New Era in Asia: A Beacon for Digital Finance

New Era in Asia: A Beacon for Digital Finance

As we celebrate a decade of leadership in blockchain investment strategies at Blockchain Coinvestors, we find ourselves at a pivotal moment in the evolution of digital assets. In our previous communications, we emphasized the rapid advancement of blockchain technology, which has not only kept pace with the early development of the internet but has also achieved significant commercialization in a remarkably short period. Just over 15 years since the publication of the Bitcoin whitepaper, blockchain now underpins trillions of dollars in value, supported by a flourishing ecosystem of products that are gaining widespread market acceptance around the world.

In order to tap into exceptional Asian based blockchain and crypto investment opportunities, and in support of our large number of Asian based LP’s, we have recently added a full time Blockchain Coinvestors presence in Hong Kong. Joy Cai, our Head of Asia, is available to share our insights, access and investment opportunities with each of you. In addition, beginning with today’s Letter from Hong Kong, Joy will provide regular updates on the state of blockchain and crypto in the region.

During our recent trip to Hong Kong and Singapore to attend Token2049 and Lw3, we observed the impressive growth of digital currencies, assets, and commodities, alongside increasing institutional adoption and supportive regulatory frameworks. These developments strongly indicate that the future we envisioned over a decade ago is rapidly materializing in Asia.

Letter from Hong Kong, Number 1

Token 2049 is perhaps the largest crypto focused event held in Asia annually with some tens of thousands of attendees, and the presence of most of the leading blockchain companies and projects, and investors including the majority of funds that we back. Lw3 is at the other end of the spectrum – an intimate gathering of leaders of blockchain where insights, perspectives, and opportunities can be shared in a ‘Chatham House Rules’ setting. Matthew and I attended both, and this month’s newsletter focuses on the insights we took away from these and other events attended.

Hong Kong vs. Singapore: Capital Flow, Family Offices, Regulations

Before providing observations from this September, a little context is probably useful for those of you who are not familiar with the importance of Hong Kong and Singapore as global financial centers, centers of digital asset innovation and investment, and as hubs for institutional asset managers, wealth advisors, family offices, and high net worth individuals. Some key insights:

Hong Kong and Singapore are engaged in a competitive race to become the leading Asian hub for cryptocurrency and wealth management, each offering unique advantages and challenges.

The family office landscape in Hong Kong is thriving, with over 2,700 single-family offices reported by the end of 2023, while Singapore has approximately 1,400, highlighting the growing interest in the single-family office as a preferred location for asset management.

In the Asia Pacific region, there has been a notable surge in interest and investment in digital assets among family offices with recent surveys revealing that 37% of family offices in this region are either currently invested in or interested in investing in digital assets.

Furthermore, one in twenty family offices in Asia Pacific reported allocating more than 10% of their investable assets to this emerging asset class.

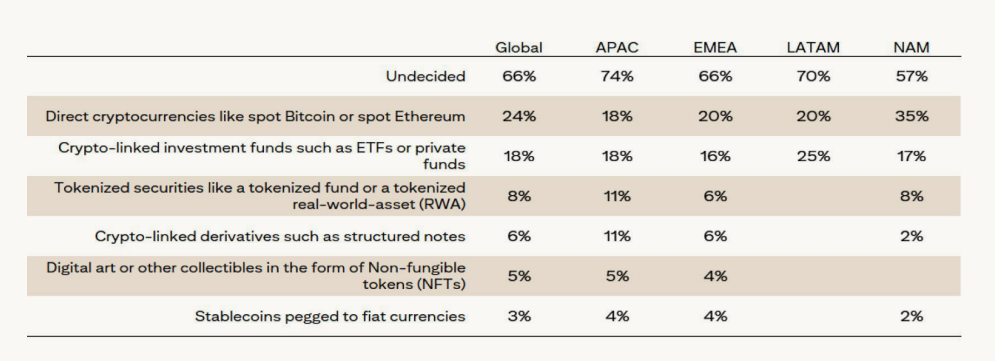

In terms of asset types, Asia Pacific respondents were equally interested in direct cryptocurrency holdings and crypto-linked investment funds (18% respectively).

The following tables provide additional data on the importance of the region in the global blockchain and crypto ecosystem.

Exhibit 1: Percentage allocation in digital assets of family offices of different regions

Exhibit 2: Asset types in digital assets investment of family offices of different regions

In terms of capital flow between the two regions, Hong Kong has recently attracted wealthy Chinese families seeking to establish family offices, particularly as Singapore tightens scrutiny following significant money laundering cases. Reports indicate that some affluent families are opting for Hong Kong as a quicker alternative for managing their wealth, given that setting up a family office there can be accomplished in a matter of weeks, compared to the lengthy process in Singapore.

From a regulatory perspective, while both regions have adopted relatively open stances toward cryptocurrency, they differ significantly in their frameworks. Hong Kong's approach is characterized by its flexibility and a focus on free-market principles, whereas Singapore employs stricter regulations, requiring comprehensive compliance measures for cryptocurrency exchanges and family offices. For more insights, please click to see the recent Global Family Office 2024 Survey from Citibank

Now on to our recent trip to each of Hong Kong and Singapore, highlighting the key takeaways that stood out in the many meetings we attended.

Observations from Hong Kong: Tokenization, Regulation, Collaboration

First, the view from China, and specifically, Hong Kong. Hong Kong has achieved significant growth in the crypto sector, recording an 85.6% year-over-year increase in its crypto market, making it a leader in Eastern Asia. This growth is attributed to supportive regulatory frameworks established by the Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC). Key initiatives include the approval of Bitcoin and Ether-based ETFs, bolstering institutional interest and increasing capital inflows.

