Three Signals Why Now is the Time to Invest in Early Stage Blockchain

THREE SIGNALS WHY NOW IS THE TIME TO INVEST IN EARLY STAGE BLOCKCHAIN

Now is the Time to Invest in Early Stage Blockchain

In a financial landscape reverberating with global macro shocks and relentless updates from worldwide regulators (mostly very positive, although the SEC continues to lag), distinguishing signal from noise is pivotal to managing and safeguarding capital.

This is the challenge we face in an environment teeming with both disruption and opportunities. At Blockchain Coinvestors, we remain focused on our thesis that the world’s financial infrastructure must be upgraded for a digital economy and that diversified early-stage exposure is the best way to access this innovative asset class. By definition this implies a period of disruption as the world’s financial system is upgraded, but it also implies the greatest value creation opportunity the world has every experienced. Two sides to the same coin.

To assist our Limited Partners (LPs) in taking advantage of this complex investment environment, we've discerned three critical market signals that underscore the relevance and opportunity presented by investing in blockchain innovation:

The Quiet, Steady Adoption by Financial Institutions. Recent initiatives by BlackRock in Bitcoin ETFs, PayPal’s unveiling of its U.S. dollar-backed stablecoin, and Visa's innovative integration of blockchain for optimizing cross-border settlements, epitomize the embrace of digital finance by the world’s leading financial institutions.

The Emergence of a Warming Global Regulatory Environment. Ensnared by regulatory entanglements resulting from 2022 failures, the blockchain industry is witnessing the gradual dissipation of such impediments, paving the way for regulatory clarity across diverse jurisdictions.

Friendly Investor Conditions. The prevailing economic context has fostered an investment landscape that is, arguably, the most alluring it has been in a decade. For early-stage investors equipped with access and capital, the golden opportunity is to invest now.

Each is discussed in turn.

Signal One: The Quiet, Steady Adoption by Financial Institutions

While media narratives remain saturated with a focus on entities like FTX and portrayals of illicit activities within the sector, the forward momentum of blockchain adoption by the world’s preeminent financial institutions continues undeterred. This persistent advance is underscored by announcements this summer from BlackRock, PayPal, and Visa, that might have gone unnoticed by many LPs.

In June 2023, BlackRock, the world’s largest asset manager, filed for a Bitcoin Exchange-Traded Fund (ETF), signaling an unprecedented embrace of digital assets. This initiative spurred a cascade of applications and re-filings from financial titans like Ark Invest, Bitwise, Fidelity, Invesco, Valkyrie, VanEck and WisdomTree. Larry Fink, BlackRock’s CEO, later emphasized in a public interview the transformative power of digital product innovations and asset tokenization, while noting Bitcoin as the quintessential example. Fink’s remarks illustrated a profound embrace of blockchain technology, championing its potential to streamline transactions, curtail dependencies on custodial entities, and diminish the need for financial intermediaries. BlackRock has a near perfect track record of ETF applications, giving our team confidence that a US Bitcoin ETF is impending. This is also a significant signal of BlackRock's strategic commitment to blockchain as the driver of the next financial innovation wave.

Then in August, PayPal announced an important blockchain initiative with the unveiling of its U.S. dollar-backed stablecoin, making itself the first U.S. financial giant to initiate such a development. The introduction of PayPal USD (PYUSD), a collaborative endeavor with Paxos Trust Company, heralds a new phase in financial transactions, providing a state-of-the-art payment channel for its customers. PayPal has a long track record in financial innovation, but we expect other industry players to launch their own stablecoins in the short-to-medium term.

Finally, in September, Visa announced its own blockchain initiative, incorporating the Solana blockchain to enhance its settlement capabilities. The initiative is poised to redefine cross-border monetary transactions as it facilitates almost instantaneous settlement for Visa between diverse global currencies. The noteworthy aspect here is the incorporation of blockchain technology by a deeply entrenched payment provider like Visa to optimize its operational processes and mitigate overhead costs. This not only ensures expedited settlements but also mitigates Visa’s reliance on the conventional banking sector and their associated fees.

