IT'S TOO LATE (FOR BITCOIN INVESTING)?

Blockchain Coinvestors Newsletter

Vol. 4, No. 5, February 2022

Stayed in bed all mornin' just to pass the time

There's somethin' wrong here, there can be no denyin'

One of us is changin', or maybe we've just stopped tryin'

And it's too late, baby, now it's too late

Though we really did try to make it

Somethin' inside has died

And I can't hide and I just can't fake it

Oh, no, no, no, no, no

(No, no, no, no)

Lyrics from the song that was playing this morning on a bright, sunny President's day in Tiburon, California.

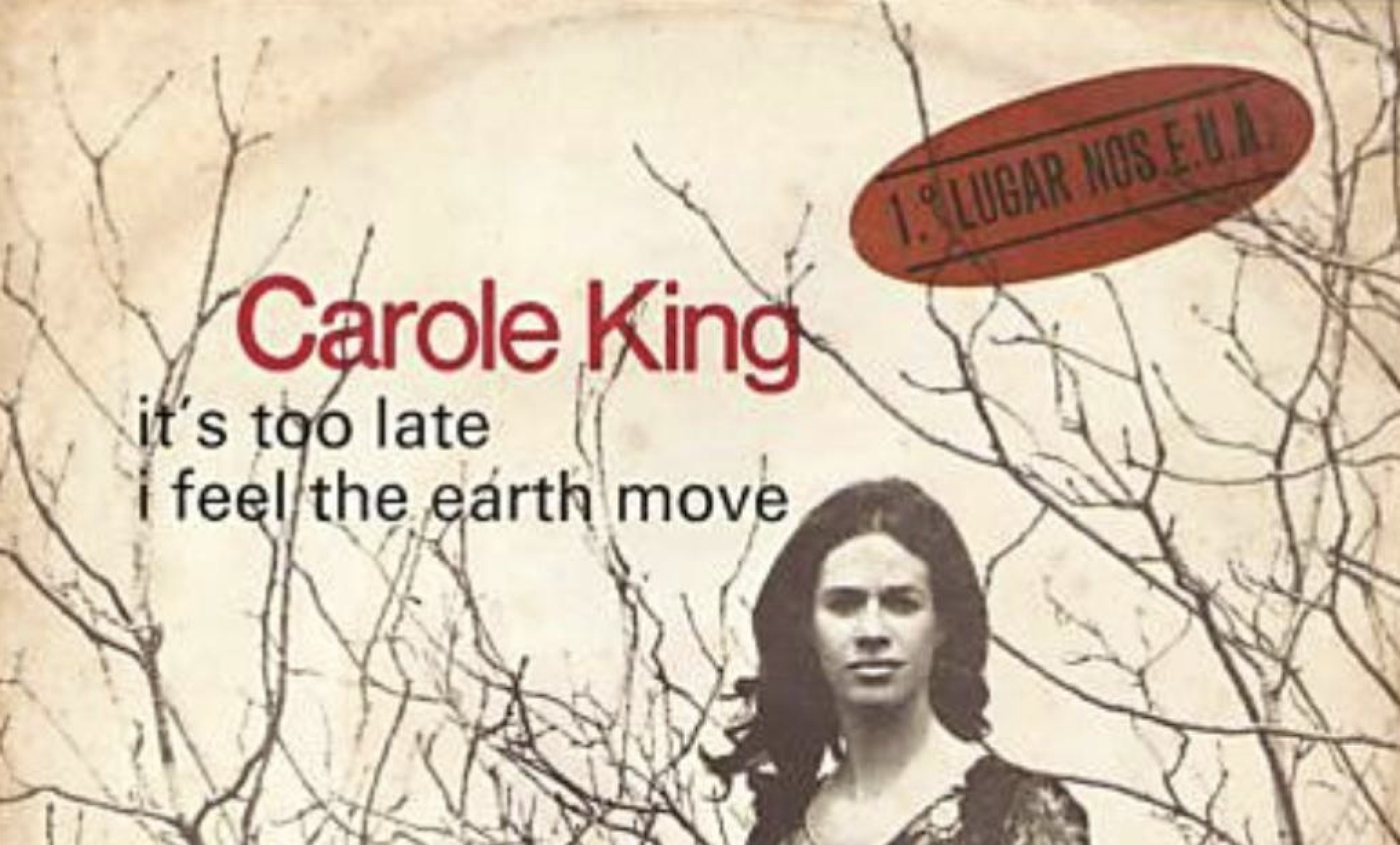

Written in 1971 in Laurel Canyon, California by Carole King it talks about her break up with James Taylor. It took her just one day to write a song that would go on to be number 1 that summer and which 50 years later still gets a great deal of airtime.

