BLOCKCHAIN INNOVATION AND CONSUMER BENEFIT

BLOCKCHAIN INNOVATION AND CONSUMER BENEFIT

The Objective Function: Gains in Consumer Benefit

There is a central belief in capitalist economies that consumer benefit matters.

There are many definitions of consumer benefit, but in general if a consumer has needs, and if those needs are met by a product or service, then the consumer will have received a benefit. While we tend to focus first on monetary value, benefits, and costs, there are other benefits, like speed, ease of use, safety, security, and so on, that can also be added into a consumer benefit equation.

For a while, shareholder value appreciation was touted as the only objective function for (US) public corporations. However, short termism became an all too frequent consequence and often corporations forgot that long term success comes from increasing consumer benefit. You can only maximize short term value for so long if you are destroying your ability to deliver competitive consumer benefits. Ultimately consumers will take their business elsewhere in all but monopoly and monopsony settings.

Meanwhile, most US government agencies - federal and state - have some concept of consumer benefit central in their charters and they exist to help ensure that consumer benefit is protected, and that it grows over time.

Consumer benefit grows over time primarily because of innovation. There are other ways in which consumer benefit can grow - for example reduced raw material or labor input prices - but in our world of scarce resources, it is innovation that has driven gains in consumer benefit in most sectors of the economy throughout our lifetimes. Corporations have to innovate.

As a result, government agencies often stress the need to maintain competitive marketplaces, and provide a supportive environment in which innovation can thrive to the benefit of consumers.

Let's take a look at our personal experience to see if we have been the beneficiaries of gains in consumer benefit over the last twenty years - at least with regard to some of our personal use of Communications, Content & Entertainment, and Commerce & Finance products and services.

What Were We Using in 2003?

While simplistic, let's start by taking a quick look at examples of our personal products and services circa 2003:

1. Communications

At home we had an AT&T multi-line, multi-location wired telephone solution with a then state of the art voicemail support service. Very costly, but it did work once you had mastered the unique user interface.

When on the go, we were using a Nokia 1100 - the best selling mobile phone of its age but with very limited functionality. Our employer paid at that time.

Because of our employer's policies, we were using IBM desktops at work with Microsoft office suite - enough said there.

In order to stay 'within policy' when on the road and also when at home, we were encouraged to stick with an IBM Thinkpad personal computer. Our employer paid again, and it was not until later that the prosumer movement turned the tide on corporate IT departments.

File storage was either local (on the device) or on discs when on the move. When connected, dial up allowed access to our firm's shared file storage, but dial in on the road was problematic and access was often denied.

2. Content and Entertainment

While it was possible by 2003 to use e-books, in practice we still bought paperbacks for pleasure and hardbacks for business reading. We still visited bookshops, or used Amazon, and books were expensive to buy, and impossible to sell.

Our music was on CDs and we had to decide which handful to take with us before leaving home - they were expensive, scratched easily, and bulky.

We got our news primarily through paper newspapers with the addition of some online news sites for specific purposes. The subscriptions were expensive, and if we were not home, the paper piled up unread on the doorstep.

Films came on DVDs or we went to the theatre to watch the latest blockbusters since DVD release was always months later. With a large family, going to a film was a substantial investment.

We played games with our kids on Sony's Playstation2 which also used DVDs - they were very expensive, fragile like CD's and quickly discarded as the kids mastered them.

3. Commerce

We were early users of PayPal, but often the person we wanted to pay would not accept it so many domestic payments were through banks or by check or credit card - this was slow and costly but we were used to the inconvenience.

International payments had to go through our bank who would correspond with other banks overseas which was very costly, very slow and very complex to navigate.

To buy real estate we went through the traditional US realtor and bank approach which was very expensive, very slow, and very difficult to work with.

We bought our public investments through our broker, sometimes in person and sometimes online. Costs were coming down, but it was several days to settle trades, and a somewhat complex process.

Private investments were a whole world onto themselves and made very complex by non standardization and by all the paper back and forth with lawyers on both sides.

There is a lot more that can be said about our lives in 2003, but that gives the gist of it.

Gains in Consumer Benefit: 2003 to 2023

By 2023, we are excited to say that in the areas of Communications and Content & Entertainment, we have greatly leveled up as a result of the innovations powered by the Internet and ever more powerful mobile devices including the move to the cloud enabling digital sharing in all its forms.

