How Do We Value Tokenized Projects?

How Do We Value Tokenized Projects?

Applying DCF Valuation Theory to Blockchain Protocols

As we prepare for the first closing of our latest fund of funds (contact our investor relations team at ir@blockchaincoinvestors.com for details), we are finding a lot of our investors are asking us how best to value tokenized projects that are not issuing equity, but which appear to have many of the same fundamentals as traditional centralized technology companies.

This is a topic that just bounced to the very top of the list for many equity analysts as the world prepares for the launch of the first US Ethereum Spot ETFs (assuming summer approvals are completed at the SEC).

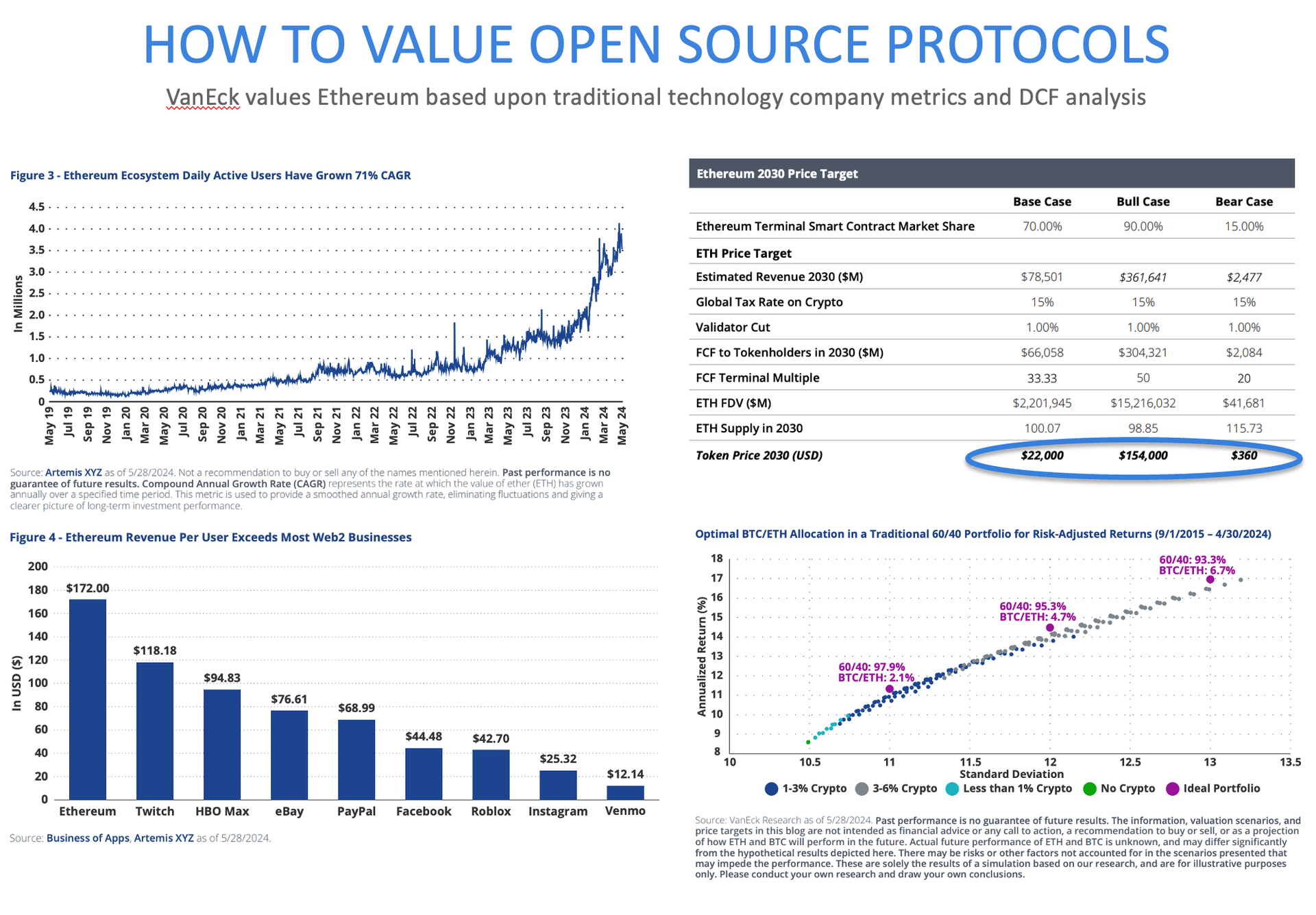

Indeed, Van Eck, one of Europe’s leading asset management firms, just put a fox among the chickens with the release of their Ethereum 2030 price targets report which is the source of our opening exhibit. Van Eck applied traditional discounted cash flow (DCF) to Ethereum and came up with a price range from $360 to $154,000. A massive range, but the important breakthrough was the realization that traditional valuation theory could be used at all.

