WHY ARTIFICIAL INTELLIGENCE GREATLY ACCELERATES BLOCKCHAIN ADOPTION

WHY ARTIFICIAL INTELLIGENCE GREATLY ACCELERATES BLOCKCHAIN ADOPTION

It seems that all of a sudden the entire world is excited (and concerned) about Artificial Intelligence (AI).

Everyday it seems one of our investors is asking us "What will AI mean for Blockchain?"

In this month's newsletter we focus on this topic, and show that while AI is not new, it is now accelerating into a phase when it will both bring enormous new value, but also threaten the entire Internet technology stack that we all rely upon. This is not a new thought. It is the core of our investment thesis. The Internet technology stack is fundamentally flawed and it is exactly for this reason that Distributed Ledger Technology (DLT, also known as Blockchain) was created.

AI will accelerate the need to fix the Internet and make it fit for purpose for a global digital economy.

Blockchain is still a key part of that future technology solution.

As a result, AI will accelerate the adoption of Blockchain.

Our new Fund VII will deploy across the early stage of this accelerating opportunity set.

WHAT IS AI?

Artificial Intelligence (AI) is neither new, nor is it what many of us, and most of our media think.

AI is about the writing of smart software as part of a software solution stack. It is about how to make software accomplish tasks better, faster, cheaper than human beings or animals can do with their limited capability brains. We are exceptionally good at many things. But when confronted by massive data sets, the need to process enormous computational loads in parallel, and the need to iterate at milliseconds - to name just three common requirements - it turns out our brains are not good at all.

So computer scientists began focusing on this topic a long time ago. Some say the academic discipline of AI was founded in the mid 1950's. However, what we know for sure is that in the last few decades we have seen ever more applications of the approach (as well as lots of sub-branding and rebranding, including terms like Big Data Analytics, Computer Based Prediction, Machine Learning, Artificial Neural Networks, Natural Language Processing, General Intelligence Solutions, and many others).

Today we just call it AI.

But we use it every day and it is not new.

Consider three examples that you all use all the time:

Google is finishing our sentences right now, if we chose to have it do so.

Amazon just suggested some purchases for us, based upon what people like us buy.

We just received (far too many) solicitations from banks, credit card companies and fintechs who thought we fit their profile of the specific offer.

We spent this morning moving a large number of phishing emails to Google Spam and Unsubscribe but they just keep on coming (more on this later).

These four examples, out of hundreds that affect us every day, are all examples of AI in action.

For more than thirty years we have worked in the broadly defined area of AI as consultants, executives, board directors, and of course, as investors. For us, it is inevitable that Marc Andreessen's quote 'Software will eat the world' will come true, and in EVERY software stack there will be a layer of 'Intelligent software'. Only now with AI the quote will be "Software is eating the software that is eating the world."

That is obvious and does not need amplification.

What just changed is that AI both became much easier to use through UI and UX upgrades, and the developers created toolsets to enable themselves to create AI based software ever faster and easier.

So the pace of iteration and innovation just went up enormously.

IS AI ANTHROPOMORPHIC?

While not the focus of this narrative, let us take a moment to diverge and answer the question of whether AI is anthropomorphic.

This is an important question because most people are deeply threatened and afraid from a lifetime of watching robots, cybernauts, AI's like HAL and Samantha, play with and eventually take over human beings.

We are existentially threatened by the notion that machines might become better than humans. That man might try to emulate god and in doing so create a Frankensteinian abomination, or worse, destroy the human race.

It is not that those fears are not real, or perhaps helpful to hold.

It's just that the logic breaks down quickly because computer scientists mostly don't want to emulate human brains, because human brains are not good at completing the tasks that computer scientists mostly want completed.

The tasks of massive, parallel, iterative computation and big data management.

But that was a tangent.

WHAT IS WRONG WITH THE INTERNET?

For our regular readers you will be well aware of our investment thesis, and our book Blockchain Competitive Advantage.

In that book, we describe the five big issues that need to be solved to make the Internet stack fit for purpose to move beyond the digitalization of communications and content (which are essentially completed) to the digitalization of commerce and transactions which has only just begun.

Those five issues are:

The Internet is insecure.

The Internet lacks a system of identity and trust fit for a digital economy.

The Internet is excessively concentrated creating large single points of failure.

The Internet does not have digital monies with which to transact.

The Internet does not have digital assets with which to record, buy and sell, and hold assets in a digitally native way.

