FOUR POSSIBLE FUTURES FOR THE GLOBAL FINANCIAL SYSTEM

Blockchain Coinvestors Newsletter

Vol. 5, No. 3, March 2023

FOUR POSSIBLE FUTURES FOR THE GLOBAL FINANCIAL SYSTEM

As early stage venture investors we need to have a long term view at all times. At Blockchain Coinvestors we are investing for the 5 to 10 year timeframe (and many of the best exits most venture capitalists see are in fact in the 10 to 15 year timeframe) so we need to look for inevitable trends that we believe will play out in this timeframe and then we seek to deploy capital in front of them.

We have repeatedly shared our vision with you:

Digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded.

We still believe in this vision, and our investment thesis and investment strategies flow accordingly.

However, in times of great uncertainty, we need to look again and see if other plausible futures are possible. One of the most powerful tools in the corporate strategists armory for thinking about the future in a world of uncertainty is scenario planning.

As a thought experiment we are sharing a scenario planning exercise we recently conducted.

Please feel free to share this newsletter with any of your fellow investors who may find it helpful in this time of great uncertainty.

What is Scenario Planning?

Without taking you through a great deal of concept and theory, we begin with two quotes from two of our former partners:

'Scenarios aim to stretch thinking about the future and widen the range of alternatives considered' - Michael Porter

'Scenarios are the most powerful vehicles I know for challenging our mental models about the world, and lifting the blinders that limit our creativity and resourcefulness' - Peter Schwartz

Given that the world is always an uncertain place, it is dangerous for any one - and certainly for long term investors - to believe that only one future is possible. So instead, we use scenario planning to broaden our thinking and allow us to temper our current period actions in ways that differentiate between what makes sense across all the possible futures we can imagine, versus those actions that will be future dependent.

Peter Schwarz - who was Matthew's partner at Monitor Group and who wrote the book 'The Art of the Long View' - says it this way:

Scenario planning provides a means for ordering perceptions about how the future may play out and determining what strategic decisions today offer the best chance of success tomorrow.

Scenario planning challenges us to revisit assumptions and consider a wider range of possibilities about the future.

The point of scenario planning is not to predict the most probable future. Rather the objective is to develop and test strategic choices under a variety of plausible futures.

In the absence of a well-developed set of scenarios, single-point forecasting and/or a reluctance to allow uncertainty leads to a (usually unconscious) projection of an “official future”, which is the one assumed to be coming.

In a time in which the global financial system has suddenly become of major concern, what can scenario planning do to help us shape our viewpoints?

What is Our Focal Question and Critical Uncertainties?

Before we can create future scenarios we need to know what we are interested in examining about the future. There are many dimensions of the future that we could explore. So we need to define our focal question. For this exercise we wrote down the following focal question and the specific implication we wanted to explore:

Focal Question: How will the Global Financial System Develop by 2030?

And where/how should venture investors participate as a result?

The next step is to think through the critical uncertainties that shape an unclear future.

Which Critical Uncertainties Should We Utilize?

In a short newsletter like this we can't go over everything we thought about of course. However, the following exhibit provides a high level summary of some relative certainties and some critical uncertainties.

