DIGITAL ASSETS ARE COMING FAST NOW

Blockchain Coinvestors Newsletter

Vol. 4, No. 10, April 2022

DIGITAL ASSETS ARE COMING FAST NOW

Those of you who are regular readers of our newsletter know that for most of a decade we have told you that central to the Blockchain Coinvestors' investment thesis is the belief that digital monies, commodities, and assets are an inevitability. This is the central foundational theme underlying our investment strategies and it is why our fund performance is proving so exceptional. We have just reported that for Q4 2021 Fund I Net TVPI is 4.72x with an IRR of 72%. Fund II shows equally impressive early results with Net TVPI of 2.08x and an IRR of 146%. We believe Pitchbook and Preqin will once again rank us as perhaps the highest performing funds in the world in our categories.

It is also why we are launching our new Fund VI (Mid Stage Growth) investment strategy to complement our early stage blockchain investing. To learn more please email us at IR@blockchaincoinvestors.com.

DIGITAL MONIES, COMMODITIES, AND ASSETS

While we have digitized communications and content through the transformative power of the Internet and its key protocol - TCP/IP - we will not transition to a true digital economy until we also digitalize commerce. Because while every industry, business and individual communicates and shares content digitally today, we still rely upon some very outdated ways to transact. And we all transact, all of the time.

In Newsletter Vol. 4, No. 3 (THE LAST FOUNDATION BRICK HAS JUST BEEN LAID) we talked about how in the US digital monies have now finally been embraced by the Federal Reserve, and in Newsletter Vol. 4, No. 7 (RUSSIA, UKRAINE, CBDC'S & BITCOIN) we illustrated how a new and tragic global crisis is accelerating digital monies just as the global pandemic greatly accelerated digital health, education, entertainment and so on.

This week we turn to the other half of the coin. Because it is not just about digital monies and commodities. It is about digital assets too.

And believe it or not, we still use paper to record and transact most of the world's assets!