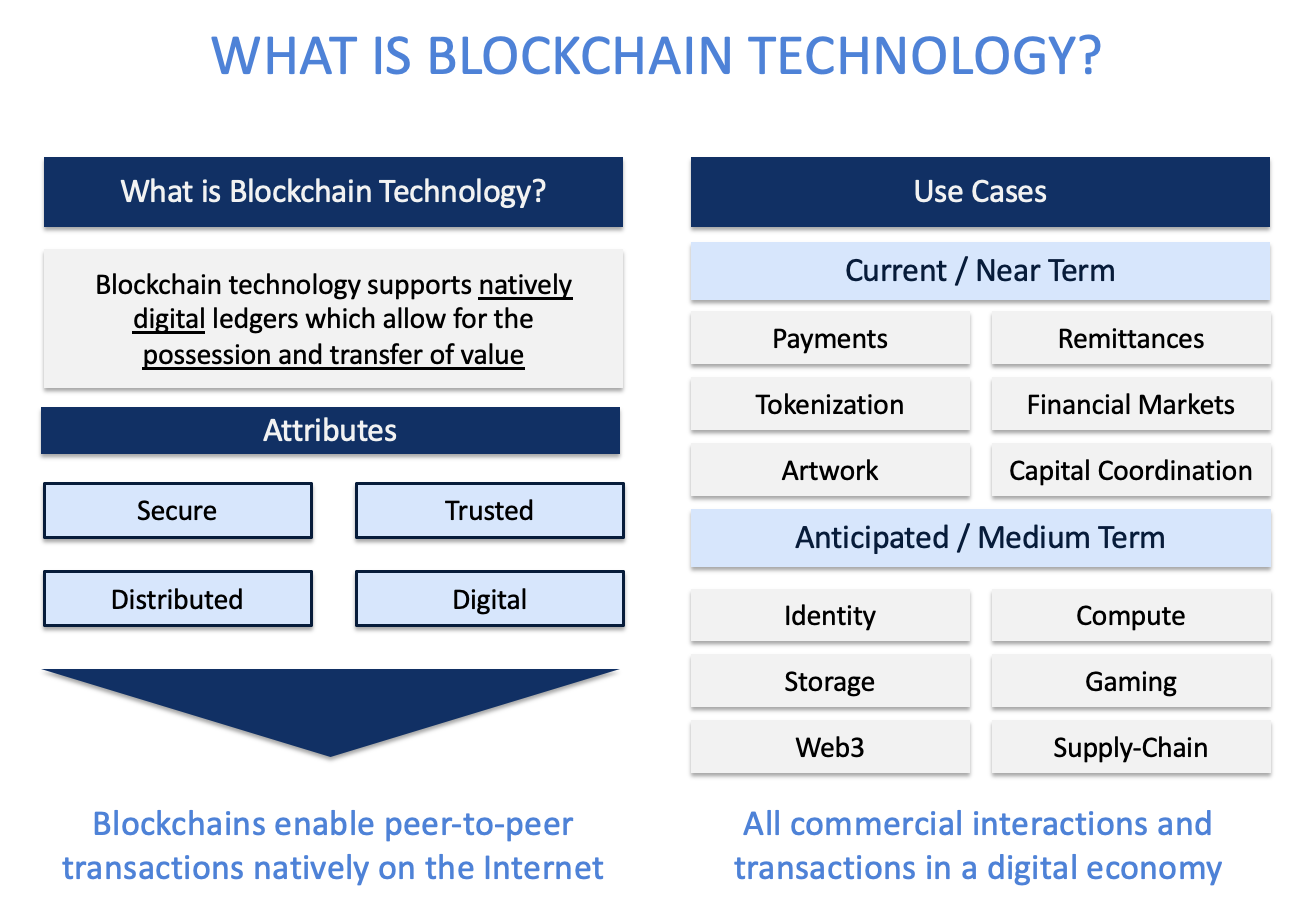

If you have not seen the following chart before, please watch our investment thesis webinar or read Blockchain Competitive Advantage.

Before the acceleration of AI, we already knew the world needed to solve all five issues to transition to a global digital economy.

We also knew that those companies and projects that solved these five issues would unlock the greatest value creation event the world has ever seen.

Which is why we invest in them in the early stage (but more on that later too).

WHY WILL AI MASSIVELY EXPLOIT INTERNET VULNERABILITIES?

So what changes with the arrival of better, cheaper, easier to use AI solutions?

Well a lot of good stuff.

But all innovations are double edged. Good actors use them for good purposes. Bad actors use them for bad purposes (and sometimes we have an unintended crossover).

Let's not talk about good actors using AI for good purposes. The rest of the world is talking about that right now.

Let's talk about bad actors using AI for bad purposes.

What would a bad actor use AI for? Well to turbocharge all the bad acts they are already focused on of course:

Many more, much larger global database breaches and massively enlarged volumes of identity scams.

Many more bank hacks and financial crimes of all sorts.

Much more large scale marketplace manipulation.

Phishing on a 10x and 100x or infinite scale (software scales easily) with much more difficult to spot human-like phishing actors.

Etc.

Why focus on monetary bad practices?

Because as Willie Sutton said, you rob the banks because that is where the money is.