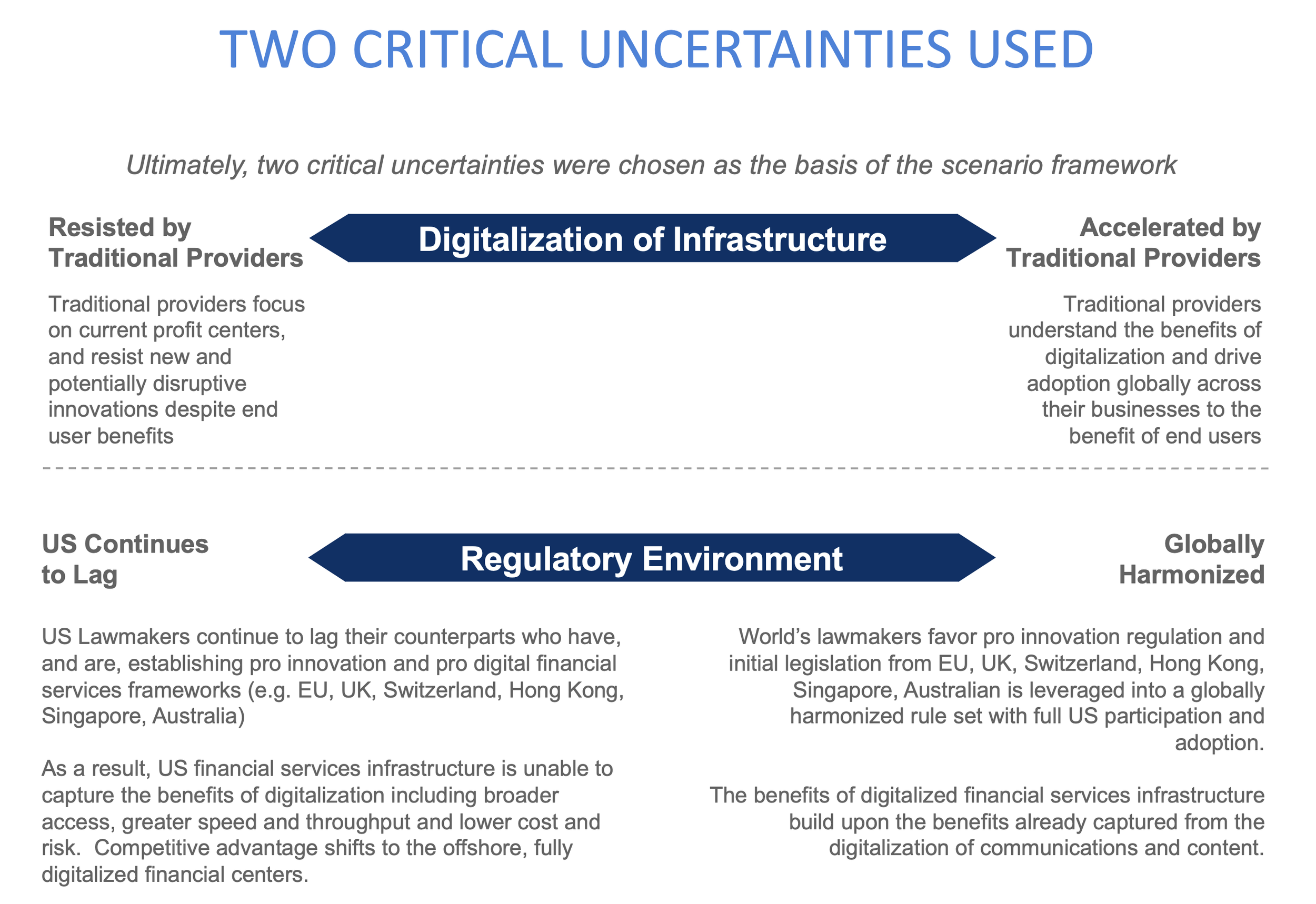

At this time, the critical uncertainties that keep us up at night are the first two:

Digitalization of Infrastructure. We are concerned that digital infrastructure will be resisted by traditional players who see it potentially undermining their current profit pools even if the results are powerful end user benefits like greater accessibility, easier and faster use, lower cost, and reduced risk.

Regulatory Environment. The second is that we hope, but are not sure, that the US government will repeat what they did in the 1990's. Then the US passed pro innovation regulation that greatly accelerated the arrival of the Internet and with it the digitalization of communications and content. The results are everywhere to be seen today, and mostly greatly beneficial to humankind. As a collateral benefit, the US also rose to be the global leader in digital innovation built on top of the Internet, and the most valuable companies in the world are mostly US based today.

Once we have defined our two axes, we can explore the various scenarios that might emerge.

What Scenarios Result?

Importantly, when we cross our two axes, four very different possible futures emerge. The chart provides some color, but we encourage you to think carefully about all four.

Wild Wild World. If the US continues to lag in setting a pro innovation regulatory environment to guide the arrival of digital monies, commodities and assets, and if traditional providers choose to resist change even if it is pro end user, we see a world of disruptive and chaotic activity with regulators paralyzed or uncertain as to how to act. While lots of money may be made and lost, it is not a comfortable world to live in. For us this is the 'official future' if we don't change what we are doing right now.

Offshore Competitive Advantage. If the US continues to lag, but the world's other jurisdictions march forward as they are doing in setting our the legal and regulatory rules for digital monies, commodities, and assets - as EU, UK, Switzerland, Hong Kong, Singapore and Australia are doing to name just six - and if the largest traditional players decide to embrace and accelerate the new innovations as we believe they are based upon our own conversations with many of the world's leading banks, asset managers, payment networks, exchanges etc., then we end up with a future in which the competitive advantage in global financial services goes to the parts of the world that are moving faster than the US. Since some of those parts of the world also want to see de-dollarization, we expect this future is not very good for the US and all of its residents.

Big Players Takeover. In a future in which there is a globally harmonized rule set for the digital financial system, but the big players resist the arrival of the new innovations, we see a world we call Big Players Takeover. It is a world that is not very good for end users, who continue to suffer the current negative externalities of bad access, hard to use platforms, slow and complex processes, excessively high costs, and great risk including heavy counterparty risks and concentrated points of failure. We think this is a world of national flag carriers in which smaller, and sometimes better, players can't compete.