Not all creativity and innovation takes decades to birth.

But 50 years later we hear Carole King's words a lot from some of our best friends - sophisticated investors who tell us:

'It's too late to invest in blockchain'

'It's too late to buy digital assets'

'It's too late to back a blockchain startup'

For us that would only be true if it was also:

'Too late to innovate our (broken) global financial system'

But the good news is that none of those fears are warranted. And we all know this implicitly because we all lived through this once before.

THE 1970's & 1980's

As Carole King sat down in California to write 'It's Too Late' she was not the only person putting pen to paper.

As we lay out in 'Blockchain Competitive Advantage' David Boggs and Robert Metcalfe were beginning to imagine a connected world down the street in California at the Palo Alto Research Center (PARC) and two years later they made their breakthrough with the invention of Ethernet. By 1976, Vint Cerf and Bob Kahn invented TCP/IP the protocol that would allow for computers to speak a common language when connected together. By around 1980, Tim Berners Lee was working on hypertext, and while working at CERN in 1984 he had the breakthrough idea of combining hypertext, TCP/IP and the domain name system to create the World Wide Web.

It took more than five years more before the first website - info.cern.ch - went live in 1991 at CERN.

Twenty years to go from initial spark of innovation to the first website launching.

THE 1990's

Was it too late to invest 20 years later as we entered the 1990's?

Far from it. The 1990's saw an explosion of innovation leveraging networked digital communications enabled by the innovations of the 1970's and 1980's. That is when most of us first heard about - and had our first interactions - with the new technologies. Perhaps we tried to send a message. A few of us may have played around with Prodigy or the first version of America Online in the first half of the 1990's. By the end of the 1990's most of us had an email address and were buying a few things online.

However, skepticism was the order of the day. Most industries, and most big businesses, were of the opinion that while good for buying books, electronic commerce would not work for complex personal purchases like apparel and household goods, and there were unlikely to be 'serious' enterprise applications. The Superbowl ads that ended the decade might be fun, but come on....

The lawmakers and regulators were also confused and chilled in the 1990's. They simply did not understand how to establish laws for this new world of digital communications and increasing content. Some of you may remember some of the sentiments in the headlines of the late 1990's:

The Internet should be banned since it is mostly used for porn and illegal activities

Electronic commerce needs to be closed down because there is too much credit card fraud online

The Internet is being used for piracy and copyright infringement and strict new laws are needed to eliminate most of the current web sites and players

It is not fair that online merchants don't pay sales tax, and until they do, the Internet should be turned off

And so on

For us as investors, the most telling observation is that even through the end of the century, most of the world's investors did not back any Internet startups. Despite the reality that many of the most valuable companies and value creation juggernauts of this century were founded in that decade including Amazon, Disney Interactive, eBay, Google, Tencent, and Yahoo, to name but a few.

They were living through the greatest value and wealth creation moment the world had ever seen and they just laid in bed and let it pass them by.

The Millennium Until Today

The 00's started out with the Dotcom crash. Game over. Too late now for sure.

But was it?

Of course not. Innovation had not stopped. And the power of the global digital communication and content platform built on top of the TCP/IP protocol and all those innovations of the 1970's and 1980's was only just being realized. For those investors who kept at it, the list of the world's most valuable, and important, companies founded in the 2000's is impressive and long. Just a few examples include Baidu, EventBrite, Facebook, MySpace, SoundCloud, Tor, YouTube, WhatsApp, WikiLeaks, and Wikipedia.

In the 2010's, the train kept rolling. We had companies like Instagram, Medium, Pinterest, SnapChat, Telegram, TikTok, Twitch, WeChat, and Zoom being founded in this decade - indeed most of the communications approaches and platforms we use most often today were only innovated after 2010.

A constant cycle of innovation and disruption. And of course value and wealth creation and destruction too. Will they ever stop innovating and disrupting our lives? No, of course not.

