Software is Eating Finance (Finally)

Software is Eating Finance (Finally)

This past weekend, amidst some spirited discussions, a friend posed some incisive questions about blockchain technology: What is it? Why does it hold value? Why should we transition to using blockchains?

At Blockchain Coinvestors, we believe that the revolution witnessed in communication and content due to digital technologies will also spread to finance and commerce. As the bulk of our interactions—shopping, working, and socializing—migrate online, the digitalization of money, assets, and commodities seems not just plausible but inevitable.

That’s why we are strategically positioned to invest ahead of the powerful tailwinds of digitalization.

Blockchain technology has a powerful role to play in the transition. Blockchains are a transformative technology that reinvents how financial infrastructures operate—through software rather than through paper- and human-based systems.

In other words, software is eating finance (finally).

This is not just an arbitrary or accidental shift; it's a logical progression in the broader trend where software disrupts and redefines virtually all industries.

Software is Eating the World

In 2011, Marc Andreessen, the legendary Netscape founder, penned a prophetic op-ed in The Wall Street Journal titled ‘Software is Eating the World.’ This piece posited that we were at the cusp of a significant economic shift where software companies were poised to dominate sectors traditionally outside the tech sphere, such as agriculture and defense.

At the time, Andreessen's viewpoint was unconventional. However, he noted that with the proliferation of broadband and smartphones, a global digital audience had emerged, creating a vast market for digital services, and transforming access to technology.

He underscored how advances in cloud computing and software tools had slashed the costs of launching and operating technology, democratizing the innovation landscape. He cited companies like Amazon and Netflix as quintessential examples of how software was usurping traditional business models—Amazon replacing Borders, and Netflix outmaneuvering Blockbuster.

Andreessen's argument extended beyond retail and entertainment, suggesting that sectors like automotive manufacturing, direct marketing, telecommunications, and even oil and gas were ripe for disruption by software, underlining its ubiquitous influence.

Reflecting on Marc’s foresight, it’s apparent that his basic premise is as follows: As the cost of compute approaches zero, any process that can be converted into software will be.

Why should finance be an exception?

(As computational costs continue to decline towards zero, the marginal cost of running software is becoming virtually negligible; consequently, anything that can be converted into software, will be.)

Blockchain 1.0: Digital Cash

The original and perhaps the simplest form of blockchain technology—dubbed Blockchain 1.0—is exemplified by Bitcoin. First introduced by an individual (or group) under the pseudonym Satoshi Nakamoto, Bitcoin represented a groundbreaking yet straightforward concept: creating digital cash.

Cash, in its traditional form, has distinct characteristics. If I hand someone a dollar bill, the transaction is immediate and self-evident. We don't need to trust or even know each other. There's no intermediary; the dollar bill is self-validating. Concerns about the bill being counterfeit or duplicated are minimal, making it a universally accepted means of exchange.

Bitcoin digitalized this concept. Instead of physical paper, Bitcoin uses software—blockchain technology—to facilitate peer-to-peer, cash-like transactions over the internet. Before Bitcoin, the idea of directly transferring value over the internet to someone in a different locale—whether in the next town or another country—was unfeasible without entangling a complex network of financial institutions. These intermediaries added layers of cost and complexity to what should be a simple exchange.

With Bitcoin, blockchain technology demonstrated that digital transactions could emulate the simplicity and directness of handing someone a dollar bill, but on a global scale.

Blockchain-Based Money: A Significant Upgrade?

At this point in the conversation, my friend stopped me to pose a rebuttal: "My banking app is already digital; why do we need blockchain? I can easily send $50 from my bank to yours."

Indeed, while many of us (in developed economies) enjoy the convenience of digital-like transactions, the underlying process is in fact neither truly digital nor instantaneous. In fact, it relies on an outdated, analog system that is slow, costly, and prone to fraud and other inefficiencies.

Understanding Traditional Bank Transfers

Take a bank transfer. Let’s say you want to send $50 to a friend. Sounds simple right?

