Wealth Advisors are Ready and Allocating to Blockchain

Wealth Advisors Are Ready and Allocating to Blockchain

Taking some time off for the holidays is beneficial for many reasons. For us, one of the main ones is that it allows us to sit back and see the big picture.

We shared some of our clarified perspective in our 2024 Blockchain Predictions webinar which you can rewatch at your leisure - the more we thought about it, the more we became convinced that 2024 is an inflection year for global blockchain adoption, and in the report we laid out just why we believe this to be the case. Including the simple fact that around 4 billion people (half the earth's population) are going to be told by their own governments in 2024 that they need to prepare for a world of digital wallets and digital monies brought to them by their Ministries of Finance, Central Bankers, Banking and Payments Departments or equivalent as well as the private sector.

For this week's newsletter, we want to share another big picture perspective that has just moved into sharp focus.

The world's wealth advisors are ready and allocating to blockchain and crypto on behalf of their clients as we begin 2024.

THE FACTS

Let's begin by sharing some facts from recent surveys of wealth advisors including Registered Investment Advisors (RIAs) and Broker Dealer Representatives in the US, Independent Financial Advisors (IFAs) in Europe, Multi-Family and Single Family Offices and the core institutional wealth advisory institutions including large banks, private banks and others. All of these reports can be downloaded directly at www.blockchaincoinvestors.com/resources if you want to go through the source documents in detail.

Our first chart below is taken from the EY Parthenon survey of 250 institutional investors at the CEO, CIO or COO level. The findings include:

While 59% of institutions note that recent market events have impacted their short-term digital assets investment plans, they have plans to re-evaluate quickly

93% believe in the long-term value of blockchain technology and digital assets

69% expect to increase their allocations in the next two or three years

The single biggest barrier to moving faster is US regulatory uncertainty at 89% (Editorial Note: In Europe and Asia this has been resolved to a large extent in 2023).

A comprehensive, sixth annual benchmark survey of over 400 financial advisors was published over the new year by Bitwise Asset Management and VettaFi. The survey focuses on financial advisor attitudes toward crypto assets and was conducted from October 20 to December 18 2023. Key findings include:

Less than half of all advisors expect a spot bitcoin ETF in 2024. Surprisingly, only 39% of advisors believe a spot bitcoin ETF will be approved in 2024. By contrast, Bloomberg ETF analysts peg the likelihood of a January approval at 90%.

...But the vast majority see its approval as a major catalyst. Eighty-eight percent (88%) of advisors interested in purchasing bitcoin are waiting until after a spot bitcoin ETF is approved. (Editorial note - 11 Bitcoin spot ETF's were approved just after Bitwise published this report)

Access to crypto is still limited. Only 19% of advisors said they are able to buy crypto in client accounts.

Once you invest, you tend to stay invested (or invest more). Ninety-eight percent (98%) of advisors who currently have an allocation to crypto in client accounts plan to either maintain or increase that exposure in 2024.

Among advisors who allocate, the size of the allocation is rising. Large crypto allocations (more than 3% of a portfolio) more than doubled, from 22% of all client portfolios with crypto exposure in 2022 to 47% in 2023.

Client interest remains strong. Eighty-eight percent (88%) of advisors received a question about crypto from clients last year.

Held-away assets remain a major opportunity. Fifty-nine percent (59%) of advisors said “some” or “all” of their clients were investing in crypto on their own, outside of the advisory relationship.

Advisors have their sights set on crypto equity ETFs. Crypto equity ETFs were advisors’ top choice when asked what type of crypto exposure they were most interested in allocating to in 2024.

Regulatory uncertainty and volatility loom large. Sixty-four percent (64%) of advisors cited regulatory uncertainty as a barrier to greater crypto adoption in portfolios. Volatility was the second most pressing concern (47% of respondents).

Advisors prefer bitcoin over Ethereum. Seventy-one percent (71%) of advisors favor bitcoin over Ethereum, a marked increase from the previous year (53%).

One of the authors, Bitwise CIO Matt Hougan, sums the key so what's up well when he says,

“If you want to gauge where crypto is going, you need to talk to the professionals who control roughly half the wealth in America. The big takeaway from these advisors this year is that, for all the hoopla surrounding the potential approval of a spot bitcoin ETF, it doesn’t appear to be priced in. There’s a massive gap in expectations between advisors and those who monitor ETF developments for a living. Couple that with the fact that almost 90% of advisors say they’re waiting for an ETF before making a bitcoin investment, and you see a lot of demand bubbling just below the surface.”

This inbuilt demand that Matt talks about is perhaps the reason why the recently approved Bitwise Bitcoin spot ETF (BITB), which is the lowest cost of those approved to date, accumulated the largest amount of new assets at launch. Matt Hougan will join us on April 3rd at BlockTalk 2024 along with panels of wealth advisors to discuss these findings and answer your questions in more detail so please register and hold the date.

