the digital asset value received in several major Latin American countries.

III. Revolutionizing Regulatory Oversight and Compliance

Navigating the complexities of financial regulations is a formidable task. Blockchain introduces a level of transparency and efficiency that simplifies compliance and elevates regulatory oversight.

While encryption ensures secure transactions, it also allows for compliance checks to be separated from the transactions themselves. Only authorized entities can access sensitive information, ensuring transparency and fostering trust. For example, a platform could verify participants' compliance with anti-money laundering regulations while permitting anonymous bidding or transacting, thereby maintaining privacy in a marketplace.

But what about financial stability? Why does it seem our regulators are always asleep at the wheel and taken by surprise each time a banking crisis unfolds?

One potential fix could be to utilize the instantaneous settlement capabilities of blockchain technology. This could empower banking regulators with real-time insights into the health of banks within their jurisdiction. By tokenizing assets and liabilities and placing them on-chain, banks could construct a live balance sheet view that would give us real-time health checks on their solvency and robustness. This system would provide regulators with advanced warning of issues, potentially averting future banking crises.

This principle has already proven effective in the DeFi ecosystem, where assets and liabilities are fully on-chain, rendering the financial health of institutions like Aave, Compound, and Uniswap transparent and instantly accessible to all market participants. Despite multiple downturns in crypto prices, these DeFi institutions have remained resilient, avoiding any bank runs or major crises. The juxtaposition could not have been starker earlier this year as banks in both the US and Europe – the two ostensible regions with the highest levels of financial stability – experienced significant runs and required government intervention.

The View from London: Navigating Towards a More Stable Financial Future

The events unfolding in Argentina and the vulnerabilities of the global financial system highlight an urgent need for an upgrade of the world’s financial infrastructure. The traditional financial frameworks, both in developed and developing economies, are proving inadequate in the face of modern economic challenges. This is where blockchain technology emerges not just as a novelty, but as a necessary innovation.

Blockchain's ability to offer secure, transparent, and efficient financial transactions presents a transformative solution. From stabilizing currencies in inflation-hit economies to safeguarding against cyber threats in advanced markets, its potential is vast and largely untapped. The upward trend in digital asset adoption, especially in economies battling financial instability, underscores the growing trust in blockchain's promise.

At Blockchain Coinvestors, we are more than observers of this transformative era; we are active participants. Our investments in cutting-edge blockchain ventures are driven by a conviction in the technology's ability to reshape the global financial landscape. We invite you to join us in this journey towards a more secure, equitable, and prosperous financial future.

Thank you for your continued support and engagement.

Best,

Mitch Mechigian

Partner, London

ABOUT BLOCKCHAIN COINVESTORS

Blockchain Coinvestors is the best way to invest in blockchain businesses. Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns. Blockchain Coinvestors’ investment strategies are now in their 10th year and are backed by 400+ investors globally. To date we have invested in 40+ pure play blockchain venture capital funds in the Americas, Asia, and Europe and in a combined portfolio of 750+ blockchain companies and projects including 75+ blockchain unicorns. Blockchain Coinvestors’ first fund of funds ranks in the top decile amongst all funds in its category on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in London, New York, Grand Cayman, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

"The best way to invest in Blockchain businesses"