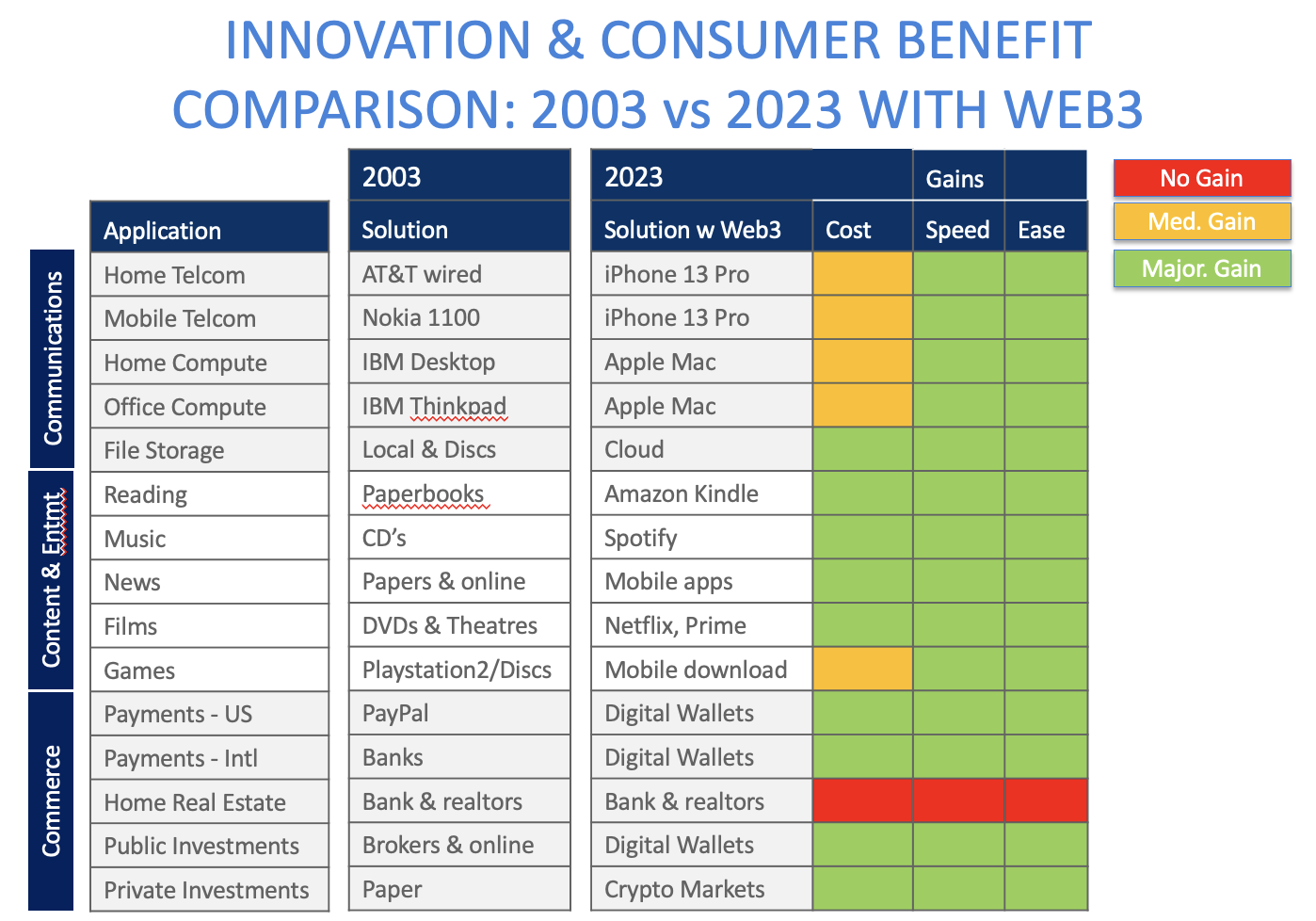

The exhibit below shows a summary of the 2023 solution in our household, and then indicates the consumer benefit gains we have experienced in terms of Cost, Speed, and Ease of Use.

What stands out a mile, is that our Commerce & Finance needs are being met in a somewhat similar way in 2023 to how we were being served in 2003. This raises some questions:

Why so little innovation?