But the BIG NEWS is that the diffusion of innovation curve that we just described which digitalized all of the world's communications and content based upon the Internet protocols of the 1970's, was complemented in October 2008 by a second innovation that seeks to digitalize all of the world's monies, commodities, and assets.

This time the underlying protocol is the Satoshi Nakamoto 'Bitcoin Blockchain Protocol'.

The global value and wealth creation of this new innovation should not be underestimated. Because just like communications and content, commerce is a true horizontal. Just in the same way that eight billion people and all of their industries, businesses, and entities need to communicate and share content, so they also all need to transact and engage in commerce.

And as you would expect, digitalizing all of the world's monies, commodities, and assets will be a massive undertaking - at least as complex as we just lived through over the last 50 years.

Is It Too Late?

In 1970 Carole King sat down to write her music using a pen and paper. Today, in 2022, when most of us prepare to invest in anything, we still have to sit down with our counter party and their and our lawyers to create a transaction based upon a paper based investment process. Because most of the world's assets are still paper based.

They are only now passing into their 'digitalization of music' moment.

How many years should we expect for this to play out?

Well, based upon our collective recent experience with digital communications and content, we would propose 50 years from 2008 sounds about right. And we should not expect all the best innovations, best projects, and best companies to be created in the first decade of this new innovation. That would only be true if the innovators would stop innovating. And they never do.

So we can expect another 40 years or so of massive innovation based disruption and value creation and destruction as all of the world's monies, commodities, and assets are brought fully into a digital age.

Please don't stay in bed all morning and let the world's greatest value and wealth creation pass you by.

Oh, no, no, no, no, no

(No, no, no, no)

And if you want any further inspiration, please note that the other side of Carole King's 'It's Too Late' was 'I Feel The Earth Move'.

Thank you for reading.

Alison Davis

Matthew C. Le Merle

ABOUT BLOCKCHAIN COINVESTORS

Launched in 2014, our goal is to provide broad coverage of the emerging unicorns and fastest growth blockchain companies and crypto projects. The strategy is now in its 9th year and has to date invested in more than 30 pure play blockchain venture funds in the Americas, Asia and Europe; and in a combined portfolio of 300+ blockchain and crypto projects including 30+ blockchain unicorns. Our funds rank in the top decile amongst all funds in their respective categories on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in Grand Cayman, London, New York, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

FUND PERFORMANCE

Blockchain Coinvestors Funds are continuing to generate strong returns. As of Q2 2021 our funds rank in the top decile amongst all funds in their respective categories on both Pitchbook and Preqin with Net IRR exceeding 60% for Funds I and II. This remarkable performance results from powerful tailwinds driving the world towards a future in which digital monies and digital assets are ubiquitous and the businesses and projects providing blockchain and crypto products, services, and infrastructure benefit disproportionately.

BLOCKCHAIN COINVESTORS FUNDS

Blockchain Coinvestors’ goals are to provide broad coverage of the emerging unicorns and fastest growth blockchain companies and to capture superior returns from investing in the leading blockchain venture partnerships:

Fund III is open only to investors who meet the Qualified Purchaser definition with a minimum subscription of $250,000.

A “qualified purchaser” is an individual or a family-owned business that owns $5 million or more in investments. The term “investments” shouldn't include a primary residence or any property used for business.

Fund III Parallel is open to investors who meet the Qualified Client definition with a minimum subscription level of $250,000 at the discretion of the Manager. Please contact ir@blockchaincoinvestors.com if the minimum is of concern.

Currently, an individual or entity is a qualified client if he, she, or it: (i) has a net worth of $2,200,000 prior to investment in the fund (excluding the value of his or her primary residence).

While the two funds are substantially the same, there may be some funds and investments that are only available in the Qualified Purchaser vehicle. Blockchain Coinvestors funds can take investments via IRAs. We support several providers, including AlgoIRA, Kingdom Trust, Millennium Trust Company and Pacific Premier Trust Company (Pensco).

Blockchain Coinvestors has launched an Early Stage Token Fund that is open to investors who meet the Qualified Client definition with a minimum subscription level of $250,000 at the discretion of the Manager. This Fund expects to have access to early stage tokenized projects that few others can access through its relationships with other leading blockchain investors. The Fund will target 20 to 30 SAFTs as well as positions in traded tokens when excess capital is on hand. This is a continuation of the direct token investing strategy of the Fund Manager that has included private stage investments in Acala, Filecoin, NEAR, Polkadot, Structure, and others.