Tokenization Initiatives

Hong Kong is actively pursuing the tokenization of real-world assets (RWAs) and has launched several initiatives to facilitate this process. The HKMA introduced the Project Ensemble Sandbox, which allows banks and financial institutions to experiment with tokenization, including tokenized deposits and wholesale Central Bank Digital Currency (wCBDC). This sandbox supports testing in areas such as fixed income, liquidity management, green finance, and supply chain finance.

Regulatory Frameworks

The HKMA has implemented a new regulatory regime specifically for virtual asset trading platforms. This framework aims to protect retail investors while ensuring compliance with anti-money laundering (AML) and counter-financing of terrorism (CFT) standards. The regulations are designed to create a secure environment for digital finance activities and encourage institutional participation.

Collaborative Efforts

The collaborations between banks like HSBC, Standard Chartered, and Bank of China in the sandbox illustrate a strong institutional interest in exploring the potential of tokenized finance. Companies such as Ant International are also involved, focusing on developing solutions for liquidity management and cross-border payments.

The overall sentiment in Hong Kong is extremely optimistic regarding blockchain and crypto innovation and the leading role that Hong Kong (and China) will play. It was impressive to hear family office after family office emphasizing that they are looking for attractive investment opportunities in this space.

Observations from Singapore: Token2049 and Lw3

As noted above, Token2049 is perhaps the best attended blockchain and crypto event annually in Asia, while Lw3 is a by invitation only event for blockchain leaders from around the world. The following is a synthesis of key takeaways from both.

Asia Focused on Fast Growing Blockchain Ecosystems

Over the past year, the ecosystems of Base, BTCFi, Solana, and TON have emerged as the fastest-growing ecosystems in the crypto landscape, showcasing the remarkable resilience and adaptability of their entrepreneurs.

Reflecting on the previous Token2049, Solana has made a remarkable recovery from the FTX incident, with its token price stabilizing and now trading in a range between $130 and $180 per token. In a market once dominated by Ethereum, the narrative has shifted, and many industry experts now believe that Solana could potentially surpass its rival.

Similarly, after a steep decline, Ordi's resurgence following its Binance listing has revitalized interest in the Bitcoin ecosystem, leading to the emergence of new developments such as Layer 2 solutions and staking. The TON community, which received little attention during the last Token2049, has garnered substantial support from numerous entrepreneurs following a series of successes over the past six months.

New Projects Gaining Momentum on Leading Protocol Platforms

In turn, this is attracting many of the most capable of a new generation of blockchain builders and entrepreneurs who prefer to build upon robust protocol foundations. Notably, multiple tokens from these ecosystems have successfully entered the top 100 by market capitalization, with Solana-related tokens alone accounting for as many as seven. Base, TON, and BTCFi have each introduced three to six new tokens that are now among the latest top 300 cryptocurrencies, further demonstrating their robust growth.

These flourishing ecosystems were vividly illustrated during Token2049, where Base and TON hosted a series of well-attended events, and Solana Breakpoint event stood out as a highlight, attracting both top-tier capital and developers.

Mass Adoption: Intuitive, Blockchain-powered Experiences at Token 2049

During Token 2049, several compelling use cases for cryptocurrency were showcased.

Just as one example, the innovative Web3 taxi app TADA in Singapore was particularly impressive:

TADA effectively leveraged its Telegram Mini App to offer significant ride-hailing subsidies, which not only attracted users but also incentivized them to adopt on-chain payments using cryptocurrencies such as $TON and $USDT.

This strategic approach exemplified how blockchain technology can enhance user experience while providing a cost-effective alternative to traditional ride-hailing services.

Furthermore, TADA's low commission structure resonated well with drivers, positioning the platform as a viable competitor in a crowded market.

By prioritizing financial fairness and operational efficiency, TADA highlighted the transformative potential of cryptocurrencies in revolutionizing everyday services.

These initiatives underscore the capacity of digital assets to drive consumer engagement and foster a more equitable ecosystem within the rapidly evolving landscape of Web3 applications.

Conclusions

For those of you who are unfamiliar with the Asian blockchain and crypto ecosystem, let me finish by summarizing the key takeaways:

Both Hong Kong and Singapore are global financial centers, and home to large and growing asset management and family office sectors.

Digital Asset investing is already well established in the region, with an increasing number of family offices saying they plan to increase their allocations to the space, including in offshore (to them) investment opportunities.

The region has long been the home of many builders and entrepreneurs who are innovating on blockchain technology and launching new crypto initiatives.

Token2049 and Lw3 emphasized just how deep this industry is and how broad the innovation.

In particular, resurgent blockchain protocols including Base, BTCFi, Solana, and Ton are getting a great deal of attention, with many new projects launching on them.

Finally, there were a number of practical use cases presented at the conferences that provide additional examples of what is now being put into operation in Asia on top of distributed ledger technology.

At Blockchain Coinvestors, we established our core investment thesis a decade ago, and we are excited in seeing a host of news confirming our investment thesis and strategy in Asia.

As a closing note, please contact any of our team at ir@BlockchainCoinvestors.com to express your interest and receive our Fund VII details as we prepare for our first closing in Q4.

Thank you for reading.

Joy Cai

Hong Kong

About Blockchain Coinvestors

Blockchain Coinvestors is the best way to invest in blockchain businesses. Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns. Blockchain Coinvestors’ investment strategies are now in their 10th year and are backed by 400+ investors globally. To date we have invested in 40+ pure play blockchain venture capital funds in the Americas, Asia, and Europe and in a combined portfolio of 1,250+ blockchain companies and projects including 95 blockchain unicorns. Blockchain Coinvestors’ first fund of funds ranks in the top decile amongst all funds in its category on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in London, New York, Grand Cayman, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

“The best way to invest in blockchain businesses”