The process of transferring money from one person's bank account to another's, especially when they are with different banks, involves a series of steps orchestrated by both the banks and the networks that connect them. Here’s a simplified breakdown of how a traditional payment works:

Initiation: You initiate a $50 transfer using online banking, a mobile app, or in person at a bank branch.

Verification: Your bank checks your account to confirm you have at least $50. If the funds are available, they place a hold on the $50, effectively debiting it from your account or reducing your available balance.

Processing: The transaction details, including the amount, your friend’s account number, and bank routing information, are input into a payment processing system like ACH (Automated Clearing House) in the U.S., or other similar networks.

Transmission: Your bank sends the transaction details through the chosen network to your friend’s bank. This transfer is often processed in batches, particularly with systems like ACH, which means the transfer might not occur immediately.

Reception and Verification: Upon receiving the transaction details, your friend's bank verifies the information, such as ensuring the account and routing numbers align with their records.

Credit: After successful verification, your friend’s bank credits $50 to their account. However, the funds are not immediately available to use.

Ledger Update: Importantly, no actual funds have been exchanged yet. Instead, what has occurred is that both banks have simply updated their internal ledgers to reflect a new balance to be settled between them.

Settlement: The actual transfer of funds between banks is settled, typically at the end of the business day. This settlement involves netting out all transactions for that day, with banks settling any remaining balances through their accounts with each other or with the central bank.

While the transfer process may appear instantaneous for some individuals sending money domestically—where the $50 reflects immediately in the recipient's account—the reality is that the two banks have merely updated their internal ledgers. A balance still needs to be settled between them behind the scenes.

Hence, this entire process, leading to the final settlement of funds between banks, can be quite protracted. For regular bank transfers, such as those using the Automated Clearing House (ACH) network in the U.S., settlement typically requires 1-2 business days. International wire transfers often take even longer, ranging from 1 to 5 business days, due to the involvement of multiple parties and various banking systems. Additional delays can arise from factors such as time zone differences, currency exchange necessities, and the participation of intermediary banks.

The Bitcoin (Blockchain) Alternative

Now transferring $50 in Bitcoin from one person to another is quite different from traditional bank transfers, mainly due to the technology which means that the entire transfer and settlement process is carried out autonomously via software code. Here's a simple explanation of how this process works:

Initiation: You begin by inputting the Bitcoin amount equivalent to $50, along with your friend’s Bitcoin wallet address, into your cryptocurrency wallet app.

Authorization: After confirming the details, you initiate the transfer. Your wallet then uses your private key to digitally sign the transaction, providing cryptographic proof that you are the owner of the wallet and authorizing the transaction. This signed transaction is then broadcasted to the Bitcoin network.

Verification (Mining): Miners, who are participants in the Bitcoin network, pick up the transaction. They verify the details, ensuring you have the requisite Bitcoin to send and checking the blockchain's history to prevent fraud, such as double spending.

Block Creation: Once verified, your transaction is grouped with others into a new block of data. This block is then permanently and securely appended to the existing blockchain.

Confirmation and Settlement: As soon as this new block is added to the blockchain, your transaction is considered confirmed and fully settled.

This whole process typically takes about 10 minutes.

Comparing Bitcoin-based payments to traditional bank-based payments reveals several clear advantages:

Speed: Bitcoin transactions typically fully complete within 10 minutes, much faster than bank transfers (1-5 days).

Reduced Costs: Bitcoin eliminates intermediary fees, often making transactions cheaper than traditional bank transfers.

Decentralization: Bitcoin operates on a decentralized network, reducing the risk of systemic failures.

Accessibility: Anyone with internet access can use Bitcoin to send money anywhere on earth.

Security and Privacy: Blockchain technology is extremely secure, making them tamper-proof.

Transparency and Traceability: All Bitcoin transactions are recorded on a public ledger, ensuring they are transparent and traceable.