Global Digital Financial System. Finally, if the US joins the rest of the world in establishing pro innovation rules for digital commerce, and if the traditional players accelerate the innovations as many wish to do, then we enter a world that we personally like a great deal. A world in which the benefits of digital communications and content created by the arrival of the Internet get extended to digital commerce and we move into a true global digital economy.

We encourage you to enter these four worlds and ask some questions:

What is the 'official future' you are implicitly holding in your mind and which of your current investment decisions rely upon it?

What other options might exist and how do you react to the four we have sketched out?

How do you feel about them, and what changes in your current worldview?

Another question is to map out what journey the world may be about to take. While only our first thought, we wonder if we are not on a trajectory in which the US first gives up its global competitive advantage in the global financial system, before eventually coming onboard and moving us to the Global Digital Financial System future.

We call it an unstable 'official future' because we ourselves are very unsure how this will play out.

What are the Implications for Venture Investors?

Now we did not do this thinking because we are futurists. We did it because we are investors. And we need to rapidly have a point of view about how the world may be about to change and what that might imply for our current and future investment decisions.

We have, and we suggest you do, consider the following investment related questions:

Consider how your current investment strategies and tactics might differ in light of these plausible futures?

What choices would you continue to take regardless – they are scenario neutral?

In uncertainty, diversification is the most important principle

Where the locus of value creation is uncertain, multiple bets are required

Investing with the best investors is always a smart strategy

Which choices would only make sense in specific futures?

How would you redirect your investing if you saw a specific scenario coming to pass?

What would you stop doing, what would you start doing?

What early indicators of probable futures will you track?

E.g. US passes anti-innovation legislation as knee jerk reaction to FTX

E.g. US banks refuse to bank the next generation of innovative fintechs

What actions can you be taking now?

Please share with us what you conclude. We need the benefit of your wisdom and the wisdom of the crowd.

How Does this Impact our Blockchain Coinvestors Investment Strategies?

Finally, we come to the main question.

How does this impact our Blockchain Coinvestors Investment Strategies?

The good news is we think we are straddled effectively across all futures:

Global not locally concentrated. Our funds are global with approximate allocations of 50% US, 25% Europe and 25% Asia. So regardless of which way the world shifts we expect we have capital in the right places.

Heavily diversified. Each of our funds backs a large number of venture funds and through them we get massive diversification - we are currently investors in more than 750 companies and projects and this is growing rapidly - probably more diversification than any one else has in early stage venture investing into the world of digital monies, commodities and assets and blockchain based innovation.

Invested with the Best Investors. Our goal is to partner with the best early stage investors who are investing into our investment thesis and we think we are in a large number of them today.

Straddled across traditional and new disruptive players. This is an important one. We are investors in the disruptive companies like Coinbase, Uphold and Yellow Card to name but three, we are ALSO investors in the infrastructure players that the traditional providers are utilizing such as Bitwise, Securitize, and SFOX to name just three again. So we are again straddled whether the winners are traditional or new players.

The one dimension that would impact us greatly is pro versus anti innovation regulation. If in the 1990's the US had banned the Internet (and many people including at the highest levels of government were arguing for this) then the American and global population would not have benefited so greatly over the past three decades.

Let's hope that pro innovation regulation wins out. If you want to share your voice, we think it would be beneficial.

Please feel free to share this newsletter with any of your fellow investors who may find it helpful in this time of great uncertainty.

Thank you for reading,

The Blockchain Coinvestors Partners

ABOUT BLOCKCHAIN COINVESTORS

Launched in 2014, our vision is that digital monies, commodities and assets are inevitable and all of the world’s financial infrastructure must be upgraded. Our mission is to provide broad coverage of the emerging unicorns and fastest growth blockchain companies and projects. Our investment strategy is now in its 9th year and has to date invested in more than 40 pure play blockchain venture funds in the Americas, Asia and Europe; and in a combined portfolio of more than 750 blockchain and crypto projects including approximately 55% of all blockchain unicorns. Our funds rank in the top decile amongst all funds in their respective categories on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in Grand Cayman, London, New York, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

FUND PERFORMANCE

The Blockchain Coinvestors Fund of Funds strategy was created to provide diverse coverage of the best blockchain pure play venture funds in the Americas, Asia, and Europe. Blockchain Coinvestors Funds I and II have already experienced significant appreciation. Almost all of our fund investments are performing as top quartile against the Cambridge Associates Venture Benchmark. Fund I Net TVPI is 4.55x with an IRR of 59.8% and is one of the highest performing fund of funds in the world according to Pitchbook and Preqin. Fund II shows equally impressive early results with Net TVPI of 1.39x and an IRR of 30.9%. Fund III closed at the end of 2022 and will begin reporting this year. Our newest fund of funds - Fund VII - is now in formation. Email us at ir@blockchaincoinvestors.com to learn more.