As a result, we are dedicating this week's newsletter to exploring this topic in detail. If you read to the end of this week's newsletter, you will learn:

Why it would make sense to value open-source operating systems (or protocols) based upon the fundamentals.

Why one might expect an open-source, decentralized protocol (such as Ethereum) to be worth more than a centralized one (such as Microsoft).

What such early models suggest about the potential value of Ethereum as it prepares for live US Ethereum Spot ETFs.

Each is discussed in turn, but let’s start by reminding ourselves about how we value.

Traditional Valuation Theory

It is over 30 years since Matthew worked with Tom Copeland, Tim Koller and Jack Murrin on the first edition of McKinsey’s seminal book of discounted cash flow analysis called simply ‘Valuation’. Since then, the book has been updated seven times, but the fundamentals are unchanged.

Despite all sorts of experiments, false starts and abandoned alternatives, discounted cash flow is still our best way of valuing assets. Some like Benjamin and Dodds taught us now to apply the approach to valuing public equities, and the Warren Buffets of the world used the techniques to become world renown investors. Today, almost every serious public equity investor learns and applies these techniques to every investment they make.

Of course, it is not perfect. Not all utility and value drivers are measurable in financial terms, or at least attempts to value happiness, fairness and environmental impact, to name just three, continue to struggle despite enormous work to include them into valuation approaches.

However, at its core, we still value assets by assessing their continuing free cash flow (FCF), and then some time in the future (typically year 10) we apply a terminal value and add it to the value of the forecast period FCF and discount back to present value.

We know it is not perfect – not least because a large percentage of valuations have the majority of their value accounted for by the terminal value, which is a perpetual extrapolation of, typically, year 10. In some industries that may work fine. In fast changing industries (are any industries slow changing these days?) such as those applying new technologies and innovations in disruptive ways, this becomes the Achilles heel of valuation. Most of Microsoft’s $3 trillion market capitalization is wrapped up in your long-term view of how the future will unfold and what Microsoft’s role in the global future of innovation will be. More on this later.

For now, suffice to say, that while not perfect, DCF is the best valuation approach we have, and it is relied upon by most investment analysts.

Applying DCF to "New to the World" Industries

It is hard to first apply DCF to new to the world industries because we don’t know all the assumptions we need to make in order to define the forecast period, and terminal value drivers and assumptions.

What will drive free cash flow in a new industry?

How will it change in the forecast period?

What might change dramatically outside the forecast period?

Can we rely upon a terminal value given this future uncertainty?

These are all tough questions that take time for investment analysts to get their heads around.

We have seen this before. In the 1990’s, Internet company valuations went through this cycle as the industry matured. Initially, we had no idea how to value these enterprises, which were groundbreaking and allowed us to do incredible and novel things.

Inevitably, there were attempts at new valuation metrics since some wanted to argue that DCF would no longer apply. Some might remember the “Eyeball Valuations” based on page views, where the belief was that attracting many users would eventually lead to profitability. It took a while for us to learn that eyeballs were not enough. For example, research such as "The Eyeballs Have It: Searching for the Value in Internet Stocks" by Trueman, Wong, and Zhang (2000) found no significant association between bottom-line net income and market prices, leading many to claim that financial statement information had limited use in the valuation of Internet stocks. Valuations were driven by market sentiment, hype (number of eyeballs), and speculation these naysayers argued.

We now know none of these creative, but fundamentally flawed, methods of valuation could last, and fundamentals would eventually catch up. After the Internet bubble burst, the wider investor market shifted to more traditional valuation metrics, focusing on revenue, profitability, cash flow, and sustainable business models. The evolution of technology companies’ valuations from the dotcom bubble to the present highlights a journey towards more disciplined, data-driven, and sustainable approaches.

But make no mistake. The digitalization of communications and content drove enormous value capture by Alphabet (Google), Amazon, Apple, Meta, Microsoft, and the other Internet leaders. It also destroyed a lot of value in the traditional industries and companies that were slow to respond.