Why so few consumer benefit gains?

Why would providers not want innovation if it is good for the consumer?

The last question is the one that lawmakers usually care most about - usually the answer is that established players seek to protect corporate profits and the status quo, rather than that they can't find ways to apply new innovations into their industry.

Gains in Consumer Benefit: 2003 to 2023 with Web3

Now there are some Web3 solutions that can do better in the area of Commerce & Finance with regards to Cost, Speed, and Ease of Use. We use them sometimes, but they are controversial and we have to be careful when we do, for fear of getting into a regulatory gray zone - that at minimum will make our year end taxes complicated to calculate.

The following exhibit updates Commerce & Finance as if we could broadly use these Blockchain based Web3 products and services, and indicates the benefits we would gain with regard to Cost, Speed, and Ease of Use.

Just as one example, we 'could' complete international remittances at almost no cost, in almost real time, on an easy to use platform, but we would be using stablecoins and digital wallets at both ends, and today that is not easy to do if you are a US based consumer.

Takeaways

Several takeaways should be called out:

Digitalization has driven innovation in Communications and Content & Entertainment providing enormous consumer benefits of lower cost, faster speed, and easier use between 2003 and 2023

Conversely, innovation has found it hard to gain traction in Commerce & Finance - at least for most people who are using traditional providers

Somehow, the objective function to maximize consumer benefit appears to have been forgotten

Perhaps it will require pro-innovation regulation to accelerate consumer benefit gains in Commerce & Finance and, as we illustrated in BLOCKCHAIN COINVESTORS NEWSLETTER VOL. 5, NO. 5, MAY 2023: GLOBAL RACE TO BE A DIGITAL ASSET HUB, most of the world's financial centers understand this is a competitive race for advantage

Implication For Investors

What does this mean for our investment activity at Blockchain Coinvestors?

As early stage investors we look for returns in the 5 to 10 year timeframe that come from innovations that bring 10x and better improvements

Blockchain innovation can already do much better than existing financial infrastructure - the gap in consumer benefit is becoming too large to ignore

Driven both by pro-innovation regulation in most of the world, but more so by the coming to prominence of digital natives who will not stand for paper, we expect these innovations to become broadly leveraged in Commerce & Finance globally

As a result, we are holding firm to our investment thesis:

Digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded

We are working hard to prepare our next Fund VII offering so that we can continue to deliver our value proposition:

A single investment accesses global, diversified exposure to leading early stage blockchain venture investments on an institutional platform

If you would like to receive the details of our new Fund VII please email our investor relations team at IR@BlockchainCoinvestors.com

The Blockchain Coinvestors Partners

ABOUT BLOCKCHAIN COINVESTORS

Launched in 2014, Blockchain Coinvestors’ vision is that digital monies, commodities and assets are inevitable and all of the world’s financial infrastructure must be upgraded. The mission is to provide broad early stage coverage of the emerging unicorns and fastest growth blockchain companies and projects. Blockchain Coinvestors’ investment strategies are now in their 10th year and have to date invested in 40+ pure play blockchain venture funds in the Americas, Asia and Europe; and in a combined portfolio of 750+ blockchain companies and projects including 70+ blockchain unicorns. Blockchain Coinvestors’ first fund of funds ranks in the top decile amongst all funds in its category on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in London, New York, Grand Cayman, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

FUND PERFORMANCE

Blockchain Coinvestors’ Fund of Funds strategy provides diversified early stage coverage of the best blockchain opportunities by partnering with leading pure play venture funds in the Americas, Asia, and Europe. Blockchain Coinvestors Funds I and II have already experienced significant appreciation. Fund I Net TVPI is 4.04x with an IRR of 51.4% and is one of the highest performing fund of funds in the world according to Pitchbook and Preqin. Fund II shows impressive early results with Net TVPI of 1.18x and an IRR of 16.3%. Fund III closed at the end of 2022 and will begin reporting this year, while Fund V is preparing for its final closing in the next quarter. The newest fund of funds - Fund VII - is now in formation. Blockchain Coinvestors also manages two direct funds; Fund IV (Early stage token) and Fund VI (Mid stage growth).