Please visit the Blockchain Coinvestors website to learn more about our offerings. You can also reach our Investor Relations team directly at ir@blockchaincoinvestors.com.

BLOCKCHAIN COINVESTORS SWISS

We are excited to announce that Blockchain Coinvestors Funds are now available through Swiss certificates for those of our non-US investors who prefer this approach. The underlying fund is the same, however, our Zurich based team at Blockchain Coinvestors Swiss, who will introduce in future weeks, can provide detailed information regarding this investment option. Email us at mlemerle@fifthera.com to learn more.

BLOCKCHAIN COINVESTORS ANGELLIST SYNDICATE

Continuing the theme of the democratization of investing, we have a rapidly growing Blockchain Coinvestors syndicate on AngelList providing access to selected coinvestments. Please join us and our partner Lou Kerner on AngelList.

Click here to receive the insightful weekly crypto newsletter and webinar invitations from our Blockchain Coinvestors partner Lou Kerner.

Digital Assets Week is coming to California: March 22nd and 23rd in San Francisco, and March 25th in Palo Alto. The focus over the 3 days is on digital security, digital assets, and institutional crypto. We invite you to join Matthew Le Merle at the event to learn from the sector's most experienced leaders. Along with Matthew, other speakers include:

Chris Larsen, Executive Chairman, Co-Founder, Ripple

Scott Lucas, Managing Director, Head of Digital Assets, JP Morgan

Matthew McDermott, Managing Director, Global Head of Digital Assets, Goldman Sachs

Andrew Peel, Head of Digital Asset Markets, Morgan Stanley

Mike Belshe, Cofounder and CEO, BitGo

Chris Rice, Head of Digital Assets, Credit Suisse

Ryan Marsh, Global Head, DLT & Digital Innovation, Securities Services, Citi

Andy Tang, Partner, Draper Associates

Greg Brogger, Founder, SharesPost Inc

Michael Ashe, Head of Investment Banking, Galaxy Digital

Justin Chapman, Head Market Advocacy & Innovation, Northern Trust Corporation

T Prasanth Mathew, Managing Director, Cash Management – Head of Global Fintech & Platform Sales and US Tech Sales, Deutsche Bank

Jamie Finn, Co-founder and President, Securitize

Dave Hendricks, CEO & Cofounder Vertalo

We will have a limited number of passes available for our investors on a first come, first served basis. If you are interested in attending, please email ir@blockchaincoinvestors.com.

RECENT WEBINAR RECORDINGS AVAILABLE

Were you unable to make one of our recent webinars? View what you missed in our webinar library! Our most recent webinar - Institutional Investors - Making the Case for Blockchain - is already available for you to watch and share with colleagues.

REGISTER NOW FOR UPCOMING WEBINARS AND CALLS

Our investment team hosts bi-monthly webinars and calls to help educate our community about the Fifth Era, fintech, blockchain and crypto. We discuss important trends, tailwinds and investment themes including what we have learned and how we are using our knowledge to inform our own investment thesis and actions. Below is a list of upcoming webinars for which you can register by clicking the links:

Investing in Early Stage Tokens

- February 28th, 7:00am PST

- February 28th, 12:00pm PST

8 Blockchain Investment Themes

- March 14th, 7:00am PST

- March 14th, 12:00pm PST

Options for Investing in Blockchain and Crypto

Recordings of past webinars and calls can be found at www.blockchaincoinvestors.com/webinars.

RECENT PRESS

CoinDesk TV: Interview on unicorns and predictions for 2022

Nasdaq Trade Talks: Discussion on the blockchain unicorn universe research and how to gain exposure

CoinDesk: Our predictions on blockchain unicorns in 2021

Ashurst: On the ESG Podcast, a discussion of the internet, fintech, blockchain, and individual revolution

Business Insider: Discussing how right now in blockchain is similar to the internet boom of the '90s in terms of growth and innovation

NBC San Francisco: An interview on what are NFTs

US News & World Report: What to know about Bitcoin ETFs

Crypto Unstacked: Podcast on the Fifth Era and the evolution of digital assets

Business Insider: Which digital asset to hold right now - Bitcoin or Ethereum

Inc Magazine: An explanation of NFTs

Pensions & Investments: How institutional investors are getting closer to blockchain and crypto investments

On the Brink with Castle Island: An overview of technology trends and the cryptoasset markets