We will also be joined at BlockTalk 2024 by the head of allocator relations at Coinbase, Anthony Basilli. Coinbase has also recently surveyed the institutional investor marketplace, but this time by way of Institutional Investor Magazine which they commissioned to conduct an independent survey.

Key findings include:

A year removed from shocks to the crypto ecosystem, institutional investors are committed to crypto, actively investing in the space, and optimistic about the future.

64% of current investors surveyed expect to increase allocations in the next three years

45% of institutional investors surveyed without crypto allocations expect to allocate in the next three years

57% of institutional investors surveyed believe prices will move higher in the next 12 months, compared to just 8% who shared that view in October 2022

Respondents believe that blockchain can replace legacy payment and trade settlement rails in the future

The survey was conducted before the approval of the 11 US Bitcoin spot ETFs, so one wonders what the institutional investors surveyed would now respond when asked about their likelihood to allocate - however, the following chart from Institutional Investors already made compelling reading.

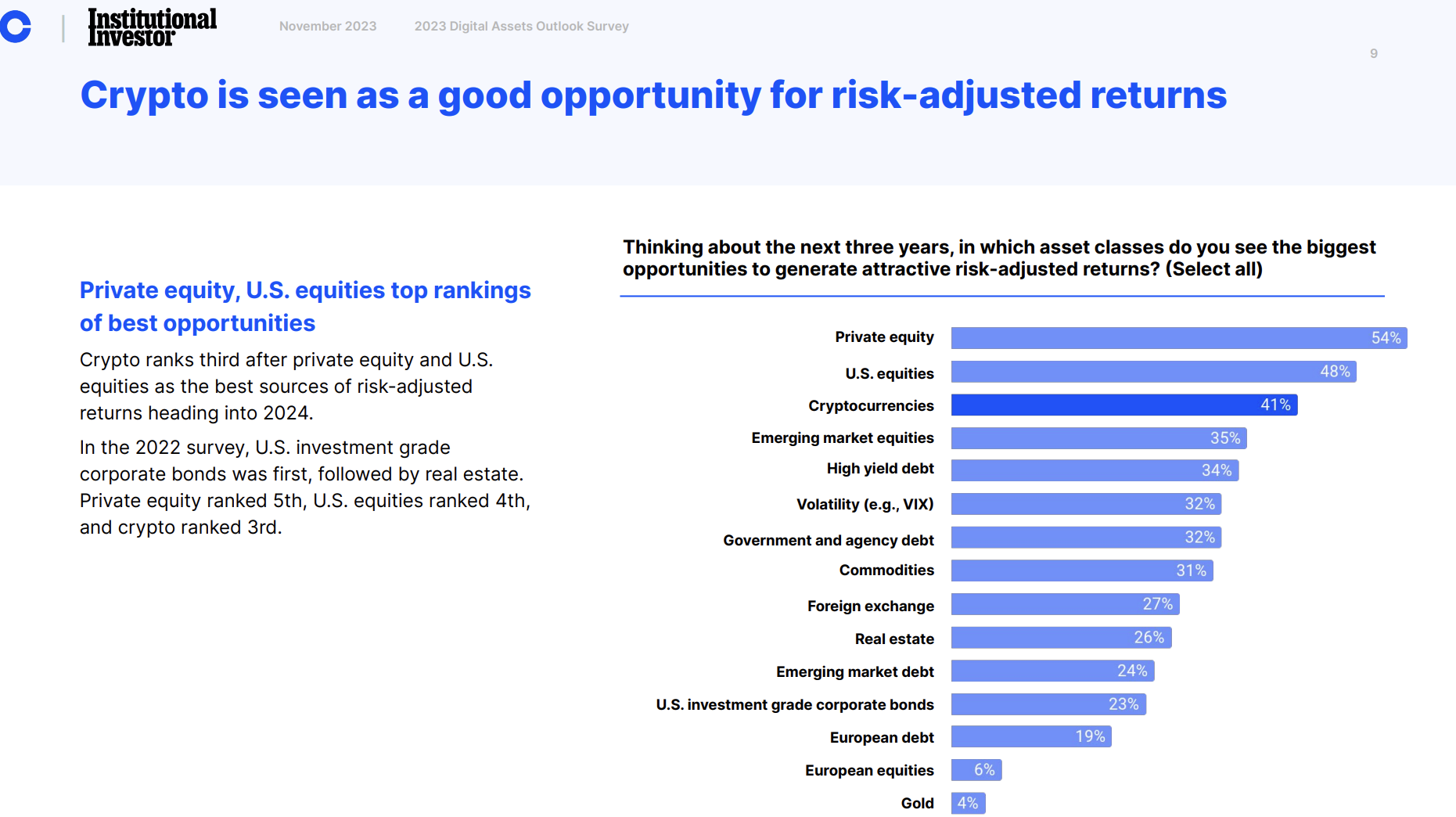

Beyond their general sentiment and likelihood to allocate, one of the most compelling charts we saw in the Institutional Investor report is reproduced below.