BLOCKCHAIN COINVESTORS CURRENT OPPORTUNITIES

Our funds provide investors with global, diversified exposure to early stage investing into the blockchain space. Our Fund of Funds allows an investor to make a single investment to access global, diversified exposure to leading early stage blockchain venture investments on an institutional platform, while our direct funds provide concentrated early stage exposure. We also provide regular coinvestment opportunities to our investors.

Funds are available to accredited investors, with minimums of $250,000 or more at the discretion of our managers.

Blockchain Coinvestors Fund VII (Fund of Funds). The Blockchain Coinvestors Fund of Funds strategy provides diversified early stage coverage of the best blockchain opportunities by partnering with pure play venture funds in the Americas, Asia, and Europe. A single investment accesses global, diversified exposure to leading early stage blockchain venture investments on an institutional platform. The newest fund of funds - Fund VII - is now in formation.

Blockchain Coinvestors Fund IV (Early Stage Token). This direct fund accesses early stage tokenized projects in their formation and seed stages through relationships with other leading blockchain investors. The Fund leverages asymmetrical information from 40+ VC Funds to pick the most attractive opportunities.

Blockchain Coinvestors Fund VI (Mid Stage Growth). This direct fund provides exposure to the emerging category leaders in the blockchain ecosystem. The Fund assesses the 750+ blockchain companies and projects in the portfolio and employs a robust investment framework to select investment opportunities in their mid stage rounds - typically Series A, B, C.

Coinvestments. The Blockchain Coinvestors' coinvestment program offers investors the opportunity to increase their exposure to emerging category leaders in the blockchain space.

Contact our Capital Formation team at IR@blockchaincoinvestors.com to learn more about any of these opportunities

INTERESTED IN MORE? REGISTER NOW FOR UPCOMING WEBINARS AND CALLS

Our investment team hosts regular webinars and calls to help educate our community about our investment thesis focused on the inevitability of digital monies, commodities and assets and the role that blockchain technology plays in enabling them. We discuss what we have learned and how we are using our knowledge to inform our own investment thesis and actions. Below is a list of our upcoming webinars for which you can register.

Meet the Blockchain Unicorns - Mid-Year Update

Our bi-annual report which includes the most comprehensive list of blockchain unicorns globally - including private blockchain enterprises and projects whose valuations exceed $1 billion. Blockchain Coinvestors uses proprietary data sources and its own database of its combined portfolio resulting from its blockchain venture fund of funds to track emerging unicorns.

Recordings of past webinars and calls can be found at www.blockchaincoinvestors.com/webinars.

UPCOMING APPEARANCES

Our team speaks regularly at conferences and seminars around the world. Please join us at any of our upcoming appearances to take deep dives into the most innovative technologies of our time.

We are pleased to once again join Prestel & Partner at their London Family Office Forum on June 20th & 21st. Our Managing Partner, Matthew Le Merle, will speak on the importance of investing in the future through venture opportunities.

RECENT PRESS

CNBC Crypto World: Matthew Le Merle discusses this year’s performance in the space and provides an outlook for 2023

Business Insider: A profile of the firm's investment strategy and why now is the right time to invest in blockchain technology

The Holy Grail of Finance: A podcast with Altvia regarding the inevitability of blockchain technology in conducting digital commerce

Boardroom Governance: Alison Davis gives her unique view on 20+ years of experience in management, investing, and board membership

CoinDesk TV: Interview on unicorns and predictions for 2022

Nasdaq Trade Talks: Discussion on the blockchain unicorn universe research and how to gain exposure

Ashurst: On the ESG Podcast, a discussion of the internet, fintech, blockchain, and individual revolution

Business Insider: Discussing how right now in blockchain is similar to the internet boom of the '90s in terms of growth and innovation

NBC San Francisco: An interview on what are NFTs

Crypto Unstacked: Podcast on the Fifth Era and the evolution of digital assets

BLOCKCHAIN COINVESTORS SWISS

We are excited to announce that Blockchain Coinvestors Funds are now available through Swiss certificates for those of our non-US investors who prefer this approach. The underlying fund is the same, however, our Zurich based team at Blockchain Coinvestors Swiss, who will introduce in future weeks, can provide detailed information regarding this investment option. Email us at mlemerle@blockchaincoinvestors.com to learn more.

"The best way to invest in Blockchain businesses"