Independent of Banking Infrastructure: Bitcoin functions without the need for traditional banking systems, considerably reducing backend costs and the need for human input.

Blockchain 2.0: The Era of Smart Contract Blockchains

The trajectory of blockchain technology did not halt with simple payment and transaction frameworks. Echoing Marc Andreessen's observation that "software is eating the world," significant advancements by developers and entrepreneurs paved the way for the next evolution: smart contract blockchains. This revolutionary concept was first brought to prominence by Vitalik Buterin in the Ethereum white paper of 2013.

Unlike Bitcoin, Ethereum incorporates a Turing complete machine. This term refers to a system capable of performing any conceivable computational function. In other words, Ethereum functions as a computer, but like the bitcoin blockchain, its operations are validated by a distributed network rather than a centralized entity.

Ethereum’s introduction marked a pivotal expansion of blockchain's capabilities beyond digital cash. It enabled the creation of complex financial applications such as money markets, trading platforms, and derivatives—all operated autonomously by software without any central governing authority like a bank. Furthermore, this innovation opened a new frontier in tokenization, where virtually any financial asset could be represented as a token on the blockchain, greatly expanding its potential applications. Outside of finance, smart contract blockchains have also opened vast potential for blockchain applications across various other industries as well.

The View from London: A New (Software-Based) Financial Infrastructure

What’s more, it’s not just crypto enthusiasts who have bought into this vision. Recent endorsements by leading financial giants, include BlackRock and PayPal, who are respectively launching products related to tokenization and stablecoins, underscore the broadening acceptance and integration of this technology.

So, what barriers remain? The primary challenge lies in the early developmental stage of blockchain technology—it has yet to scale to the capacity required to handle transactions and volumes comparable to our traditional financial systems. However, doubting the scalability of blockchain would be as shortsighted as those initial skeptics of the personal computer—who deemed it too costly and too slow.

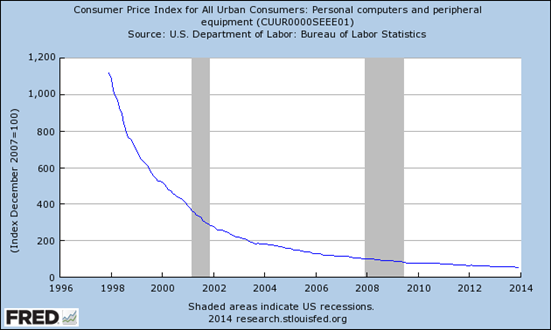

(The steep decline in the cost of personal computers, as captured in the graph, reflects a reality that was once deemed implausible—personal computers becoming affordable and ubiquitous in homes, defying the early skeptics' doubts and vindicating visionaries like Steve Jobs and Bill Gates.)

History has shown that software evolves at an exponential rate and with computational costs trending toward zero, we are confident that blockchains will eventually scale efficiently, making it economically feasible to rely on blockchain-based systems as the backbone of global financial infrastructure.

At Blockchain Coinvestors, we continue to invest in the world’s leading funds and companies at the forefront of this financial revolution. We see blockchain as the natural progression in the unstoppable trend toward digitalization. The emergence of natively digital assets, commodities, and currencies is inevitable, and blockchain technology is poised to be the pivotal force in this transformation.

Software has too come for finance.

Thank you for reading.

Mitch Mechigian

Partner, London

About Blockchain Coinvestors

Blockchain Coinvestors is the best way to invest in blockchain businesses. Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns. Blockchain Coinvestors’ investment strategies are now in their 10th year and are backed by 400+ investors globally. To date we have invested in 40+ pure play blockchain venture capital funds in the Americas, Asia, and Europe and in a combined portfolio of 1000+ blockchain companies and projects including 80+ blockchain unicorns. Blockchain Coinvestors’ first fund of funds ranks in the top decile amongst all funds in its category on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in London, New York, Grand Cayman, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

“The best way to invest in blockchain businesses”