This historical context of financial markets learning how to value a new industry/asset class is indicative of understanding the current trends in blockchain valuation, as we anticipate a similar maturation process where speculative hype gives way to fundamental value metrics and the application of DCF to blockchain too.

Where are we in June 2024?

As we write this newsletter, this issue of how to value digital assets, is just becoming front and foremost in the minds of many investment analysts. The issue is live and important, because we are beginning to see the arrival of new to the world technology innovations once again. And there is enormous confusion. Most investors don’t even have a working categorization of digital assets. The popular press confuses us even more, equating Bitcoin (a digital store of value), with Ethereum (a global open-source operating system or protocol), with Shiba Inu (a speculative meme-coin price point with no value beneath it).

In our webinar, Investing in Early Stage Tokens, we provide a simplified categorization of digital assets and we argue that no investor can get started without one. How would you think you can value something if you don’t know what it is? You value an Apple, an Orange, and a General Motors stock quite differently since they are operating in different industries with different valuation drivers.

Well, the same applies to digital assets.

Just to get you started on this thought process, we offer the following exhibit that compares the current market values of certain digital monies and commodities on the left with their new digital asset equivalents. And then on the right, it compares the leading centralized technology companies with their new open-source competitors.

How should you think about valuing the shaded dark blue projects? Especially, those on the right-hand side like Ethereum, Solana, Coinbase, and Cardano?

It is a big question, but it is time for the world to get to grips with it.

Valuing Decentralized Open-Source Operating Systems (Protocols)?

To start, if we were capable investment analysts, and we were in the business of applying DCF in our work, how would we get started when attempting to value a decentralized, open-source, operating system or protocol?

We would start by looking for fundamental drivers of discounted cash flow. We would ask questions like:

Are there products and services built on top of the protocol?

Do they have users?

Do the users pay transaction fees or generate other types of cash flow?

Does some or all of that cash flow accrue to the protocol itself?

How does that get reflected in the value of the protocol token initially and over time?

And so on.

The answer is if you look, you will start to see a host of similarities between how Microsoft makes money and how an open-source protocol like Ethereum makes money:

In the case of Microsoft, it primarily helps us digitalize our communications and content sharing (Internet) with many hundreds of millions of users using the products and services built on top of the Microsoft operating system. We pay a lot for the privilege from licensing fees, software purchasing fees, cloud storage fees, revenue shares and commissions paid, etc. Microsoft has enormous free cash flow, and we project it always will do so, when we get to the terminal value. We value it today at $3 trillion or so.

In the case of Ethereum, it primarily helps us digitalize our financial and commercial activities (Internet of Value) with many hundreds of millions of users using the products and services built on top of the Ethereum protocol. We pay a lot for the privilege from transaction fees, revenue shares, and so on. Ethereum has enormous free cash flow, and we might project it always will do so, when we get to the terminal value. We value it today at $427 billion or so.

The big differences between Microsoft and Ethereum include:

Microsoft is a closed, centralized operating system focused on communications and content which means only approved software developers can access and use it and all the value accrues to the Microsoft shareholders.

Ethereum is an open, decentralized protocol focused on digital finance which is a much larger application. Anyone in the world can build on Ethereum (it is open) and the value accrues to the Ether token holders.

We could go on, but you get the direction of the conversation.

Now let’s take a look at a first application of DCF to Ethereum.

Public Equity Analysts Looking to Apply DCF to Blockchain

Van Eck, a leading European asset management firm, just published its first application of DCF to Ethereum. It did so because it is in the hunt to issue the first US sanctioned Ethereum Spot ETF, and wants to have an easy-to-understand logic for how to value Ethereum that traditional investors can get their heads around.

Needless to say, the Van Eck team did what they should do. They went back to the fundamentals and assessed Ethereum based upon the cash flows that it would capture over time.

The next exhibit provides some appreciation for their work. On the left the Van Eck team assessed the exceptionally fast growth of Ethereum users and the very high revenue per user. In traditional valuation we search, and usually don’t find, the proverbial holy grail of value – the company with profitable fast growth.

Ethereum appears to be just that.

Then on the right of the exhibit, Van Eck takes a first crack at building a discounted cash flow model for Ethereum. They run a number of scenarios and come up with three potential valuations:

Base case - $22,000 per token in 2030, market capitalization of $2.643 trillion

Bull case - $154,000 per token in 2030, market capitalization of $18.502 trillion

Bear case - $360 per token in 2030, market capitalization of $43.000 billion

As we write, Ethereum is trading at $3,554 with a market capitalization of $427 billion. Microsoft has a market capitalization of $3.338 trillion.