So bad actors will use AI for financial crimes of course.

As well as some terrorists or state sponsored AI experts who may take down the Internet, collapse the Global Positioning System, or design the next generation, targeted, Covid-like pandemics with AI.

Whoops - that last sentence is really frightening.

But the central point holds. Most of the uses of AI by bad actors will be to accelerate with technology the financial bad practices that they already focus on.

Which brings us back to the vulnerabilities of the Internet that we have already named.

They will just up the stakes massively on us fixing the first three:

Security

Identity and Trust

Over concentration

Which we have to do anyhow.

Just now we have to move much faster.

WHY WILL BLOCKCHAIN BE NEEDED TO UPGRADE THE INTERNET STACK?

This is where it gets magical for us as Blockchain early-stage investors.

Some one, people, thing (AI?) created an innovation called Distributed Ledger Technology in 2008 and 2009 because he/she/they wanted to create a peer to peer electronic cash that the entire world would be able to use called Bitcoin.

But this peer to peer cash would need to run on the Internet.

And the Internet was, and is, not fit for purpose for digital commerce.

So the innovator's dilemma was how to launch bitcoin on the fundamentally flawed technology stack of the Internet.

The answer was to complement the Internet with a new technology stack now called Blockchain.

And in so doing, Satoshi Nakamoto solved the issues of security, identity, and trust and put in a decentralized approach as well.

He/She/They also created the world's first peer to peer cash or digital money.

And here at Blockchain Coinvestors our light bulb turned on when we realized in seeing Bitcoin, that if you could have one digital money, you could have an infinite number.

And if you can have digital monies then you can have digital commodities and assets too.

Which in turn means that Bitcoin and Blockchain provide a proof of concept for the digitalization of all of the world's monies, commodities and assets.

And it was not too much of a leap to then add the word INEVITABLE.

But the consequence of course is that all of the world's infrastructure will have to be upgraded.

WHAT WILL THIS DO FOR BLOCKCHAIN ADOPTION?

What will it do for the adoption curves of blockchain?