Going in 2024, institutional investors see cryptocurrencies as one of the three asset classes most likely to deliver attractive risk-adjusted returns.

Which ultimately is the most important point of all.

Wealth advisors are meant to deliver superior returns to their clients, and they collectively believe an allocation to blockchain is the way to achieve this in 2024.

THE UNDERLYING FORCES DRIVING THIS

So why are wealth advisors around the world now declaring their readiness to invest some of the many $ trillions that they manage on behalf of their clients into blockchain?

Some of the reasons we talk a lot about at Blockchain Coinvestors, and which we will not repeat in any detail in this newsletter, include:

Digital monies, commodities and assets are inevitable, and the entire world is now working hard to prepare for them

The value and wealth creation resulting from the upgrading of all the world's financial infrastructure will be larger than the internet delivered, which was the largest driver of investment alpha over the last few decades

The key challenges are mostly now resolved (eg. ways to access, custody, report and so on, although US regulatory uncertainty is still a major barrier as noted above)

The digital natives are demanding low cost, fast and easy access to the asset classes they want to invest into, and crypto is one of their top picks, and for many their number one most attractive investment opportunity

The digital natives are entering their peak earning, saving and investing years, and forward looking wealth advisors know they need to embrace this reality - serving boomers will only be a sufficient strategy in itself for another handful of years

Returns matter, and bitcoin has now demonstrated since inception that it can deliver superior risk-adjusted returns when compared to almost any other asset class or investment

However, there is another simple fact that Bitwise and VettaFi call out in their report, and which we reproduce in the next two charts.

First, only a small percentage of each type of wealth advisor currently allocates their clients into blockchain based investments.

However, clients are investing regardless of whether their wealth advisor helps them or not

Ultimately, wealth advisors know that if they don't assist their clients gain access to the most attractive investment opportunities, then their clients will ultimately go to someone else that will provide that access.

CONCLUSIONS

Even before the recent approvals of a large number of Bitcoin spot ETF's in the US, which removed permanently one of the most important barriers for allocation of client funds by US based wealth advisors, the global wealth advisor and institutional investment sentiment was mostly bullish for the future of blockchain as an attractive asset class for their clients (please note at Blockchain Coinvestors we see at least six distinct and different asset classes under the Blockchain umbrella).

The approval has, however, slammed the door on the issue. Not only has the US decided that digital monies, commodities and assets are in our futures, but the US judicial system is now providing the leverage to ensure that never again can an appointed, or elected, US official get away with simply saying 'these are all securities and 78 year old legislation is sufficient to manage them'. Always a ludicrous position, and one which has cost US citizens hundreds of millions of wasted taxes in defending to date. The damage to US financial and innovation leadership has been incalculable, and catching up with the rest of the world will be hard and expensive going forward.

For us at Blockchain Coinvestors, the other side of this is very exciting. Because so far most wealth advisors have only had access to publicly listed and traded crypto assets. Meanwhile, the asset classes we focus on, early and mid stage venture in blockchain, are even harder to access for most investors. This is why we have worked so hard over the last decade to build our unique value proposition:

A SINGLE INVESTMENT ACCESSES GLOBAL, DIVERSIFIED EXPOSURE TO LEADING EARLY STAGE BLOCKCHAIN VENTURE INVESTMENTS ON AN INSTITUTIONAL PLATFORM

Combined, the findings we have shared in this newsletter build to a key takeaway.

Blockchain access is no longer a 'nice to have' for a wealth advisor. It is now a 'must have'.

And that means vast amounts of capital will now begin to flow into blockchain and the companies and products built upon it.

A CLOSING THOUGHT

In our October 25, 2023 Letter from London newsletter we shared the sentiment of the CEO of the world's largest asset management firm, Larry Fink of Blackrock.

“WE ARE HEARING FROM CLIENTS AROUND THE WORLD ABOUT THE NEED FOR CRYPTO…THE RALLY TODAY IS ABOUT A FLIGHT TO QUALITY.” - LARRY FINK, CEO AND FOUNDER OF BLACKROCK

We have put this into capitals, because it is the key point. Around the world, the clients of wealth advisors want this, and view it as a quality asset class which they need exposure to.

The new iShares Bitcoin spot ETF is available now, along with Bitwise BITB and a host of others, on the platforms that every wealth advisor uses.

Thank you for reading

The Blockchain Coinvestors Partners

ABOUT BLOCKCHAIN COINVESTORS

Blockchain Coinvestors is the best way to invest in blockchain businesses. Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns. Blockchain Coinvestors’ investment strategies are now in their 10th year and are backed by 400+ investors globally. To date we have invested in 40+ pure play blockchain venture capital funds in the Americas, Asia, and Europe and in a combined portfolio of 750+ blockchain companies and projects including 75+ blockchain unicorns. Blockchain Coinvestors’ first fund of funds ranks in the top decile amongst all funds in its category on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in London, New York, Grand Cayman, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

"The best way to invest in Blockchain businesses"