These groundbreaking announcements are a stark contrast from a media narrative around trading prices, reflecting how sophisticated financial players maintain committed to embracing the inevitable digital economy.

Signal Two: The Emergence of a Warming Global Regulatory Environment

For the better part of a decade, regulation of blockchain technology has been slow-moving, and confusing, leading to significant overhang on the sector as companies and investors had little direction on the rules of the road. This is now changing rapidly with the global regulatory landscape positively tipping towards pro-innovation regulation enabling digital monies, commodities and assets, and related financial technologies across most key jurisdictions.

In the European Union, MICA (Markets in Crypto Assets) came into force on June 20, 2023, establishing a comprehensive regulatory framework for the cryptocurrency industry, with the first segment of regulation slated to take effect on June 30, 2024. It mandates compliance for entities engaged in issuing or providing services related to crypto assets, such as crypto exchanges, wallet providers, ICO issuers, and entities that hold or custody crypto assets on behalf of others, shaping a coherent regulatory environment for diverse stakeholders. While not perfect, the regulatory framework is a welcome development. Beginning in the middle of next year, companies will have a clear set of guidelines on how to operate legally in all 28 EU member states.

Similarly, the United Kingdom has initiated its blockchain regulatory framework with the Financial Services and Markets Act of 2023 (“FSM Act”), which received Royal Assent on June 29, 2023. Parts of this act are already in force, with remaining provisions set to be enacted in phases, representing the government's policy to regulate crypto assets following extensive consultations by HM Treasury on regulating fintech and cryptoasset activities. Prime Minister Rishi Sunak has called for the UK to become a global hub for cryptoasset innovation.

Moreover, while mainland China had taken a hardline approach to unregulated cryptocurrencies in past years, Hong Kong has recently adopted a more flexible approach, with its Securities and Futures Commission (SFC) opening applications for crypto trading platform licenses from June 1 and allowing licensed virtual asset providers to serve retail investors under conditions, reflecting an easing in its policy posture. This is noteworthy as it signals a shift from the Chinese government as they seek to foster innovation in its traditional financial center.

Dubai has introduced a much-anticipated regulatory framework, exciting the local crypto industry. The robust framework defines relevant authorizations and licenses for entities offering crypto-related services and is complemented by comprehensive rulebooks detailing service-specific requirements. The framework has been lauded for its meticulous design, instilling clarity and certainty in the region's crypto future.

Finally, the United States, while comparatively slow, is making progress with two significant bipartisan bills navigating through Congress, suggesting momentum towards establishing comprehensive regulations, although we believe it is unlikely to conclude before the next presidential election. Nevertheless, major presidential candidates and congressional representatives from both sides of the isle are publicly calling for a prudent and clear regulatory regime that fosters US-based innovation.

While each jurisdiction demonstrates a unique approach to regulation, the global trend is toward establishing clear, coherent regulatory frameworks to govern the evolving digital asset landscape, thereby addressing uncertainties and establishing safeguards for companies and investors.

Signal Three: Friendly Investor Conditions

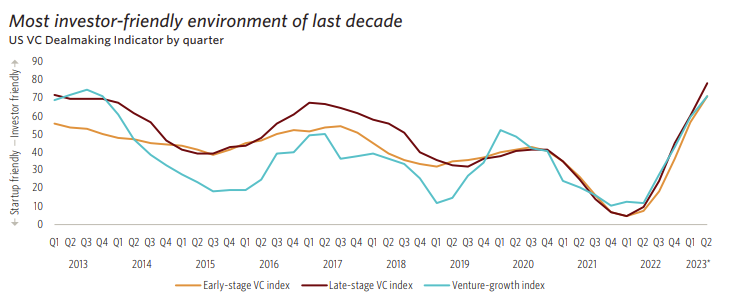

The ongoing economic scenario presents an attractive landscape for venture investments due to appealing entry valuations and increasing scarcity of capital. Since the Federal Reserve tightening cycle, valuations have subsided, particularly at the late stage, and deal size has diminished. Moreover, recent data reveal the emergence of down rounds, with 14.2% of Q2 completed financings being at a lower valuation compared to the companies' previous rounds. In fact, the Pitchbook-NVCA Dealmaking Indicator, which tracks venture deal making conditions, suggests the current market is the most investor-friendly in a decade.