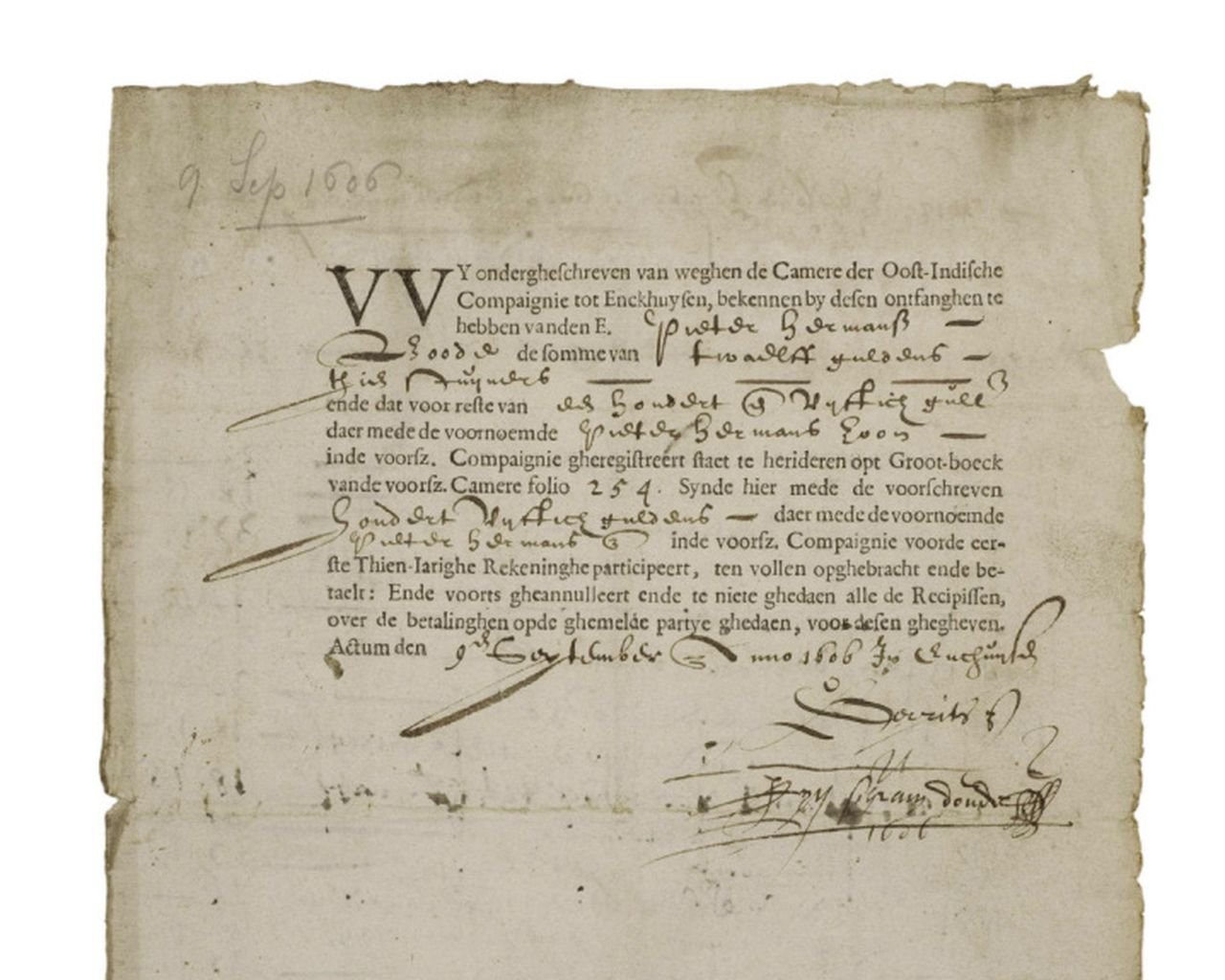

MOST OWNERSHIP CERTIFICATES STILL PAPER BASED

The image that we begin this newsletter with is perhaps the world's first stock certificate. It was issued in 1606 by the Dutch East India Company. We know the holder was Pieter Harmensz who paid 150 Dutch Guilders for it and today it can be seen at the Westfries Museum in Holland. As we have previously discussed, in the 1980's, the world's leading stock exchanges and many companies stopped the physical trading of paper stock certificates and instead decided to hold them at a central depository and keep records of the trading instead. We got rid of the paper, but we still (mostly) kept the paper based processes. The DTCC in the US still maintains the quaint concept that we need to clear transactions through a central clearing house and that it should take time, cost and add substantial complexity to do so. Because back in the days of paper stock certificates we knew no better.

Well guess what. Most ownership certificates are still paper based.

This week we gifted our 16 year old Range Rover to our gardener and replaced it with a five year old one for the heavy jobs like towing. Believe it or not we had to complete paper ownership certificates like this one below. We call them 'Pink Slips'. Because they are pink. They are also made of paper. And it takes a LONG time to get someone at the DMV to process them. Believe us. Time is money, and all those DMV's and all those DMV workers get paid by someone.

Do we really need to have the 280 million and more cars that are on the roads of the US reliant upon pink slips and lengthy, costly and complex paper based certification processes? Isn't there a better way?

Yes of course there is a better way.

But before we talk about the better ways that are, of course, digital assets and digital processes, we want to dig a slightly deeper hole here.

MOST ASSETS HAVE NO PROOF OF OWNERSHIP AT ALL

Almost all of the world's assets don't even have paper based proof of ownership certificates.

Consider this picture below which is the White Drawing Room at Buckingham Palace. It is one of 775 rooms in Buckingham Palace that covers more than 19 acres of floor area (about 77,000 sq metres).

It is full of items of great value. Assets. Furniture, art, rugs, chandeliers and so on as you can see. Multiply that by 775 rooms and you begin to see that recording the assets would become quite difficult. As an example there are 350 clocks and watches in the Palace and two full time horological conservators who wind them up every week and keep them in good working order.

In fact there are more than 800 members of staff at Buckingham Palace procuring, recording, maintaining, and if necessary fixing all of the assets.

Now look around the room you are sitting in. You also have assets. You have furniture, rugs, art, and so on. But unless you are very disciplined and keep all of your invoices and receipts, we bet you have no ownership certificates for any of your assets. You can't prove you own your assets, and neither can almost all of the 8 billion people in the world - modest as most of their circumstances may be.

Most assets in the world have no certificate or record of ownership at all.

WHY WOULD DIGITAL OWNERSHIP CERTIFICATES BE BENEFICIAL?

Quite apart from the obvious point that if your assets had their own digital ownership certificates you could prove you owned them, there are other important benefits that come with the digitization process.

Take a look at this shocking exhibit from Zillow. The average US citizen will lose some 8 to 10% of the VALUE of their largest asset - their home - each time they try to buy or sell it.

EIGHT TO TEN PERCENT!

That is shocking. In this digital world, the organizations who are in their roles to protect investors and citizens - like the SEC to name but one - perpetuate a world in which every American loses an enormous portion of the value of their assets because of the inertia of an antiquated and broken paper based world.