BLOCKCHAIN COINVESTORS CURRENT OPPORTUNITIES

Blockchain Coinvestors Fund VII (Fund of Funds). Our fund of funds strategy provides diversified coverage of the best blockchain pure play venture funds in the Americas, Asia, and Europe. Almost all of our fund investments are performing as top quartile against the Cambridge Associates Venture Benchmark. Fund I Net TVPI is 4.55x with an IRR of 59.8% and is one of the highest performing fund of funds in the world according to Pitchbook and Preqin. Fund II shows equally impressive early results with Net TVPI of 1.39x and an IRR of 30.9%. Our newest fund of funds - Fund VII - is now in formation and currently taking indications of interest.

Blockchain Coinvestors Fund IV (Early Stage Token) accesses early stage tokenized projects in their formation and seed stages through our relationships with other leading blockchain investors. We leverage asymmetrical information from our 40+ VC Funds to pick the most attractive opportunities.

Blockchain Coinvestors Fund VI (Mid Stage Growth) provides direct exposure to the emerging category leaders in the blockchain and crypto ecosystem. The Fund assesses the more than 400 blockchain and crypto projects in which we are already investors and employs a robust investment framework to select investment opportunities in their mid stage rounds - typically Series A, B, C.

Coinvestments. Our coinvestment program offers our investor community the opportunity to increase their exposure to emerging category leaders in the blockchain space. Please let us know if you want to learn which coinvestments are currently open for funding.

Contact ir@blockchaincoinvestors.com to learn more about any of these opportunities.

INTERESTED IN MORE? REGISTER NOW FOR UPCOMING WEBINARS AND CALLS

Our investment team hosts regular webinars and calls to help educate our community about the Fifth Era, fintech, blockchain and crypto. We discuss important trends, tailwinds, and investment themes including what we have learned and how we are using our knowledge to inform our own investment thesis and actions. Below is a list of our upcoming webinars for which you can register.

8 Investment Themes

There are multiple layers of blockchain technology and what it supports. Matthew Le Merle will break down and explain the various layers of technology to understand how they come together to form the blockchain ecosystem. Knowing how the ecosystem works together can help direct investment strategies and choices.

Digital Monies and Assets Adoption

As digitalization of monies, commodities, and assets continues to develop into the future, a variety of sectors will find ways to utilize these new methods for their internal and external communities. Mitch Mechigian will discuss what this will look like as blockchain technology advances in the coming years.

Recordings of past webinars and calls can be found at www.blockchaincoinvestors.com/webinars.

UPCOMING APPEARANCES

Our team speaks regularly at conferences and seminars around the world. Please join us at any of our upcoming appearances to take deep dives into the most innovative technologies of our time.

Grand Cayman

Matthew Le Merle discusses the

future of FinTech after the crash of FTX.

Digital Asset Week brings together some of the brightest minds in the space. Join our team as we provide our experienced insights of what is happening now and in the years to come.

RECENT PRESS

CNBC Crypto World: Matthew Le Merle discusses this year’s performance in the space and provides an outlook for 2023

Business Insider: A profile of the firm's investment strategy and why now is the right time to invest in blockchain technology

The Holy Grail of Finance: A podcast with Altvia regarding the inevitability of blockchain technology in conducting digital commerce

Boardroom Governance: Alison Davis gives her unique view on 20+ years of experience in management, investing, and board membership

CoinDesk TV: Interview on unicorns and predictions for 2022

Nasdaq Trade Talks: Discussion on the blockchain unicorn universe research and how to gain exposure

Ashurst: On the ESG Podcast, a discussion of the internet, fintech, blockchain, and individual revolution

Business Insider: Discussing how right now in blockchain is similar to the internet boom of the '90s in terms of growth and innovation

NBC San Francisco: An interview on what are NFTs

Crypto Unstacked: Podcast on the Fifth Era and the evolution of digital assets

BLOCKCHAIN COINVESTORS SWISS

We are excited to announce that Blockchain Coinvestors Funds are now available through Swiss certificates for those of our non-US investors who prefer this approach. The underlying fund is the same, however, our Zurich based team at Blockchain Coinvestors Swiss, who will introduce in future weeks, can provide detailed information regarding this investment option. Email us at mlemerle@blockchaincoinvestors.com to learn more.