INVESTING IN BLOCKCHAIN BUSINESSES

A single investment accesses global, diversified exposure to leading early stage blockchain venture investments on an institutional platform

-

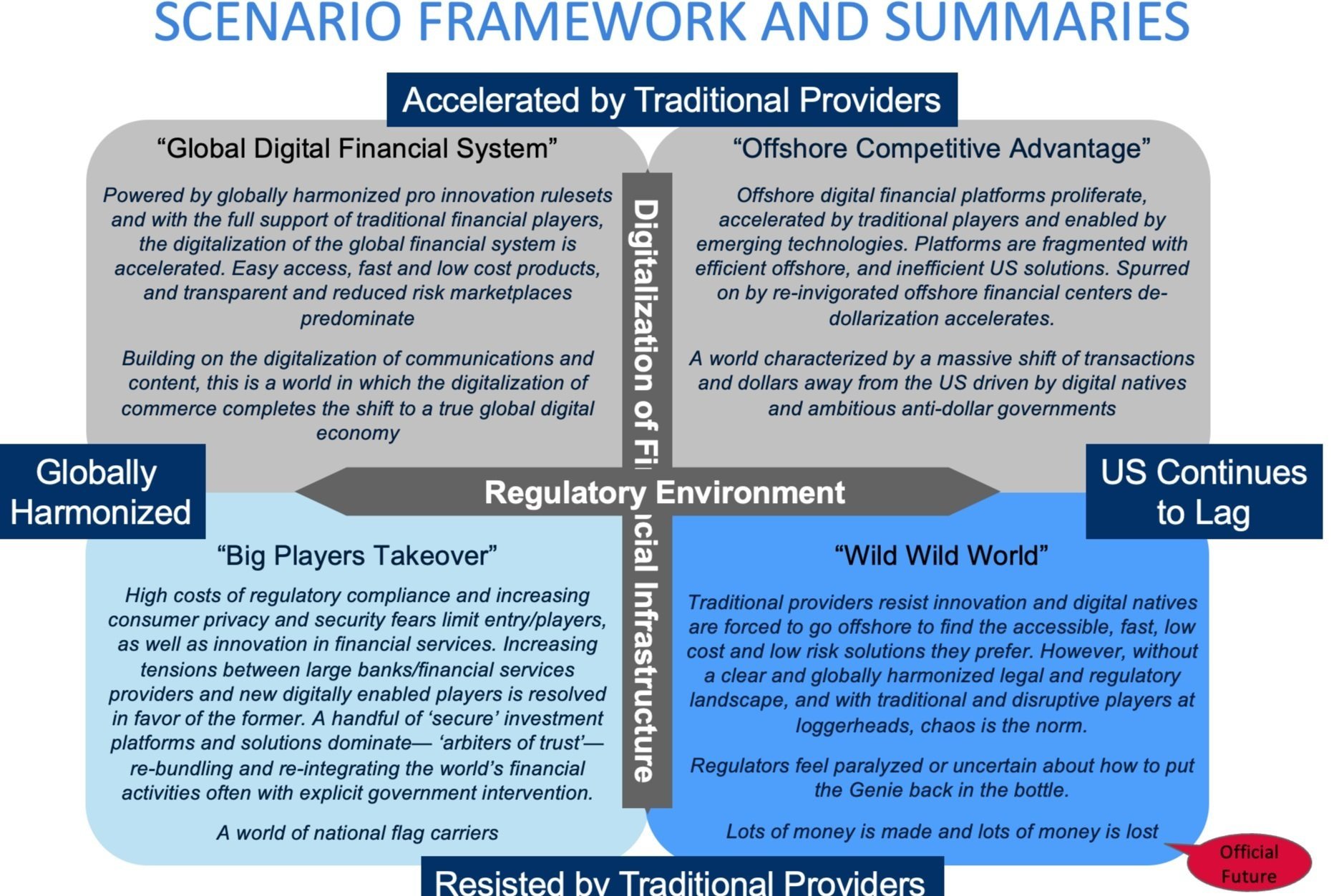

Our vision is that digital monies, commodities, and assets are inevitable and all of the world’s financial infrastructure must be upgraded.

Our mission is to provide broad coverage of early stage blockchain investments and access to emerging blockchain unicorns.

-

We provide our investors diversified exposure. To date we have invested in a combined portfolio of 1,250+ blockchain companies and projects by partnering with 40+ pure play blockchain venture capital funds in the Americas, Asia, and Europe Visit our entire combined portfolio

-

Blockchain Coinvestors Funds I and II have already experienced significant appreciation. Fund I Net TVPI is 3.96x with a Net IRR of 38% and is one of the highest performing fund of funds in the world according to Pitchbook and Preqin. Fund II shows impressive early results with Net TVPI of 1.32x and a Net IRR of 14%. Fund III and V will begin reporting this year.

-

We are direct or indirect investors in more than 110 blockchain Unicorns including as examples; Amber, Animoca, Anchorage, Blockdaemon, Chainalysis, Circle, Coinbase, Dapper, Kraken, Ledger, Opensea, Ripple, SuperRare, Worldcoin, Yuga Labs and many others

-

The best blockchain funds are often many times oversubscribed. Blockchain Coinvestors has > $450m guaranteed investment rights into a majority of our partner funds.

-

Blockchain Coinvestors has partnered with outstanding auditors, banks, brokerages, fund administrators, law firms and qualified custodians to provide an institutional solution for our investor community. Click to see our partners.