With this said, the obvious benefits of digitizing assets records are:

Provable, immutable, and transferable ownership of assets

Low cost and fast processes of digital asset record keeping

Easy to use, user-focused processes that don't require hours standing in line

More accessibility, and fairness for all asset owners who would share a common process of ownership

But that is the tip of the iceberg of the benefits that digital assets can unleash.

WHAT OTHER BENEFITS WOULD ASSET DIGITIZATION BRING?

Back in the 1980's when we were at McKinsey and we worked on the Big Bang and the movement of public equities to a digital asset model, we never guessed that cost, speed and ease were not all that digital assets unleash. Here are a few more benefits:

Digital assets can be held in digital wallets and traded in digital marketplaces.

Given that 4 billion people are connected and online today, this means that a digital asset can be presented to a marketplace that can, in principal, include 4 billion sellers and buyers.

Even if in practice local jurisdictional regulations greatly reduce that 4 billion, we can still see massively larger numbers of buyers meeting sellers.

This means that price discovery should be more efficient. Price should rise to the level that a willing buyer would pay a willing seller even if they never meet physically. Massive markets mean efficient pricing.

Massive markets also mean much greater liquidity. Which in turn opens up the options of high speed and algorithmic trading, and so on - all creating even more efficient markets.

And then when we have a digital asset, we can create derivative products.

And so on.

Is that all? No it is not. Because a digital ownership certificate is not physical by definition. It is digital. Which means it is software. Bits and Bytes.

And when we have one set of code, we can attach other code to it. So now we can also add to a digital asset certificate of ownership other features such as:

A behavioral based incentive or loyalty program

Benefits (or costs) that unlock over time as the terms of the initial contract are met

The option of tracking the asset and moving from a one time buy and sell model of transaction, to ongoing commission, royalty, and residual based models of compensation

Rewards for creators for creating assets throughout the life of the asset

And so it goes on and on and on.

NON FUNGIBLE TOKENS ARE HERE NOW

A couple of years ago in Newsletter Vol. 3, No. 5 (WHAT ON EARTH ARE NFTS?) we explained how NFT's are one manifestation of the coming age of digital assets. We will not repeat the substance here, although we have an upcoming webinar on NFT's scheduled:

What are NFTs?

- June 20th, 7:00am PT

- June 20th, 11:00am PT

Suffice to say that while digital assets can be made to work for any asset:

Public and private equity investments

Real estate

Other investment funds

Cars

Furniture

Art and collectibles

And so on

It just happens to be digital assets that the digital natives have decided to digitize first.

It is in their name.

You can go to Newsletter Vol. 4, No. 2 (THE DIGITAL NATIVE TAILWIND) to learn why the future is being driven today by those under the age of 45 who were born digital and who now represent about half of the world's population and citizenry.

Finally, you can download our free book The Fifth Era to learn about this future digital world of which digital assets are a part, and you can also download Blockchain Competitive Advantage to understand why TCP/IP has to be complemented with new commerce focused protocols like the Blockchain protocol to resolve the five key issues of security, identity and trust, over centralization, and the absence of native digital monies and assets in today's Internet.

Thank you for reading.

Alison Davis

Matthew C. Le Merle

ABOUT BLOCKCHAIN COINVESTORS

Launched in 2014, our goal is to provide broad coverage of the emerging unicorns and fastest growth blockchain companies and crypto projects. The strategy is now in its 9th year and has to date invested in more than 40 pure play blockchain venture funds in the Americas, Asia and Europe; and in a combined portfolio of 400+ blockchain and crypto projects including approximately 50% of all blockchain unicorns. Our funds rank in the top decile amongst all funds in their respective categories on both Pitchbook and Preqin. Headquartered in San Francisco with a presence in Grand Cayman, London, New York, Zug and Zurich, the alternative investment management firm was co-founded by Alison Davis and Matthew Le Merle.

FUND PERFORMANCE

Blockchain Coinvestors Fund III (Fund of Funds) was created to provide diverse coverage of the best blockchain pure play venture funds in the Americas, Asia, and Europe. Blockchain Coinvestors Funds I and II have already experienced significant appreciation. Fund I Net TVPI is 4.72x with an IRR of 72%. Fund II shows equally impressive early results with Net TVPI of 2.08x and an IRR of 146%. Almost all of our fund investments are performing as top quartile against the Cambridge Associates Venture Benchmark.

BLOCKCHAIN COINVESTORS FUNDS

Blockchain Coinvestors’ goals are to provide broad coverage of the emerging unicorns and fastest growth blockchain companies and to capture superior returns from investing in the leading blockchain venture partnerships. Our funds are open to investors that meet the Qualified Client definition with a minimum subscription level of $250,000 at the discretion of the Manager.