We see an increased probability of further down rounds, pressuring valuations, and increasing leverage for venture investors. Interestingly, insider-led rounds are at their highest in a decade, corroborating the notion of more rounds serving as extensions or top-offs to runways.

Moreover, historical data shows early-stage venture consistently outperforms in the periods succeeding a downturn (see Letter from London Vol. 2, No. 4 – Venturing Through Recession). The dynamics during, and in the years shortly following, a downturn are quite clear and favor early-stage venture investing:

Favorable Valuations: Reduced competition for capital allows investors to secure investments at lower valuations and negotiate more favorable terms and conditions.

Increased Innovation: Economic downturns often spur innovation as startups seek to solve new problems that arise during these times.

Abundant Talent: Downturns often lead to talent availability as major companies downsize, allowing startups to access experienced individuals willing to join new ventures.

Startup Efficiency: Limited resources compel startups to operate more efficiently, focusing on bootstrapping and revenue generation over negative cash flow strategies, which are common in better economic times.

Market Opportunities: Well-funded startups active during downturns see a concentration of go-to-market opportunities and have the potential to capitalize on the scarcity and secure a substantial market share when the economy rebounds.

The existing economic conditions position this period as optimal for early-stage venture investing. Our approach is not just to seize attractive entry points provided by economic downturns but also to contribute to the innovation and success of potentially revolutionary companies in their nascent stages.

The View from London

The seismic shifts in the financial landscape, marked by steadfast adoption from financial juggernauts like BlackRock, PayPal, and Visa, signify a transformative phase where digital assets are integrated as pivotal elements in business strategies of the world’s largest financial enterprises.

Furthermore, developments in the global regulatory environment are indicative of an impending era where blockchain based innovation is embraced and guided by clear, coherent frameworks, minimizing uncertainties, and establishing robust safeguards for both entities and investors. Regions like the European Union, the United Kingdom, and Dubai are establishing regulations, and even the United States, despite its paced approach, is showing progress in shaping regulations for the crypto space.

Finally, the investment landscape is arguably at its most attractive stance in a decade, characterized by favorable investor conditions and the historical tendency of early-stage venture to thrive post-downturn. The venture capital landscape is ripe with opportunities, offering the promise of substantial returns to those with a discerning eye, long-term perspective, and an appetite for innovation.

This convergence of institutional adoption, regulatory advancement, and favorable investment conditions has created a compelling investment moment for allocating capital to early-stage blockchain technology. The alignment of these signals makes a compelling proposition for early-stage investors to act, allocating and investing in shaping the future of finance worldwide.

We invite you to contact us to learn more about these favorable tailwinds and our currently open investment opportunities.

Thank you for reading.

Mitch Mechigian

Partner, London

ABOUT BLOCKCHAIN COINVESTORS

Blockchain Coinvestors is the best way to invest in blockchain businesses. Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns. Blockchain Coinvestors’ investment strategies are now in their 10th year and are backed by 400+ investors globally. To date we have invested in 40+ pure play blockchain venture capital funds in the Americas, Asia, and Europe and in a combined portfolio of 750+ blockchain companies and projects including 75+ blockchain unicorns. Blockchain Coinvestors’ first fund of funds ranks in the top decile amongst all funds in its category on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in London, New York, Grand Cayman, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

“The best way to invest in Blockchain businesses”