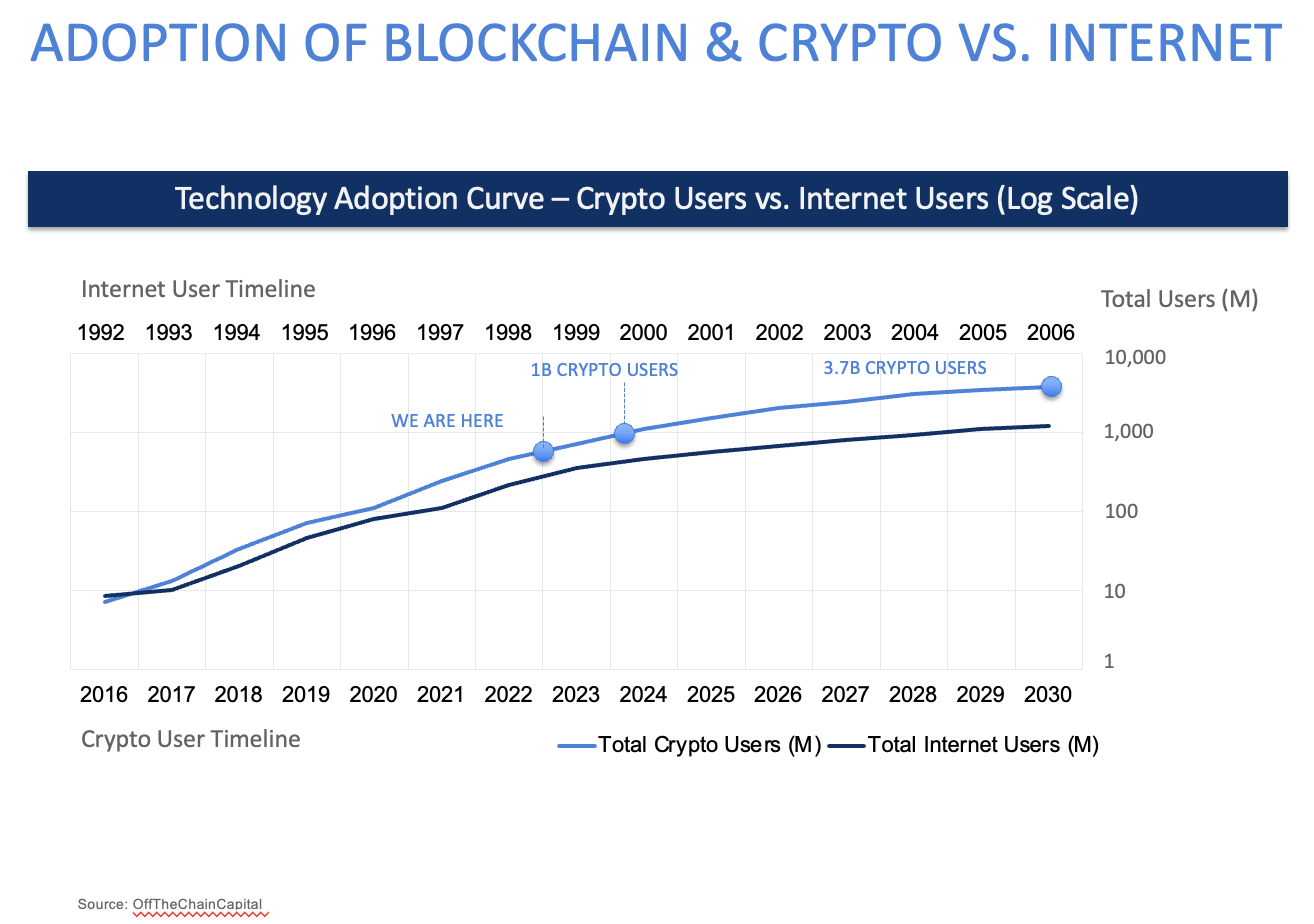

Firstly, those adoption curves are looking fabulous already.

The adoption of crypto, which is a sub-category of digital monies, commodities and assets, is already accelerating faster than the Internet adoption curve of the 1990's.

That makes sense because this time we can roll out new software in a world that is already digitally connected and is already using digital content solutions.

It also makes sense because the digital natives are now approaching their mid forties, and they are not only wanting, but are reliant upon digital approaches to live their lives.

Then while the US media would have you believe that all the world's lawmakers and regulators want to do Blockchain in, the reverse is actually the worldwide reality.

Almost every financial center in the world is scrambling to pass pro-innovation, digital money, commodity, and asset regulation as we speak and many have already done so.

The US will too, once it gets past this Luddite phase we have been working through (Should that be Warrenite or Genslerite? Maybe a branding opportunity here).

So we don't need blockchain adoption to be accelerated further for it to already be an amazing value creation opportunity for investors.

But let's just answer the question:

Will AI accelerate Blockchain adoption? Yes, because AI will take advantage of Internet vulnerabilities and force us to upgrade all databases and our approach to everything we do to make it more secure, with better identity and trust in a way that has less centralized points of failure.

How else will AI accelerate Blockchain? Maybe we will also need new human identity solutions so we know what is an AI and what is a human as Sam Altman and Worldcoin believe.

On the other side of the coin:

Will AI undo Distributed Ledger Technology? Well perhaps, but only if the security algorithms of DLT don't keep ahead of the ability to crack them.

But then the bigger point here is that if AI can crack database security, then all the LESS GOOD THEN DLT databases of the world will go first.

And so all the legacy databases in use today will have to be upgraded.

And as of today, one of the most promising solutions is DLT database technology.

Which ironically means this threat could actually turn out to be very accelerative of Blockchain as well.

That last thread is important. Most people who want to slow down innovation and the disruption it is creating for their own businesses create fears about how it may go wrong.

But the gorilla in the room is that it is exactly because the status quo of legacy solutions is so bad that innovators are making them better.

Any time you come up with an idea that threatens an innovation.

Turn it against the status quo and see what happens.

If AI (or Quantum) can crack blockchain, it will be so easy for AI to crack the leaky, vulnerable, breached every day databases that all the world's governments and businesses rely upon right now.

Incumbent heal thyself.

Upgrade to DLT now.

WHAT ARE THE IMPLICATIONS FOR INVESTORS?

The implications for Investors including ourselves are clear:

Deploy capital now into the next wave of Blockchain innovation.

Do so by having access to the world's leading investors in the space.

Ensure you have broad and deep diversification against all of the world's sub investment themes within Blockchain.

Selectively follow on invest but only when the best investors believe the opportunity is the emerging category leader.

Do it all on a low cost, institutional platform.

That is our investment strategy at Blockchain Coinvestors.

Our value proposition for you is that you can make a single investment and access global, diversified exposure to leading early stage Blockchain venture investments on an institutional platform.

You can join our newest Fund of Funds - Fund VII - to see our value for yourself. Schedule a call with our team to discover more.

Thank you for reading.

The Blockchain Coinvestors Partners

ABOUT BLOCKCHAIN COINVESTORS

Blockchain Coinvestors is the best way to invest in blockchain businesses. Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns. Blockchain Coinvestors’ investment strategies are now in their 10th year and are backed by 400+ investors globally. To date we have invested in 40+ pure play blockchain venture capital funds in the Americas, Asia, and Europe and in a combined portfolio of 750+ blockchain companies and projects including 75+ blockchain unicorns. Blockchain Coinvestors’ first fund of funds ranks in the top decile amongst all funds in its category on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in London, New York, Grand Cayman, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

"The best way to invest in Blockchain businesses"