Blockchain Coinvestors Fund III (Fund of Funds) was created to provide diverse coverage of the best blockchain pure play venture funds in the Americas, Asia, and Europe. Blockchain Coinvestors Funds I and II have already experienced significant appreciation. Fund I Net TVPI is 3.64x with an IRR of 69%. Fund II shows equally impressive early results with Net TVPI of 1.72x and an IRR of 161%. Almost all of our fund investments are performing as top quartile against the Cambridge Associates Venture Benchmark.

Blockchain Coinvestors Fund IV (Early Stage Token) provides direct access to promising private stage token projects accessing our relationships with many of the world’s leading blockchain investors. We leverage asymmetrical information from our 40+ VC Funds to pick the most attractive opportunities. This is a continuation of the direct token investing strategy of the Fund Manager that has included private stage investments in Acala, Filecoin, NEAR, Polkadot, Structure, and others.

Blockchain Coinvestors VI (Mid Stage Growth) provides direct exposure to the emerging category leaders in the blockchain and crypto ecosystem. The fund leverages our unique sustainable competitive advantage (USCA) in blockchain, web3, and fintech to create a concentrated portfolio of between 20 and 30 investments with attractive return profiles and visible paths to liquidity. The fund assesses the more than 400 blockchain and crypto projects in which we are direct and indirect investors and employs a robust investment framework to select investment opportunities into the leading mid stage growth rounds - typically Series B, C and D. This is a continuation of the mid stage investing strategy of the Fund Manager that has included investments in Bitwise, Brex, InfiniteWorld, Securitize, Uphold, Wyre, and others.

Please visit the Blockchain Coinvestors website to learn more about our offerings. You can also reach our Investor Relations team directly at ir@blockchaincoinvestors.com.

BLOCKCHAIN COINVESTORS SWISS

We are excited to announce that Blockchain Coinvestors Funds are now available through Swiss certificates for those of our non-US investors who prefer this approach. The underlying fund is the same, however, our Zurich based team at Blockchain Coinvestors Swiss, who will introduce in future weeks, can provide detailed information regarding this investment option. Email us at mlemerle@blockchaincoinvestors.com to learn more.

BLOCKCHAIN COINVESTORS ANGELLIST SYNDICATE

Continuing the theme of the democratization of investing, we have a rapidly growing Blockchain Coinvestors syndicate on AngelList providing access to selected coinvestments. Please join us and our partner Lou Kerner on AngelList.

Click here to receive the insightful weekly crypto newsletter and webinar invitations from our Blockchain Coinvestors partner Lou Kerner.

REGISTER NOW FOR UPCOMING WEBINARS AND CALLS

Our investment team hosts bi-monthly webinars and calls to help educate our community about the Fifth Era, fintech, blockchain and crypto. We discuss important trends, tailwinds and investment themes including what we have learned and how we are using our knowledge to inform our own investment thesis and actions. Below is a list of upcoming webinars for which you can register by clicking the links:

Investing in Early Stage Tokens

- May 9th, 7:00am PT

- May 9th, 12:00pm PT

Blockchain Coinvestors Investment Thesis

- June 6th, 7:00am PT

- June 6th, 12:00pm PT

What Are NFTs?

- June 20th, 7:00am PT

- June 20th, 11:00am PT

Recordings of past webinars and calls can be found at www.blockchaincoinvestors.com/webinars.

RECENT PRESS

CoinTelegraph: The impact of crypto on the Russian sanctions

CoinDesk TV: Interview on unicorns and predictions for 2022

Nasdaq Trade Talks: Discussion on the blockchain unicorn universe research and how to gain exposure

CoinDesk: Our predictions on blockchain unicorns in 2021

Ashurst: On the ESG Podcast, a discussion of the internet, fintech, blockchain, and individual revolution

Business Insider: Discussing how right now in blockchain is similar to the internet boom of the '90s in terms of growth and innovation

NBC San Francisco: An interview on what are NFTs

US News & World Report: What to know about Bitcoin ETFs

Crypto Unstacked: Podcast on the Fifth Era and the evolution of digital assets

Business Insider: Which digital asset to hold right now - Bitcoin or Ethereum

Inc Magazine: An explanation of NFTs

Pensions & Investments: How institutional investors are getting closer to blockchain and crypto investments

On the Brink with Castle Island: An overview of technology trends and the cryptoasset markets

"The best way to invest in Blockchain businesses"