Fordefi: The World’s Leading Gateway to Institutional DeFi

Fordefi: The World’s Leading Gateway to Institutional DeFi

This week we discuss the growing institutional interest in digital assets and decentralized finance (or DeFi), the current barriers to entry and a company called Fordefi, that we believe is set to level the playing field for institutional access.

As Predicted, The Year of Institutional Adoption

Regular readers of our content will know the past few weeks have, arguably, been the most consequential few weeks in US crypto history. From the senate’s vote to repeal SAB 121, which would have removed arbitrary barriers to banking digital assets, to the passage of the US’ first piece of honest crypto regulation by the house in FIT21 – America is most definitely joining the digital finance race. (More on what just happened in the US here).

Biden ultimately vetoed the repeal of SAB121 and FIT21 has yet to face the senate, as does the recent CBDC Anti-Surveillance State Act passed by the house, but democrats are already starting to break ranks with the Biden/Warren/Gensler anti-crypto cabal as their positions get harder and harder to justify. (Being against highly-accessible, efficient, and secure commerce and financial tools is a very hard argument to make). On the republican side, presidential candidate Donald Trump recently declared himself the US crypto candidate.

Globally, the story is much the same. Our recent Digital Asset Regulatory Report, which tracks digital asset regulation and legislation around the world, showed that the world’s leading financial centers are already vying to be the Silicon Valleys of tomorrow via digital asset enablement. The vast majority are passing or have already passed comprehensive crypto regulation and many have already launched pilots of their new CBDCs. Our global tracker is shown below. (Check out the full webinar here).

But why is this happening? The answer is simple. It’s driven by a growing demand for the practical benefits and financial efficiency digital assets afford, particularly on the part of institutions. As we predicted in our 2024 Blockchain Predictions, institutions drove the US Bitcoin spot ETFs well past expectations earlier this year and just inked another win with the subsequent approval of the Ethereum Spot ETFs. Our recent Institutional Digital Finance Adoption Report confirmed it, showing that the world’s leading financial players are largely already building out digital finance capabilities as they eye this new class of composable, digital financial products.

As we’ve been saying for years, digital finance is inevitable. All that changed recently is that the world’s largest financial institutions and governments are now seeing it too. And they want in.

Barriers Remain, But The Winners Here Will Win Big

Like the digitalization of communications and content, this won’t happen overnight. Many barriers remain and the infrastructure is still being built out. Stablecoins are already a mega killer app of their own, but they represent only the tip of the iceberg in terms of the financial innovation made possible with composable digital assets and DeFi products built on open source software.

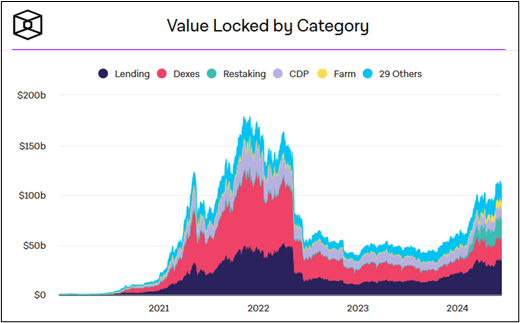

There is over $100bn currently locked in these new emerging DeFi products like decentralized loan protocols, liquidity pools, and even prediction markets. Yet advanced as they are technically, interacting with many DeFi products still feels like sending money into a black box and the UI/UX is often sorely lacking.

We’ve written about it before, but even the basic wallet experience can even be jarring for many. Thoughts of accidentally oopsy-ing your money away with an errant click swirling in your head. Or the idea of losing your private keys in a fire, or simply because your roommate “didn’t know that thing was important, sorry dude.”

For individuals, these risks are more palatable and good security practices can usually alleviate these concerns. But for institutions managing large sums of their own and even other people’s capital, these represent significant risks and barriers to adoption. So while the total value locked (or TVL, akin to AUM in tradfi) in DeFi protocols peaked out at more than $170bn in the 2021/22 bull run as seen below, this largely excluded institutions. Simply put, legacy infrastructure providers at the time were not equipped to provide the security and transparency necessary for large institutions to partake in the benefits of DeFi.

This year, however, institutions are keenly focused on digital assets and DeFi, having watched this asset class deliver outsized returns through multiple cycles now. Regulatory frameworks are also rapidly emerging, setting the stage for large scale interest to become large scale adoption. As such, companies that are able to abstract away the technical complexities of managing digital assets and interacting with DeFi products stand to usher in a massive wave of untapped institutional capital.