The importance of Van Eck’s work is not so much in the accuracy or precision of their valuation scenarios.

It is in the fact that a leading asset management firm has been able to value Ethereum based upon DCF, itself based upon fundamental analysis and considered assumptions about valuation drivers and the future.

Soon we all will be doing the same.

Why Open-Source Protocols May Be Worth More

The reason why the upside on Ethereum valuation is so high is because of the nature of open-source protocols.

Essentially, the Internet protocols were given away for free, and Microsoft and every other leading technology company uses them today and builds upon them. This means that the Internet allowed software companies to sell their products on a global scale, which was basically impossible before. The application layer (e.g., Alphabet/Google, Amazon, Apple, Meta, Microsoft, etc.) leveraged the open protocols of the Internet to provide products and services, where value concentrated.

Blockchain protocols provide the same scale of access as the Internet in the same permissionless manner. However, blockchain's edge is that the protocols themselves are ‘owned’ by the protocol projects such as Bitcoin, Ethereum, Solana, and others. They use tokens to incentivize adoption and development. Tokens serve as both a medium of exchange and a value capture mechanism, rewarding participants for contributing to the protocol’s growth. They also allow investors to participate in the upside of the protocol's growth. In short, in this new world, no equity is issued.

Finally, the tokens like Bitcoin and Ethereum are commodities (or monies) not securities.

Back to the Fat Protocol Thesis

A lot more can be said about this, and fortunately an earlier writer – Joel Monegro – did some valuable work on this topic.

Joel Monegro developed the Fat Protocol Thesis in 2016, which offers a compelling framework for understanding blockchain valuation. According to Monegro, the market cap of a protocol layer (like Ethereum) grows faster than the combined value of applications built on top of it. The idea is that the success of the application layer (think dApps like Uniswap) drives further usage at the protocol layer, increasing the value of the protocol layer and incentivizing competition at the application layer. (The Fat Protocol Thesis essay can be found here for those of you interested in learning more.)

For the first time, the world’s investors are going to get the opportunity to easily invest into the leading blockchain protocols (Bitcoin and Ethereum) through traditional financial products – ETFs.

So having a view on the Fat Protocol Thesis, and how to conduct a DCF of a blockchain protocol are now mission critical.

In Conclusion

We continue to believe that cash flow matters and that most assets are only valuable because they can be seen to generate it – value that can be measure in financial terms.

Other forms of value are important, and perhaps the world will become less financially oriented in the future, but for now DCF is the best form of valuation we have.

We know how to value Internet companies today, although twenty-five years ago it was a difficult and confusing discipline. Today, valuing blockchain projects is confusing and difficult, but we think it will resolve in the same way. Like Van Eck, we will all eventually apply DCF to Ethereum and the wave of blockchain protocols coming behind it.

This, however, doesn’t mean that blockchain protocols will have similar market capitalization to Internet companies. At Blockchain Coinvestors we believe that digital finance will be much bigger than digital communications and content (which is what the majority of the Internet companies do). We also see that open-source protocols like Ethereum have room to be much larger than closed protocols, like Microsoft, since the entire world can build products and services upon the former and create value with their products and services, some of which accrues to the underlying protocol and its token.

While this is not meant to be investment advice, we believe that most probably Ethereum will be more valuable than Microsoft in the long term. Today their respective market capitalizations are Ethereum ~$400bn and Microsoft ~$3trn. That is an interesting thought experiment as we all wait for the US Ethereum Spot ETFs to go live.

Please let us know your reactions, and do ask for the Fund VII materials from ir@blockchaincoinvesors.com.

Thank you for reading.

The Blockchain Coinvestors Partners

About Blockchain Coinvestors

Blockchain Coinvestors is the best way to invest in blockchain businesses. Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns. Blockchain Coinvestors’ investment strategies are now in their 10th year and are backed by 400+ investors globally. To date we have invested in 40+ pure play blockchain venture capital funds in the Americas, Asia, and Europe and in a combined portfolio of 1000+ blockchain companies and projects including 80+ blockchain unicorns. Blockchain Coinvestors’ first fund of funds ranks in the top decile amongst all funds in its category on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in London, New York, Grand Cayman, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

“The best way to invest in blockchain businesses”