We believe Fordefi is one of those companies, which is why we invested in their oversubscribed $10m Series Seed extension round last April, led by Electrical Capital alongside Lightspeed Venture Partners, Castle Island, Pantera Capital, Digital Currency Group, and others.

Enter Fordefi: The Institutional Gateway to Web3 and DeFi

Fordefi is a seamless digital asset custody provider that enables institutions to securely hold and deploy digital assets into smart contracts and DeFi protocols with confidence. Publicly launched in 2022, the team’s cutting-edge infrastructure moves security sensitive components into hardware enclaves which protect the software from external threats. Private keys are split between Fordefi and users and only ever computed in whole to sign transactions. This is the gold standard in private key storage practices, known as multiparty computation (or MPC). Fordefi also offers MFA tools, disaster recovery features and regularly conducts external audits to ensure the robustness of their award-winning security architecture.

The company’s MPC wallet-as-a-service product eliminates single points of failure associated with legacy solutions and provides broad connectivity to the wide world of DeFi and decentralized applications (or dApps). Purpose-built for DeFi security, having achieved a lauded SOC-2 Type-2 cybersecurity certification from EY, the company’s wallet-as-a-service offering enables businesses anywhere to easily integrate secure, user-owned digital wallets right into their own applications. Alongside granular wallet controls and tools like their one-of-a-kind smart contract simulator, this puts DeFi within reach for many institutions previously deterred by the lack of core infrastructure.

Maybe more poignant though, given DeFi’s black-box reputation – Fordefi offers unparalleled clarity into smart contracts and DeFi transactions, which has been a pivotal barrier in institutional participation thus far. Their first-ever smart contract simulator allows users to test smart contracts and DeFi protocols in a fully simulated manner before ever putting in a single dollar. For institutions this is a gamechanger and makes interacting with DeFi and dApps significantly easier. Other features such as self-serve policy management, time-of-transaction insights and risk alerts come together with customizability tools to make Fordefi’s MPC wallet platform the most secure gateway for institutions into Web3 and DeFi.

And the Timing Couldn’t be Better

As we noted earlier, this has been the most consequential few weeks in US crypto history, driven by an increasing demand for the practical benefits of this technology. The attempted repeal of SAB 121, although subsequently vetoed by Biden, signals a growing bipartisan appetite for digital assets and a mounting disappointment with the US’ anti-innovation approach to digital finance thus far.

The veto is already garnering heavy criticism on both sides of the aisle and we think equivalent legislation will eventually pass – removing long-standing, arbitrary barriers to banking digital assets and web3 enterprises. This will be a major growth catalyst across Web3.

The impending launch of Ethereum Spot ETFs also spells green arrows for Ethereum, if the Bitcoin ETFs were anything to go off of. But as many crypto natives know, investment into Ethereum almost always begets deeper interest and eventual investment into DeFi. (This is one of the most common paths into DeFi and Web3). Ethereum’s value, in large part, is due to the vibrant ecosystem of financial services and dApps growing atop it. So institutional investment into Ethereum ETFs will inevitably be a stepping stone to DeFi access and participation.

Altogether these factors spell out a potential flywheel scenario for providers who can deliver a seamless experience for institutions taking their first steps into the future of digital finance. And by delivering institutional-grade security, broad access to the world of DeFi and unparalleled smart contract transparency, we believe Fordefi is perfectly positioned to usher in this next wave of institutional capital.

The World Leader in Institutional Defi Access

Fordefi’s initial MVP launched in November 2022, with support for a dozen Ethereum Virtual Machine (or EVM) blockchains. Since then, the team has been hard at work delivering on their promise of broad defi connectivity, and the results have been astounding.

Today, Fordefi supports more blockchains and provides more defi protocol access than any other institutional product on the market – giving clients access to over 27 different blockchains across Ethereum, Cosos and Solana, including all the associated ecosystem tokens and protocols.

This eliminates long standing pain points and gives institutions unprecedented access to DeFi, for the first time ever. Along with the significant regulatory progress and digital finance adoption worldwide, we are rapidly entering the era of institutional DeFi. As we’ve been saying for years, this transition is inevitable. And firms like Fordefi who can make this transition easy for the world’s institutions stand to usher in the next wave of digital finance.

Author

Christopher Nelson

Head of Digital Asset Research